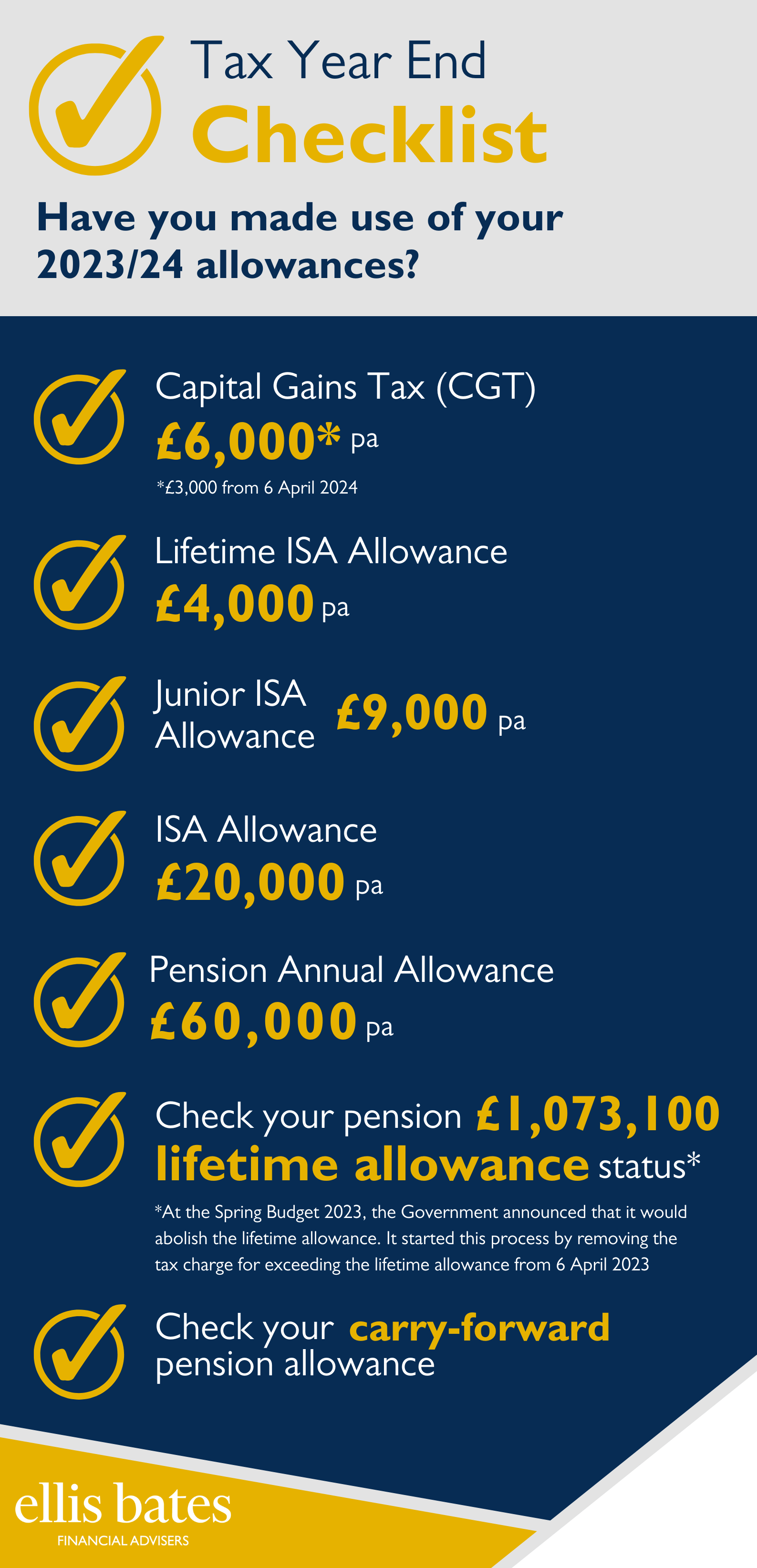

Tax Year End Checklist

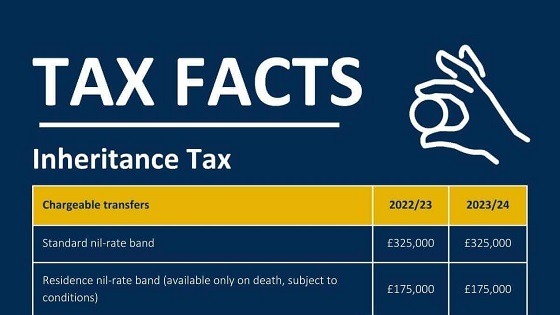

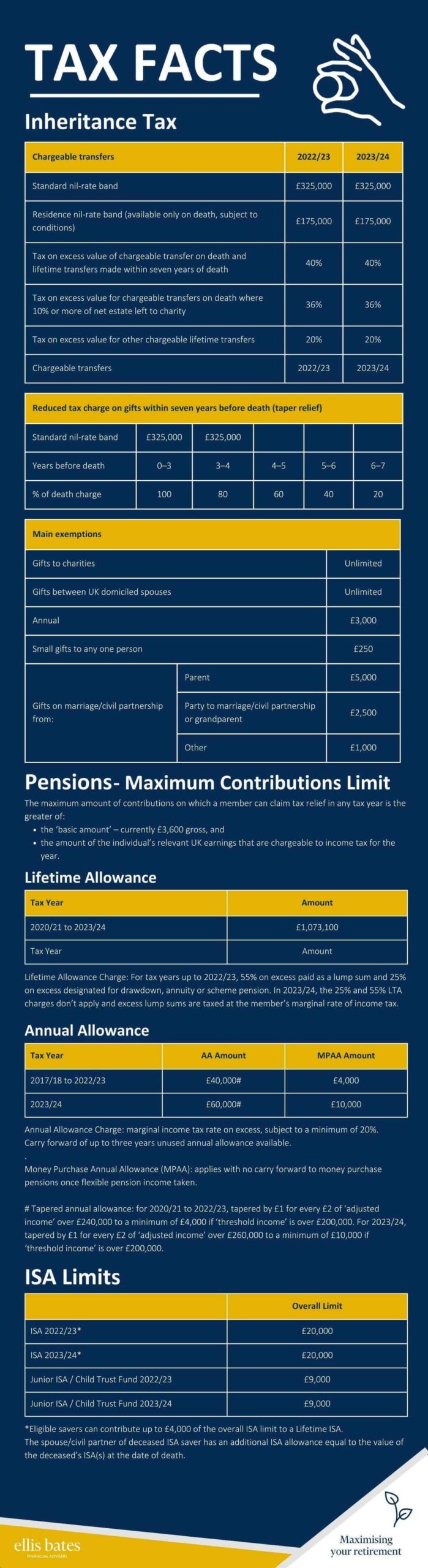

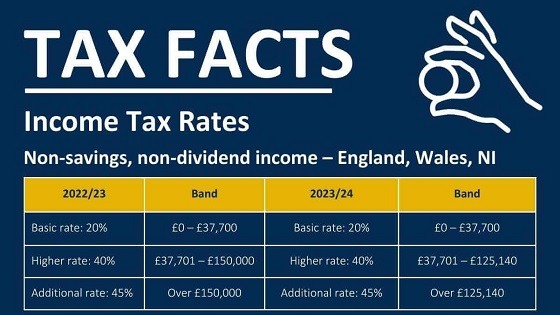

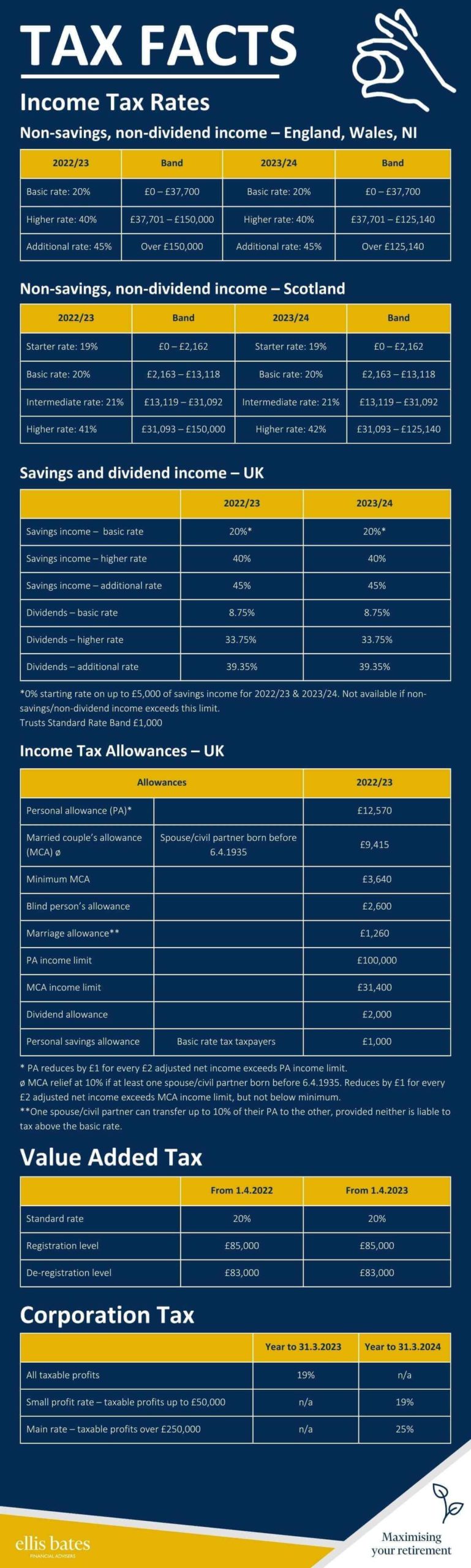

https://www.ellisbates.com/wp-content/uploads/2024/02/Tax-year-end-checklist-FB2-Copy.png 940 591 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gPersonal tax planning should be at the top of your agenda as the end of the current tax year is not too far away. Taking action now may give you the opportunity to take advantage of any remaining reliefs, allowances and exemptions.

At the same time, you should be considering whether there are any planning opportunities that you need to consider either for this tax year or for your long-term future.

Feel you need to talk about a tax year end tax health check?

We hope you find this checklist useful, but please bear in mind that this only provides a summary of the options available and not all options will be suitable for everyone. Please do contact us if you would like more information on any of the areas outlined above.

7 Benefits of Financial Advice

7 Benefits of Financial Advice