All views expressed in this article are those of the author Roger Martin-Fagg and do not necessarily represent the views of Ellis Bates Financial Advisers.

In this update I will continue to give evidence for my optimistic outlook. I do understand that many of you will consider my assessment as unrealistic. I see my purpose as giving you the facts insofar as we know them and then it is up to you to decide on the future progress of our economy and your role and response within it.

As far as I am able to discern currently the infection rate in the EU and the UK is rising. The much vaunted R is above 1 but not yet 2. The predicted second wave is upon us. There is increasing evidence that if an individual is reasonably fit, not overweight, exercises in the fresh air and sunlight they will not die from CoVid 19. They will feel ill, and like flu it is unpleasant but not life threatening. However if they are significantly overweight and have underlying health issues then the risk of becoming very ill and possibly dying rises with age. 90% of deaths have been those who are old and unhealthy.

The issue for the Government is how far to go with lockdown and isolation for the majority to protect the most vulnerable. It is a very difficult judgment to make. There is growing evidence that if there are sufficient hospital ICU beds available, care homes have the necessary support and there is an effective track and trace system then the balance should be in favour of letting the nation get on with normal life.

I believe public opinion is skewed by the mawkish media who seem to revel in portraying the suffering of the unfortunate few. And most people will have a story of a friend who has suffered. But equally they will know of friends who only suffered mild symptoms. If we look at the experience of our European neighbours, Italy stands out as the least affected by the second wave. And it would seem this is because of an effective test and trace system.

My guess is that we will not have a national lockdown but there are and there will continue to be local restrictions applied. The 10pm curfew is clearly an error and I suspect it will be dropped. A well-run pub or restaurant will be a much safer space than a large household with plenty of alcoholic refreshment. And why is anyone surprised that there are spikes in infection when schools and universities reopen?

All that follows assumes no national lockdowns in the UK and the EU.

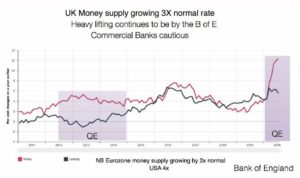

Basically the economy is all about how much money is created by banks and how quickly that money changes hands as individuals buy stuff and pay debts. If we begin with how much money is being created the numbers are staggering in their magnitude.

The money supply in the USA is expanding at nearly 4x the normal rate.

In the EU it’s 2x normal.

In the UK it’s 3x normal.

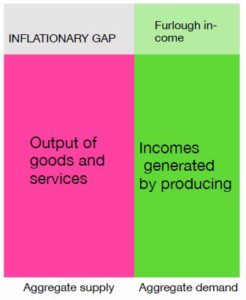

Globally the monetary stimulus is 17% of Global GDP. This is a massive increase in potential purchasing power. If this had happened last year, the scribblers would be headlining “hyperinflation is on its way”. However, all this new money is not flowing through the system at normal rates. Anyone in the hospitality, travel, aerospace, public entertainment, sports and events industries will be suffering significant falls in customer spend and income. This is what lockdown, social distancing and the need to self-isolate causes. In addition the number of hours worked has reduced by around 15%. However thanks to furlough schemes incomes have fallen by less. So there is what is called an inflationary gap.

Graphic Illustration of an Inflationary gap

It is generally accepted that individual prices are determined by supply and demand at a point in time (think of eBay bids). The same can be said of aggregate demand and supply. If in the economy as a whole there is more spending power than immediately available goods and services, average prices rise, albeit with a time lag. The time lag exists because most prices of goods and services are not determined as they would be at an auction but are administered by companies who tend to mark up on unit cost after annual price reviews. The market which responds quickest (apart from commodities) is real estate. Over this next year thanks to Covid we will see central city commercial property prices falling and rural house prices rising. It is difficult to be accurate but I guess central city offices and shopping centres prices will fall 10-20%. And rural house prices rise 5-8%.

To reiterate: since March actual earnings have been higher than the volume of goods and services produced. The inflationary gap is because people have been paid whilst not producing.

In the UK an inflationary gap opens up whenever the money supply begins to grow consistently above 6% per annum. Its currently growing at 12% pa. The new job support measures are quite different; there is effectively no money without output. One would think the gap was closed, but it isn’t, the new money is in the system somewhere and it will get spent sooner or later. The Baltic Exchange freight rate for containers is a very good indicator of global trade volumes. The chart suggests strong demand from Northern European consumers for Asian goods. It is of course possible that container ship capacity has been reduced since March, but I imagine such vessels are probably the safest places to be assuming all the crew are tested a few days before embarkation. Global output is now only 5% below Jan 2020 levels.

Exports from China are rising at 10% year-on-year, the fastest rate for nearly two years. The reasons for all this are of course that since lockdowns were relaxed there has been a surge in consumer demand.

As I write this there is a high level of uncertainty for individuals and families and much discussion on the arrangements for Christmas!

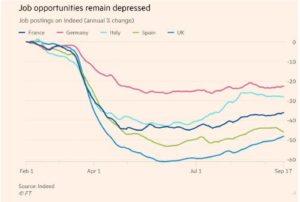

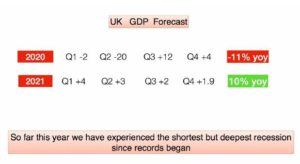

If you are running a business you will have higher levels of cash than normal. You will be trying to guess demand, decide on how many employees you will need over the next years or so, and probably preparing for the worst but hoping for the best. The following data supports this view. The chart reflects the GDP performance of each country. Germany had the smallest contraction in Q2, the UK the largest at 20%. The question is what will happen to unemployment? Overall the average rate will rise to around 8% of the workforce. This means that 92% of the available labour supply will be gainfully employed. And it does not mean our economy and in particular the housing market will shrink. Although the media seem convinced otherwise.

From 1980-1989 the average unemployment rate was 8%, there were recessions at the beginning and the end of the decade, but the average GDP growth rate was 2.5%. It was a decade of blue collar unemployment as UK Manufacturing raised its productivity and either did well or ceased to exist. In the early Eighties the pound was overvalued by about 20% due to North Sea oil, so thin margin exporters failed. The deep-mined coal industry disappeared as low cost open cast Columbian and Australian coal was imported. Most of the unemployment was structural. This means the job was gone for good, and regardless of total spend in the economy would never return.

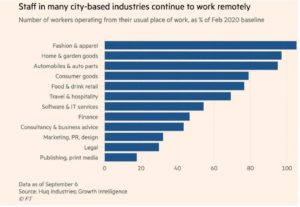

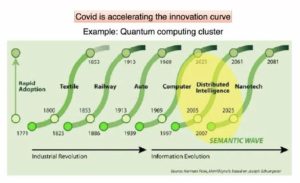

The unemployment we will experience over the next ten years will also be structural. This time it will be white collar jobs disappearing from the back offices of service companies. Smart systems are replacing legal clerks, HR personnel are being replaced by clever recruitment software; orders, dispatch and invoicing all automated. This has been around for at least 10 years but now it will be become generalised. The good news is many white collar workers have transferable skills, so an HR manager, with a bit of training, could design employment systems and processes. Covid is accelerating this change, along with how and where people work.

It is clear home working will be the norm for perhaps 40% of employees. And on the evidence to date is it is more productive. The central office will be reconfigured for more meeting/social interaction space and less rows of screens. New build housing will have to include studies, even if they are small. And for the professional couple, two study rooms or another in the garden will be seen as essential. In short we are entering a period of rapid change with reconfiguration of workplaces. This will create many new income streams for entrepreneurs who spot niches and act quickly to supply.

The example I particularly like is the massive increase in demand for domestic garden pizza ovens! I do not have one nor do I plan to but round here pizza parties for six are popular. The key point is these structural changes will increase GDP per capita so long as companies and employees embrace the opportunities.

The Housing Market

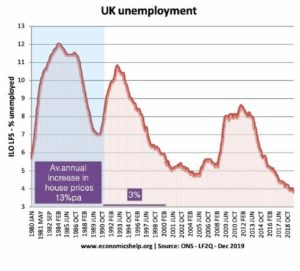

I read on a daily basis commentary which forecasts a collapse in house prices next year. Figures abound but the range is between minus 10% and 20% (the same forecasters predicted house prices would fall 7% this year, when so far they have risen by three percent!). The reason given is banks will be unwilling to lend and individuals unwilling and or unable to borrow because of actual or fear of job loss.

The banks know that their mortgage business is a Walmart operation: pile it high and sell it cheap. The margins are small so the volume has to be large and almost all the process can be automated. The losses on mortgage books currently are under one percent. Next year they may rise a bit but they will always be less than losses on lending to SMEs, which are likely to escalate. But with unemployment doubling the housing market will surely weaken, it’s obvious!

Well, no it isn’t.

Take a look at history:

House prices from 1980-1990 rose at an average annual rate of 13%. In the nineties unemployment steadily fell but house prices remained subdued on average growing at 3% per annum. The reasons are found in the behaviour of banks. In the eighties Barclays and NatWest were both determined to be the UK’s biggest banks, measured by total assets. Mortgages are nearly 60% of banks’ assets. So they slugged it out, and then Building Societies were allowed to become banks which meant they could start manufacturing money. Thus regardless of employment levels the wall of money was created.

House prices from 1980-1990 rose at an average annual rate of 13%. In the nineties unemployment steadily fell but house prices remained subdued on average growing at 3% per annum. The reasons are found in the behaviour of banks. In the eighties Barclays and NatWest were both determined to be the UK’s biggest banks, measured by total assets. Mortgages are nearly 60% of banks’ assets. So they slugged it out, and then Building Societies were allowed to become banks which meant they could start manufacturing money. Thus regardless of employment levels the wall of money was created.

In the early nineties Barclays and NatWest were close to insolvent due to reckless lending and the fall in interest rates reducing profit margins. Also Basle1 came into force which required them to be more prudent. I conclude that unemployment has little or no impact on prices but a recession does reduce the number of transactions. Assuming no national lockdown the UK economy will grow 10% next year despite job losses. Today’s money supply determines next year’s average house price. Money is virtually free and will remain so for the next two years. This means house prices next year will rise between 5 and 8%. For a change London will suffer but relatively depressed rural areas will boom. I accept that airport-dependent places such as Crawley and Luton will suffer.

Covid will do more to ‘level up’ between the regions than Government policy.

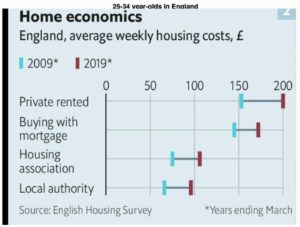

But you will say, this is all well and good, but it’s the deposit requirement which prevents youngsters from buying. Thanks to Covid many of the 25-34 year olds have been forced to save because of lockdowns. And many have had no commuting expense. And the bank of mum and dad has higher cash levels than normal. Why hold cash earning 0.1% when you can help a sibling get a house? If inflation doubles next year to 4%, the desire to buy property will increase. An inflating capital asset which is tax free. I rest my case.

Rising house prices increases consumer confidence via the wealth effect. Evidence suggests that households hold very little precautionary saving if their main asset is growing in value. Given the structural changes taking place, its likely half retail spend will be online by the end of 2021. The outlook for commercial property is a different ball game. Large sheds for online retail will still be in demand but city centre retail and office space will not. So we can expect both rent and capital values to fall on the latter. Some suggest by 20%.

Creative Destruction

An Austrian economist, E.F. Schumaker, was fascinated by innovation as a cause and effect in economic growth. He concluded that whereas inventions are random, innovations (which is an invention put to use) seem to cluster at particular points in time. We have known since 1922 that there are long waves in economic life which are around 50 years in duration. There are 30 years of above trend growth followed by 20 years of below trend. Its during below trend periods that clustering takes place and it is this which creates the next above trend wave of growth.

Since 2008 Western Economies have been below trend growth and Covid is accelerating technological change. There are many examples but the one I would like to mention is Quantum Computing. It is going to be the next big thing over the next 10 years. Google has already demonstrated a machine which within a few minutes made a calculation which would take thousands of years on current classical hardware. The ability to crunch masses of data at speed will transform everything in particular the application of AI and the Internet of Things.

BUT for success a large number of related and supporting activities have to be combined. This is why science parks next to Universities are so important and why silicon valleys exist. It is the combining of discrete activities which creates the wave. And destroys the old way of working. The resulting productivity gains simultaneously increase GDP per capita and structural unemployment.

The next 18 months:

Take a look at the chart. Normally the red line moves in line with the black line because when a bank lends it creates the money. When banks stop lending, as in 2011-2014, the central bank has to take over by creating new money which it uses to buy mostly Government debt. Covid has required more money than the commercial banks are willing to create so the Bank of England is creating it. We know so far Covid has cost £3k per person. None of this is funded from taxes, all of it has come from the Bank, in total just under £200Bn.

The crucial point is this is the equivalent of giving every citizen £3k to spend. Over the next 18 months I am convinced there will be another £1.5k per person spent by the Government and financed by the Bank. Remember debt = money. This is the largest economic stimulus we have seen since WW2.

Only when the new money is flowing freely through our economy will the Government claw some of it back through higher taxes. Next year Boris has to show the nation and the EU that the UK performs better outside the club than within it. Hence the stimulus will be maintained until higher growth is a reality.

There has been talk of negative interest rates, which is a system where you pay the bank to deposit money and they pay you to borrow. It is designed to stimulate bank lending and money creation. The chart above is clear: we do not need further monetary stimulus. So negative interest rates will not happen in the UK.

If inflation rises next year, will interest rates follow? No, because it is likely that the B of E will look at average inflation over a number of years before changing rates. The Fed has just adopted this approach in the USA. So money will be virtually free for the next 18 months.

The exchange rate illustrates how much political risk plays a role when the financial variables are similar. There will be a deal with the EU, so Sterling strengthens, then Boris says he will walk away and it weakens. Similarly with Trump’s utterances for the dollar.

I guess at a range of $1.30-1.38 and Euro 1.10-1.15 And as you can see I still expect strong growth next year. The IMF forecast is for global growth to be back at pre-Covid levels by the end of this year. Currently we are at 95% of pre-Covid output.

The performance of our economy over the next 18 months will depend on attitude. I am fortunate enough to be in touch with a range of SME owners in the UK. Their resilience, adaptability, and care for their employees is remarkable. And they are already trialling new business models with considerable success. As SMEs produce 60% of our national income their performance is critical. My optimism is the result of the attitude of these leaders: they do not whinge, moan, or give up.

They think, act, and create sustainable businesses. Some work in the hospitality sector and they are succeeding. I do not believe in Boris’s bluster, but if the media would publish more good news stories I believe it would have a more positive effect on attitude in general. Finally, there will be a bare bones trade deal with the EU, neither side can afford not to, but the detail will take years to settle. And yes there will effectively be a border in the Irish Sea.