Only two-fifths of Britons know how to boost their pension

https://www.ellisbates.com/wp-content/uploads/2024/07/Picture1-blog.png 793 594 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gHow much money will you have for retirement, where it’s invested, and what are you being charged?

According to new research[1], just two-fifths (42%) of the UK population know how to contribute more to their pension. The study also found that a quarter of those with multiple pots would not know where to start consolidating multiple pension pots accrued throughout their working life.

According to new research[1], just two-fifths (42%) of the UK population know how to contribute more to their pension. The study also found that a quarter of those with multiple pots would not know where to start consolidating multiple pension pots accrued throughout their working life.

The Financial Conduct Authority (FCA) Financial Lives Survey reported that 47% have not reviewed how much their pension pot is worth in the last 12 months. Pension saving can seem complicated and inaccessible for many people, but we should all be doing it as soon as we start working.

Understanding Pension Consolidation

Pension consolidation is a process that can gather up your previous pensions and bring them together. As you move from job to job and change addresses, it can be tricky to manage pensions. With every new one, there’s more admin to deal with.

By combining them, you can have a clearer view of how much money you have for retirement, where it’s invested, and what you’re being charged. This consolidation can simplify your financial landscape.

It’s important to remember that a pension is an investment. Its value can go down as well as up and could be worth less than what was paid in. Pension consolidation won’t be right for everyone.

Managing Your Retirement Savings

Gathering up your pensions could give you a better idea of your overall pension pot and what it could be worth when it’s time to retire. Lower charges are another benefit; you could potentially save on management fees, which can help your pension pot grow faster.

The more pensions you have, the harder it can be to track them and how they’re performing for you. With just one pension, managing your retirement savings becomes much easier.

Simplifying Your Financial Future

Consolidating your pensions can provide peace of mind by offering a straightforward overview of your retirement funds. This reduces the administrative burden and makes making informed decisions about your financial future easier.

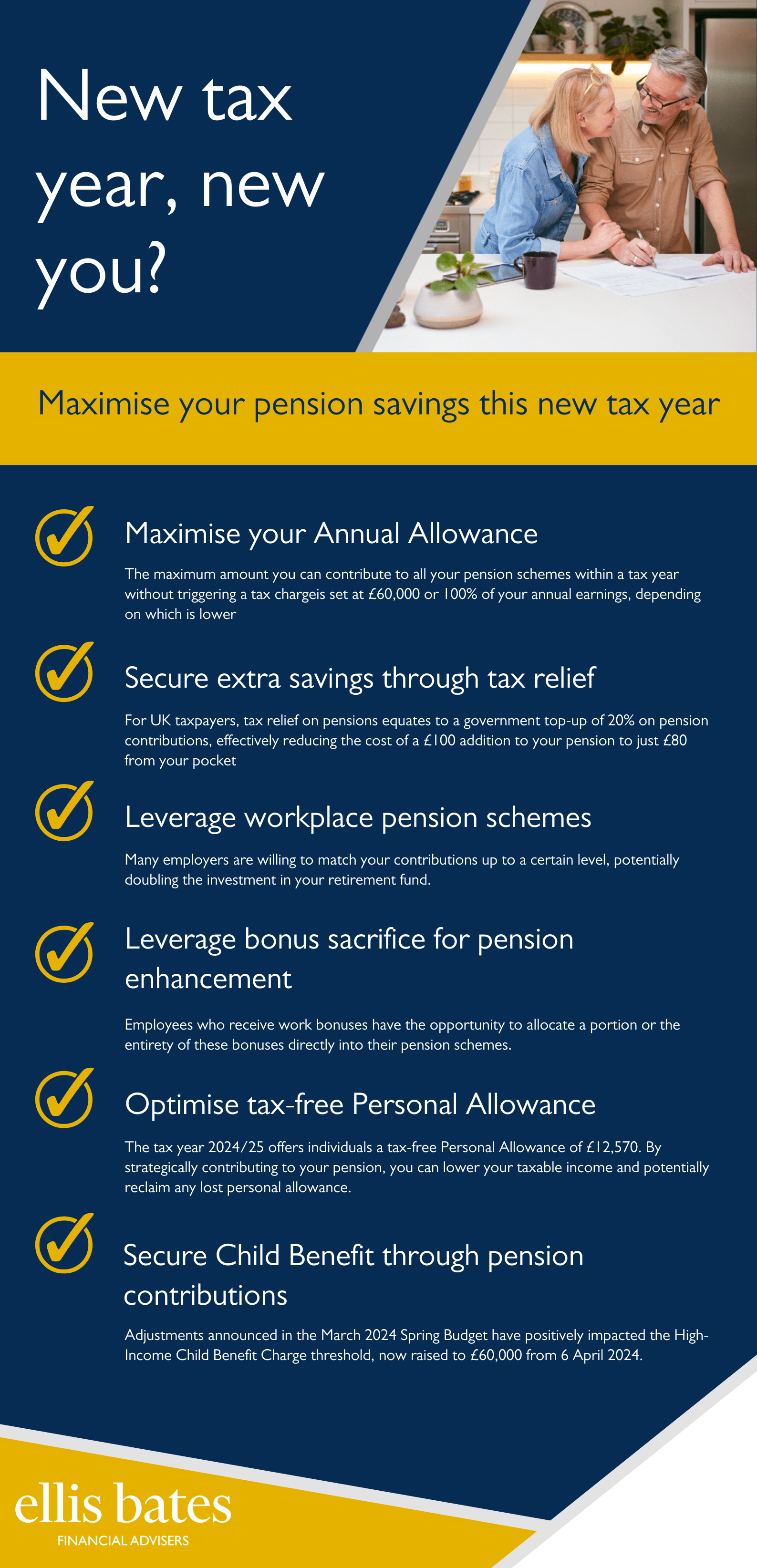

It’s crucial to stay informed about the value of your pension pot and the different options available to boost your retirement savings.

Taking proactive steps now can ensure a more secure and comfortable retirement.

Role of Professional Financial Advice

Obtaining professional financial advice is invaluable when considering pension consolidation. We can provide tailored recommendations based on your unique

circumstances and long-term goals. We’ll help you navigate the complexities of pension schemes and select the right options for consolidating your pensions effectively.

Engaging with us also ensures that you are making well-informed decisions, maximising the potential of your pension savings, and preparing for a financially stable retirement.

At any stage in your career, you may want to determine precisely how much you have saved in your pension and begin managing these funds more effectively. If you require further information on consolidating your pensions or need assistance understanding your options, please contact us for more detailed guidance.

Source data:

[1] Lloyds Bank research 09.05.24

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.