All views expressed in this article are those of the author Roger Martin-Fagg and do not necessarily represent the views of Ellis Bates Financial Advisers.

Last weekend the Daily Telegraph had a banner headline: ‘Britain’s biggest ever collapse in GDP wipes out 18 years of growth’. This statement is completely wrong. I am concerned that individuals

who are trying to make the right judgement call on the future of their business are being fed this nonsense. To be clear: 18 years ago our GDP was £1 trillion. It is now £2.2 trillion. The reduction

in spending in April was 20% on the previous April. The monthly flow of spending averages £200bn. 20% of that is £40bn. The media, as we know, impact emotion and decision taking. That

Telegraph article is therefore both economically illiterate and irresponsible.

Over the past few months the BBC has occupied its 10 o’clock news slot with images of people who have died, are seriously ill, or extremely upset because they have lost loved ones to Covid19. There is little or no coverage of how SMEs are adapting their business model and successfully serving customers.

That lack of coverage could persuade people that things are going badly wrong in the British economy and that recovery will be a long and difficult process. That is not my view. And it is not the case.

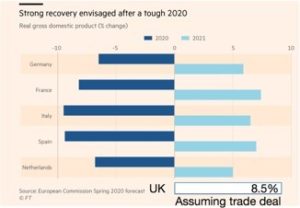

In this update I want to convince you that we will see a rapid recovery in the third quarter of this year and the global system itself will be back at 2.5% growth by this time next year.

If we consider previous recessions they exhibited similar characteristics. In 1979 the price of oil doubled, which caused inflation in the west to rise quickly – and interest rates soon followed. The

recession was caused by households and companies trying to balance their cash position. In 1989 the price of oil doubled and inflation rose to 10%; the response was an increase in interest

rates. Households cut their spending to balance their cash position and in the UK two banks, Barclays and NatWest, had overlent to the housing market which took them close to insolvency.

They called in loans and caused a short but dramatic shortage of credit. In 2008 the recession was caused by the western banking system which had over-leveraged its balance sheets. There

was a liquidity crisis as insolvent banks refused to lend to other insolvent banks and all of them stopped lending to businesses. In short, the last three recessions had similar causes and effects.

At the time of writing there is no recession. The definition of recession is two successive quarters of negative growth, which I do not think will happen.

So far it is clear that Q2 will be significantly negative. However, I expect Q3 to be significantly positive.

We all know that Q2 spending collapse was because people were unable to spend their income.

It is the 16th June as I write this. Shops opened yesterday. Footfall outside London was up 50%, in London up 30%. I would expect a steady increase over the next few weeks. Until cafes and or

public lavatories are opened we will not see many over 60 out shopping (except in garden centres because they have lavatories!).

My expectation is based on a simple piece of behavioural economics.

I believe that the majority of consumers and the majority of business owners like to see a particular number in their current account at the end of each month. this number could be positive or negative. Each of us likes to be in monetary equilibrium. There are two types of disequilibrium. The first type is insufficient money – we look at our current account balance and we see that it is

less than we are comfortable with. To restore the balance we immediately cut non-essential spending. It is this behaviour which caused the 1979 recession and the 1989 recession. In both

instances the increase in interest rates plus the increase in energy costs caused many to have insufficient money balances.

The second type of disequilibrium is excess money – we look at our current account balance and there is more there then we are comfortable with, so we spend it. However it doesn’t disappear

from the economy as a whole. It becomes an increase in sales and hence incomes for other players who in turn find they have excess money and they spend it. In this way excess money drives

an economic boom which may or may not result in rising inflation.

The big question is, where are consumers and businesses placed today? It is my judgement that the majority of consumers have excess money which they will get rid of as soon as they are able.

Consumers have excess money because even though their income has fallen in recent weeks their expenditure has fallen by more. Turning to businesses, the picture is less clear. Businesses

which have been able to borrow under the terms of the government sponsored schemes are likely to be cash neutral. Other larger businesses are probably enjoying excess money balances. Finance

directors are trained to ensure the business is both liquid and solvent. The data I will share with you suggests many businesses have excess liquidity which will be spent as soon as confidence

returns to the boardroom. Sales well ahead of forecast is a significant driver of confidence. Taken together I expect consumer spending to be stronger than forecast and, with a time lag, I

would expect business to splash the cash. In short I, unlike the majority, expect an inflationary boom to take off in the next few months. The only things which will dampen this could be the media

reporting company closures, an increase in the R well above 1 (even if it a small pocket), and stories of mass redundancies.

The latest employment data shows how well the employment support packages are working. Headline rate is unchanged at 3.9%. I would remind you that in a modern economy which is undergoing significant technological change and thus requires people to change jobs and careers – the definition of full employment is 5%. The data for March-May shows that hours worked for full time workers fell from 36.5 to 33.9 per week. The media have emphasised the increase in benefit claimants at 600,000. However it is possible to be employed and claim benefits simultaneously. For example there are 500,000 self-employed musicians in the UK. I would expect the majority to be getting only intermittent work if at all. Many will be claiming benefits.

The employment support packages reduce and then end by October. Many commentators are suggesting that unemployment will surge beyond that date. It will if spending fails to recover from

now. I am assuming the Government will bring the 2m rule down to 1m and drop the two week quarantine rule for visitors by July 4. This will be just in time to save the hospitality sector. If Government delays beyond this date then I would expect a significant increase in redundancies beginning in August. There are 3.2 million employed in the hospitality sector and of course more dependent on it for custom such as food service, the drinks industry and musicians. The industry employs people under 30 many of whom receive the minimum wage. I now want to give you the reasons for my optimism (I realise this is uncharacteristic).

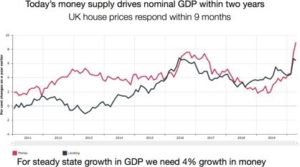

The rate of growth in money supply has more than doubled.

The Government is spending an extra £40Bn a month. All this is new money created by the Bank of England. In addition the banks are growing their loan books.

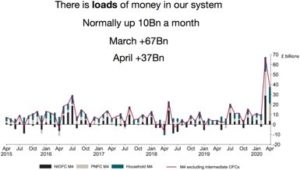

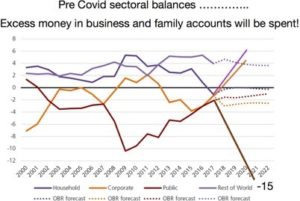

This chart needs some explaining. Assume business A buys and pays for something from business B. The amount in the grey block doesn’t change. Assume a household buys two new bikes –

the amount in the blue box goes down, the amount in the grey block goes up. So new money in the system changes hands and accounts when it is spent but it remains in the system unless it is

spent abroad.

This data shows that overall the system is flush with ‘cash’. It is not equally spread. One of the consequences of lockdown is the increase in inequality it causes. For example a well-run small

business may make some employees redundant to conserve cash. All we need is lockdown to end and the cash will begin to change hands, when it does GDP indicators will soar.

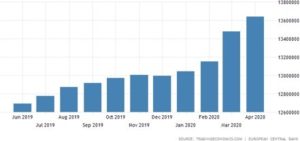

The data is replicated throughout the World. By the end of 2020 global personal and business accounts will have circa £14 trillion more than at the start of the year. There will be not be an L

shaped recovery. It will be a short V. When £14 trillion begins to be spent, that is seriously strong demand for goods and services. Just to be clear. The £14 trillion has been spent once by governments, we now need business and consumers to spend it. This is what economists call the multiplier or velocity of money.

Euro Area Money Supply

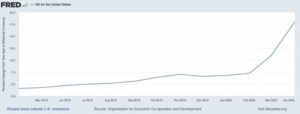

They do it bigger in the USA: look at the graph: money is growing 3x faster than normal.

The steady state growth in money supply for the USA is circa 5% per annum. It is now growing at nearly 18%. No wonder the stock market is defying gravity! Why is this happening you may ask?

New Monetary Theory

In essence NMT challenges mainstream economic thinking. This mainstream view is as follows: at any point in time there is a finite supply of money for investment by Government and business. If Government borrows more then it leaves less for business to borrow. So if Governments increase their borrowing it crowds out the private sector. And it has political consequences: mainstream

thinking supports Conservative/Republican mindsets. NMT is seen as the excuse for lefties to increase the size of the state which will crush the private sector.

Mainstream economics has never fully understood money, very few economists actually understand how money works in a modern society.

In 2008 when the Western banking system failed because it had created too much money lending to dodgy property companies and households who were unable to afford the interest bill. Governments bailed them out using new money created by the central bank. Then Governments introduced austerity measures to pay for it.

BUT austerity killed productivity growth due to underinvestment in training, infrastructure, health services, and R&D. And lower productivity meant slower growth in wages and taxable incomes.

NMT shows that if the government borrows newly created money from its own bank and spends it on productivity raising activities then the tax base expands (with a time lag), and the interest

payable on the new debt is easily financed. The outstanding debt remains as an increase in the national debt. Anyone with a mortgage knows that providing one can pay the interest and the value

of the asset rises then it works. NMT applies exactly the same thinking to the country as a whole.

It must be emphasised that Government should not use the new money to finance transfers such as pensions, welfare payments and social support. And given historical experience it is best that

the new money is allocated to private sector companies to deliver the products and services.

NMT has been quietly adopted in the UK, Germany, Japan and the USA. France has always applied it with its state sponsored Indicative Planning. Brits should note that the French produce the same output as we do but with 17% fewer hours of work. Italy would adopt it if the EU would let it.

I find the politics of NMT theory fascinating. Because of anchoring and confirmation bias people see NMT as socialism by the back door. And yet Rishi Sunak is clearly a convert, and Boris (who

doesn’t understand money) buys it if it keeps northern voters on side. It will allow a levelling up. Trump buys it if it means he remains President. The surprise is Germany. I have no doubt that when inflation takes off next year there will be siren voices claiming it is a mistake, unless of course the value of their property portfolio and SIPP grows faster than inflation, which it will!

Dear reader, I hope you are still awake!

We are in the final stages of the analysis, hang in there.

There are four composite sectors in an economy.

Households, Businesses, Government and the Overseas sector (measured by the balance of

payments).

There are massive flows between each sector. One sector’s surplus is another’s deficit. All four sectors summed must equal zero.

I have adapted the chart below from the Office of Budget Responsibility. The OBR forecast the budget deficit will rise to 15% of GDP (£330bn in today’s money) by the end of 2021. This deficit

will mostly be financed by new money from the Bank of England, so no crowding out of the private sector and no increase in interest rates. The rest of the World has a 4% surplus with us because we have a deficit on our current account balance of payments of 4%. We can assume this will not change much.

Households were forecast to be in balance but thanks to the March budget plus Covid support, increases in public sector pay, the 3.9% increase in the state pension, and the upcoming infrastructure spend households will enjoy a surplus of 6%. NB this is £132bn in today’s money.

Corporates will enjoy a surplus of 4%, or £88bn in today’s money. If the labour market tightens considerably then households will get more and corporates less.

The implication of this is straightforward. The economy will grow strongly as soon as lockdown is over and households return to their old consumption habits: enjoying meals out with friends, going to concerts, buying new cars and televisions, shopping online and down the high street, painting their house and buying new furniture, new lawnmowers, a patio, a garden office, an expensive holiday, skiing. Upgrading their PC, going to the pub, splashing out on significant birthday celebrations, etc. And for some a bigger house, or a second home, or a boat, or paying for the

grandchildren’s education.

It is up to you whether you agree with this analysis. If you do you will be getting your business fit for the imminent expansion and ignoring the doom laden scribblers. If you don’t you will be hanging on to cash, cutting capex, making people redundant, and agreeing with those who say the new normal will be much less consumption, an L shape economic profile, and a country going

nowhere fast.

In my next update I will forecast the usual numbers but as I write this our PM has some critical choices to make: 1m distancing, ending travel quarantine, building more permanent ICU capacity,

opening up all hospitality, ensuring there is trade deal by the 1st Jan t and most important of all telling the nation that Covid in its various forms is likely to be a regular occurrence. As a nation we

must learn to live with it instead of locking down society.

Roger Martin-Fagg

June 16 2020

About the author

Roger Martin-Fagg is an economist who combines insight into the financial and policy worlds with management strategy. He specialises in making economic activity, trends and indicators understandable and delivers both an economic outlook, and what organisations should do to prepare.