Enhancing retirement through lump sum contributions

https://www.ellisbates.com/wp-content/uploads/2024/05/GettyImages-1161412690-1024x683.jpg 1024 683 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

Contributing additional amounts to your pension stands to benefit you significantly in the long term

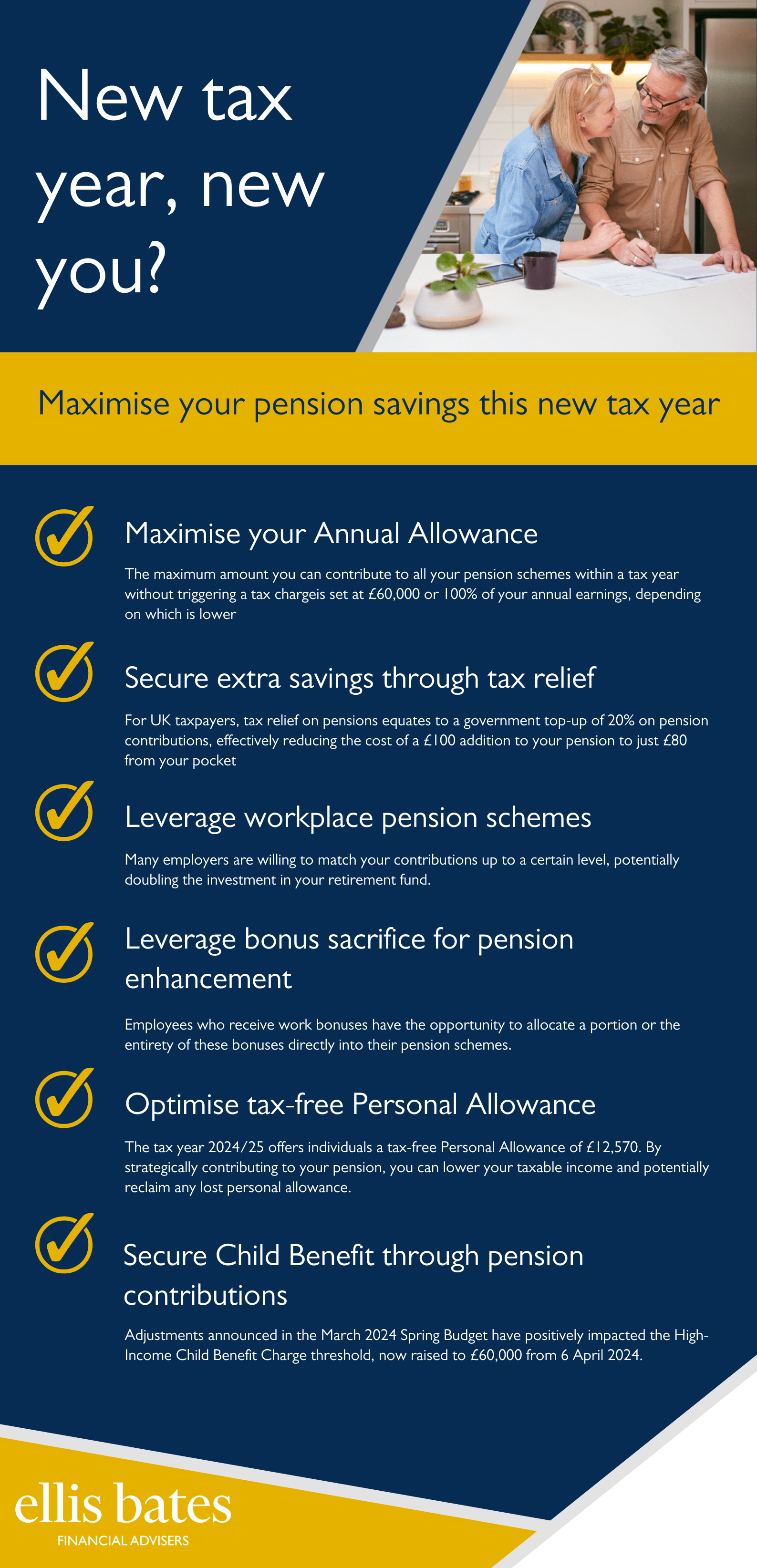

Recent research findings have brought to light a striking observation: fewer than 10% of adults in the UK contribute occasional lump sums to their pensions. This statistic is particularly surprising given that such contributions could significantly amplify one’s retirement savings.

Analysis reveals that even modest lump sum investments can significantly increase the overall size of one’s pension pot due to the power of compound growth over time. For example, starting with an annual salary of £25,000 and contributing the auto-enrolment minimum (5% from the employee and 3% from the employer) from age 22 could lead to a retirement fund of around £434,000 by 66.

Yet, by adding nine lump sum payments of £500 every five years from age 25 to 65, you could enhance your retirement savings by an additional £11,000. Those capable of making heftier contributions, such as £5,000 every five years, could see their pension pot grow to £549,000, which is £115,000 more than without any lump sum additions, not accounting for inflation.

Value of forward-thinking financial decisions

Encountering unexpected financial windfalls, whether through bonuses, gifts or other means, often tempts immediate expenditure. Currently, many are directing these extra funds towards managing monthly expenses. However, those who are financially able to contribute additional amounts to their pension stand to benefit significantly in the long term.

Pensions offer tax efficiency and the potential to outpace both inflation and interest rates on savings accounts, making them a wise choice for securing one’s financial future. With the end of the fiscal year having passed, and with it the expectation of annual bonuses for many, allocating a portion of this windfall towards a pension could substantially impact your retirement lifestyle.

Role of employers and providers in future planning

Employers and pension providers play a crucial role in educating individuals about the importance of long-term financial planning. It is essential to illustrate how pensions fit within a broader financial context, ensuring individuals perceive retirement savings as a key component of their overall financial strategy.

These efforts can empower individuals with the knowledge and resources needed to make informed decisions about their financial future, fostering a proactive engagement and planning culture.

If you’d like to discuss your financial future, please get in touch with us:

Source data:

[1] Boxclever conducted research for Standard Life among 6,350 UK adults. Fieldwork was conducted 26 July–9 August 2023. Data was weighted post-fieldwork to ensure the data remained nationally representative on key demographics.

[2] Calculations assume the following: Starting salary £25,000 – Employer contributions 3.00% – Employee contributions 5.00% – Investment growth 5.00% – Salary growth 3.50% – Annual investment costs 1.00%

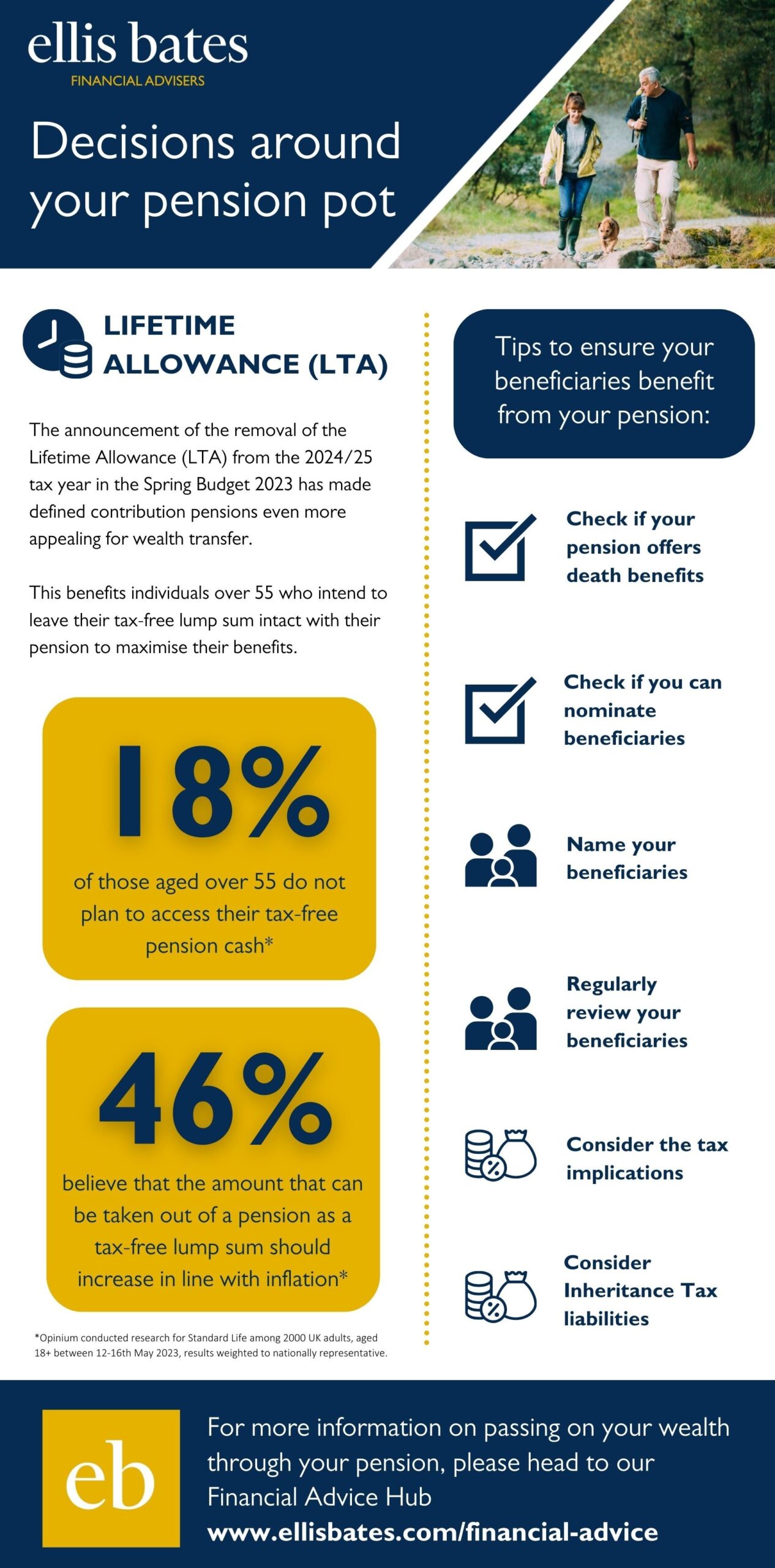

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.