Festive Financial Gifts

https://www.ellisbates.com/wp-content/uploads/2020/11/Festive-Financial-Gifts-blog-holder.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g Deciding on the right investments for the children in your life

Deciding on the right investments for the children in your life

As the festive season approaches, have you thought about gifting your children or grandchildren something different this Christmas? Giving them a good start in life by making investments into their future can make all the difference in today’s more complex world.

Many parents and grandparents want to help younger members of the family financially – whether to help fund an education, a wedding or a deposit for a first home. Christmas is a time for giving so what better gift to make to your children or grandchildren than a gift that has the potential to grow into a really useful sum of money.

There are a number of different ways to get started with investing for children that could also help you benefit from tax incentives to reduce the amount of tax paid, both now and in the future. Don’t forget that tax rules can change over time so it is important to obtain professional financial advice before making financial decisions.

Ownership of the investments

Investing some money – either as a one-off lump sum or on a regular basis – is an ideal way to give a child a head start in life. There are a number of options available when it comes to ownership of investments for a child. Children receive many of the same tax-efficient allowances as adults, so it’s a good idea to consider specialist child savings accounts.

Some people prefer to keep investments for children in their name; that way, if a future need arises in which you require access to the funds, it is still available to you as it has not yet been transferred to the child.

If you retain personal ownership of the investment, it will be your tax rates that apply as opposed to the child’s. If the investment remains in your estate upon death, more taxes could be payable, so be aware of this.

Bare Trusts

You can hold investments for your child in a bare trust or designated account. Bare trusts allow you to hold an investment on behalf of a child until they are aged 18 years (in England and Wales) or 16 (in Scotland), when they’ll gain full access to the assets.

Bare trusts are popular with grandparents who would like to invest for their grandchild, because the investments and/or cash are taxed on the child who is the beneficiary. This is only the case if you are not the parent of the child. If you are and if it produces more than £100 of income it will be treated as yours for tax purposes.

Grandparents can contribute as much as they like as there is no limit to how much can be invested each year into this type of account. This can be a beneficial way of reducing a potential Inheritance Tax bill if a grandparent would like to make gifts to a child.

Discretionary Trusts

A discretionary trust can be a flexible way of providing for several children, grandchildren or other family members. For example, you might set up a trust to help pay for the education of your grandchildren. The trust deed could give the trustees discretion to decide what payments to make, depending on which children go to university, what financial resources their families have and so on.

A discretionary trust can have a number of potential beneficiaries. The trustees can decide how the income of the investment is distributed. This type of trust is useful to give gifts to several people, such as grandchildren. However, it’s worth keeping in mind that the tax rules can become complex when using a discretionary trust and the investment and distribution decisions are taken by the trustees (of which you can be one).

Junior ISAs

If you want to ensure the money you give to your children remains tax-efficient, a Junior Individual Savings Account (JISA) is available for children born after 2 January 2011 or before 1 September 2002 who do not already hold a Child Trust Fund.

The proceeds are free from income tax and capital gains tax and are not subject to the parental tax rules. They have an annual savings

limit of £9,000 for the current tax year which runs from 6 April to 5 April the following year.

A child can have both a Junior Stocks & Shares ISA and a Junior Cash ISA. From the age of 16, children can have control over how their JISA is managed, but cannot withdraw from it until the age of 18.

Child Junior SIPPs

It is never too early to start saving for retirement – even during childhood. While it may seem a little early to be thinking about retirement as the parent of a child, it’s worthwhile. The sooner someone starts saving, the more they will gain from the effects of compounding. There are significant benefits to setting up a pension for a child. For every £80 you put in, the Government will top it up with another £20, which is effectively free money.

A Junior Self-Invested Personal Pension Plan (SIPP) is a personal pension for a child and works just like an adult one. Parents and grandparents can save up to £2,880 into a SIPP for a child each year. What’s great about this gift is that the Government will top it up with 20% tax relief. So you can receive up to £720 extra, boosting the value of your present to £3,600. This can help a child to build a substantial pension pot if payments are made every year.

But while starting a pension for your child or grandchildren will benefit them in the long run, you need to consider that they won’t be able to access their money until they are much older.

Planning to give the children in your life a financial gift this Christmas?

A gift of money to your children or grandchildren at Christmas can be a wise choice, especially if you take a long-term approach. Many families want to give their children or grandchildren a head start for their future finances. When it comes to investing for children, tax can make a big difference to returns over the longer term. We can help you decide on the right investments for the children in your life. Please contact us to discuss the options available.

Placing money in companies that bring positive change. Issues such as climate change and sustainability have become increasingly hot topics globally and often the subject of conversation. As a result, Environmental, Social and Governance-linked (ESG) investment strategies continue to dominate financial headlines.

Placing money in companies that bring positive change. Issues such as climate change and sustainability have become increasingly hot topics globally and often the subject of conversation. As a result, Environmental, Social and Governance-linked (ESG) investment strategies continue to dominate financial headlines.

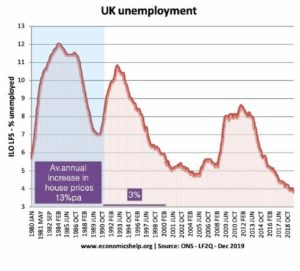

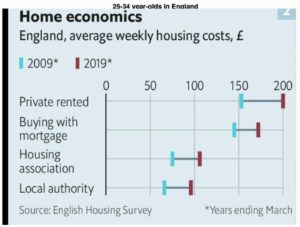

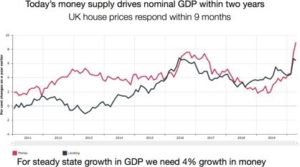

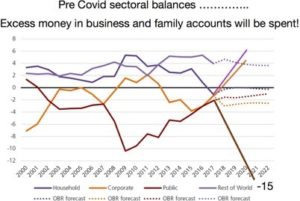

House prices from 1980-1990 rose at an average annual rate of 13%. In the nineties unemployment steadily fell but house prices remained subdued on average growing at 3% per annum. The reasons are found in the behaviour of banks. In the eighties Barclays and NatWest were both determined to be the UK’s biggest banks, measured by total assets. Mortgages are nearly 60% of banks’ assets. So they slugged it out, and then Building Societies were allowed to become banks which meant they could start manufacturing money. Thus regardless of employment levels the wall of money was created.

House prices from 1980-1990 rose at an average annual rate of 13%. In the nineties unemployment steadily fell but house prices remained subdued on average growing at 3% per annum. The reasons are found in the behaviour of banks. In the eighties Barclays and NatWest were both determined to be the UK’s biggest banks, measured by total assets. Mortgages are nearly 60% of banks’ assets. So they slugged it out, and then Building Societies were allowed to become banks which meant they could start manufacturing money. Thus regardless of employment levels the wall of money was created.

By Grant Ellis, Director Ellis Bates Group

By Grant Ellis, Director Ellis Bates Group

One in five self-employed and contract workers unable to survive a week without work. The world of work has changed enormously over the past 20 years. Being self-employed, freelance or working on a contract basis has become the norm for all sorts of professions. Although it has many benefits, working for yourself means that the responsibility for providing a financial safety net shifts from the employer to the individual. New research has highlighted the precarious nature of self-employed people’s finances.

One in five self-employed and contract workers unable to survive a week without work. The world of work has changed enormously over the past 20 years. Being self-employed, freelance or working on a contract basis has become the norm for all sorts of professions. Although it has many benefits, working for yourself means that the responsibility for providing a financial safety net shifts from the employer to the individual. New research has highlighted the precarious nature of self-employed people’s finances.

How to secure your family’s financial future.

How to secure your family’s financial future.

Preserving your wealth and transferring it effectively.

Preserving your wealth and transferring it effectively.