Navigating Change (Again)

“She stood in the storm, and when the wind did not blow her way, she adjusted her sails.” – Elizabeth Edwards

2020 has been interesting. To the end of June, year to date our Growth, SRI (Socially Responsible Investment) and Passive portfolios are effectively flat and ahead of benchmarks (and significantly also over 1 / 3 / 5 year timescales) although the journey has clearly been anything but steady. The Income portfolios have been more adversely affected as companies have reduced / cancelled dividends, while withdrawing forward guidance on earnings and income forecasts – effectively leaving a void where previously there was generally boring certainty and stability. Interest rates are verging on negative, oil futures in the US briefly went negative, the Federal Reserve is buying junk bonds, and in the UK, the government is offering £10 discounts on your meals out (Mon-Wed throughout August at all participating restaurants). I do not recall any of this being covered in my Economics A-Level back in the early 1990s. Some updated textbooks (digital of course) and theories will be needed for the current crop of home-schooled students.

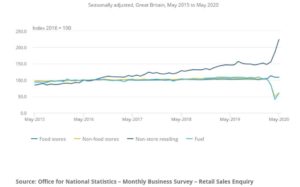

Change is always fascinating and that is exactly what we have got. What the digital age ensures is that change is at a much-accelerated pace, and adoption of new technologies is often far quicker than anticipated, while necessity is still the mother of invention. This is demonstrated in the data from the Office of National Statistics (below) showing the sharp rise in “Non-Store retailing” (i.e. online) as the Covid-19 economic shutdown forced shoppers to opt for delivered goods and abandon reliance on traditional physical stores.

Figure 1: A sharp uplift to already increasing sales for non-store retailing during the coronovirus pandemic, while non-food stores and fuel show growth in May 2020 from the lowest levels on record in April

This change in purchasing behaviour is likely to be a continuing trend although the non-food and fuel sales will probably rise to a more normalised level while still falling ever further behind online activity. The adoption of all things digital and the move to a cashless society is likely to accelerate further which will present clear challenges and opportunities depending on the relevant business sector. This helps explain the drastic variation of fortunes in the outlook and share prices of various businesses over recent months, with exuberance and despair seemingly the two overriding moods of the markets.

The punishment for being in unfavoured sectors of the market has been brutal, and the UK stock indices have suffered more than most. In our own portfolios the bottom performing fund this year has been a UK focused income fund concentrating on smaller companies, while the top a global technology holding – with a 70% disparity of returns between the two over the first 6 months of 2020. The economic data, as expected, has been appalling with the UK registering its biggest ever monthly drop in GDP in April (-20.4%) and the rise in unemployment levels globally seem set to escalate. The unprecedented steps taken by the Chancellor in the UK to support jobs highlights the concerns the government has about the inevitable impending increase in unemployment, particularly when the furlough support ceases and if further lockdown periods are deemed necessary.

However, there is some optimism that the recession may have already hit its worst, and while the return to previous levels of economic activity and employment may take considerable time, signs are that we are on an upward trajectory. Of the largest 12 global economies, 6 now have readings in excess of 50 on the Manufacturing Purchasing Managers Index – readings over 50 signal expansion. This supports some views that this will be a savage, but brief recession and while economic activity may recover quickly, the labour market globally may be more severely affected.

The continued role of central bankers and their “blank cheque” mentality is providing much needed liquidity in the markets and, potentially, supporting sentiment as the fastest correction in the S&P 500 in history was followed by its biggest ever 50 day rally. Jerome Powell, Chair of the US Federal Reserve, gave this unequivocal statement at his Congressional Testimony in June:

“The Federal Reserve is strongly committed to using our tools to do whatever we can for as long as it takes to provide some relief and stability to ensure that the recovery will be as strong as possible and to limit lasting damage to the economy. The Fed will continue to use these powers forcefully, proactively, and aggressively until we’re confident that the nation is solidly on the road to recovery.”

The mantra of “don’t fight the Fed” may be in play for now, but relying entirely on emergency measures from central banks and governments would be careless when perennial issues such as Brexit, the China vs US trade dispute and the small matter of a US election in November will add further uncertainty to the current situation. There is also the question of who is going to foot the bill for furlough benefits, SDLT holidays, and the endless monetary expansion that will create unprecedented levels of debt? Longer term there are implications, with the most material impact likely to revolve around whether prolonged low growth and deflation or inflation will be more prevalent. There are legitimate arguments for either outcome, but clearly the ramifications will be significant.

We are in a period of substantial change, and the mistake is to think that change is not normal – a simple glance through history shows it is ever present. While on an individual basis we grow accustomed to our own ways and preferences, humanity invariably collectively advances through forces of supply, demand and genetic desires that are impossible to rationalise into a simple formula. The combination of data-driven statistical theory aligned with the gloriously idiosyncratic behaviour of individuals is what makes the investment markets so fascinating and unpredictable.

One of the joys of investing is that occasionally when the wind blows a different way you can adjust your position if needed. The next 12 months will be intriguing as we adapt to different economic realities – but we will adapt and much of the change is merely accelerating the trends that were already in place. Given the increased uncertainties and extremes in valuations of various assets we believe adopting a well-diversified approach and incorporating the skills of some excellent fund managers will continue to protect and enhance our client’s financial wellbeing.

This is something we have done since we were established in 1980, and it is reasonable to assume our 40th year has given us, and our clients, a new challenge or two. We have addressed these in the same manner as all the others in the previous four decades by acting in the best interests of our clients, thinking of the long term, and dealing with reality. We are in a privileged position to have been trusted with safeguarding the futures of our clients and multiple generations of their families for 40 years – we look forward to many more in an ever-evolving world.

Please note any past performance mentioned is not a guide to future performance and may not be repeated. Any sectors, securities, regions and countries shown are for illustrative purposes only and are not to be considered advice, nor a recommendation to buy or sell.

Alan Cram – Investment Director

Ellis Bates Financial Advisers