5 fundamentals for successful investing during a General Election

https://www.ellisbates.com/wp-content/uploads/2024/06/1-1024x576.jpg 1024 576 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

How could the general election impact your finances and investments?

The upcoming general election could bring significant changes to your financial planning and investment strategies.

Please get in touch with us if you have any questions or want to reassess your situation.

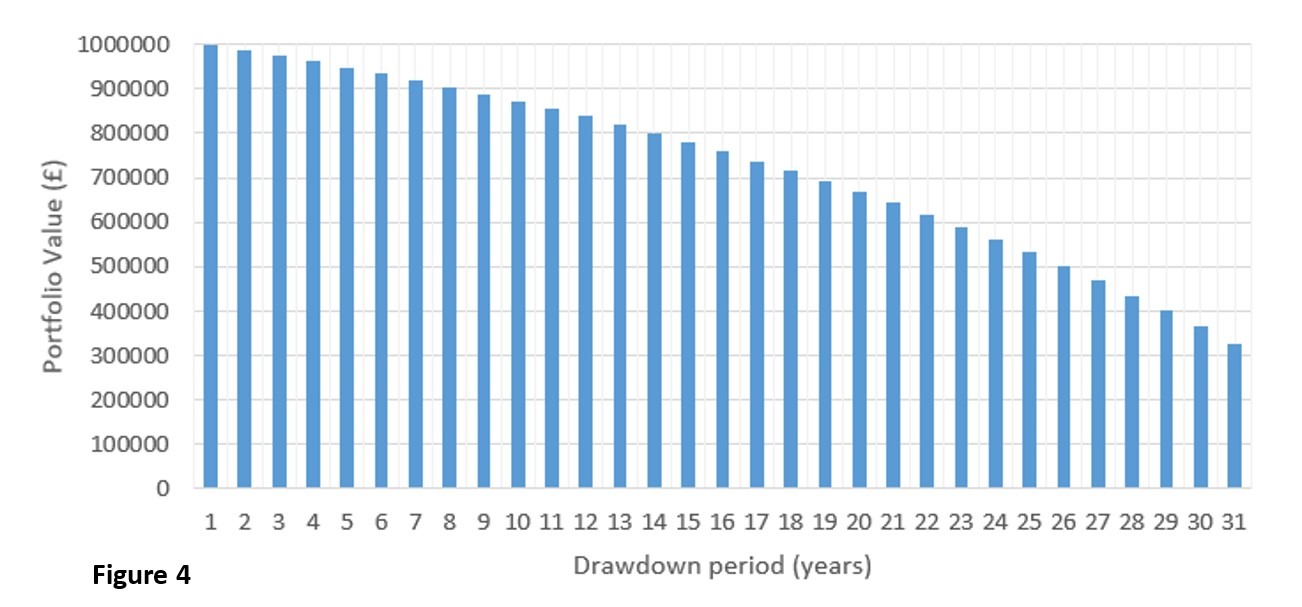

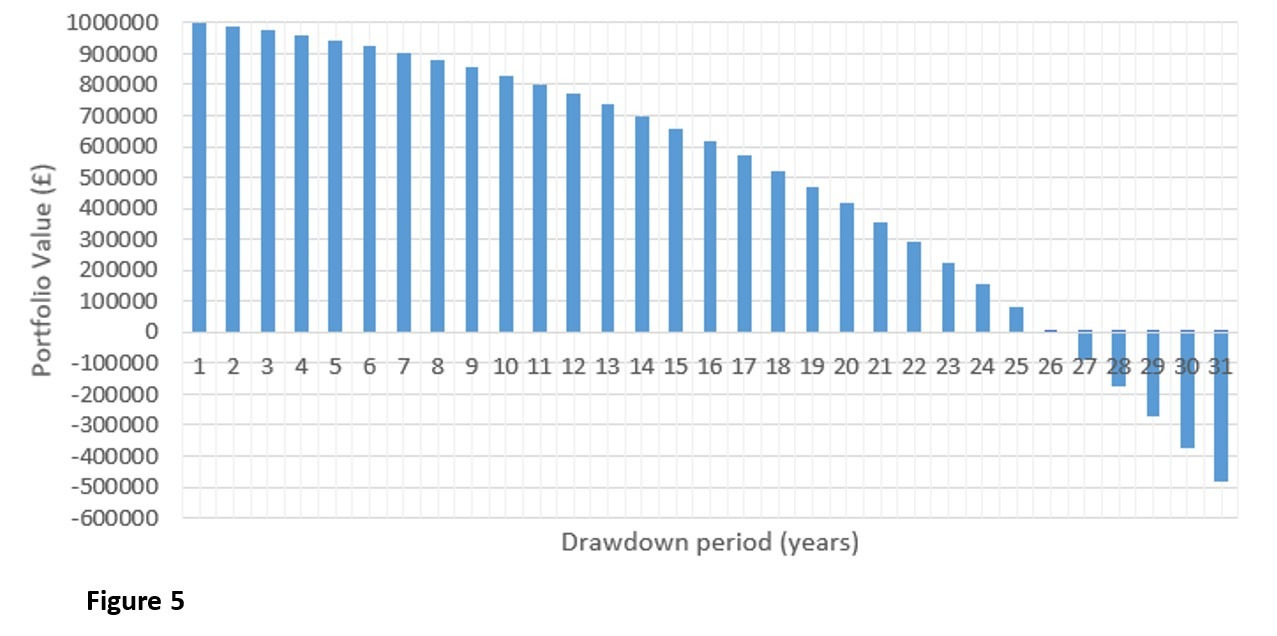

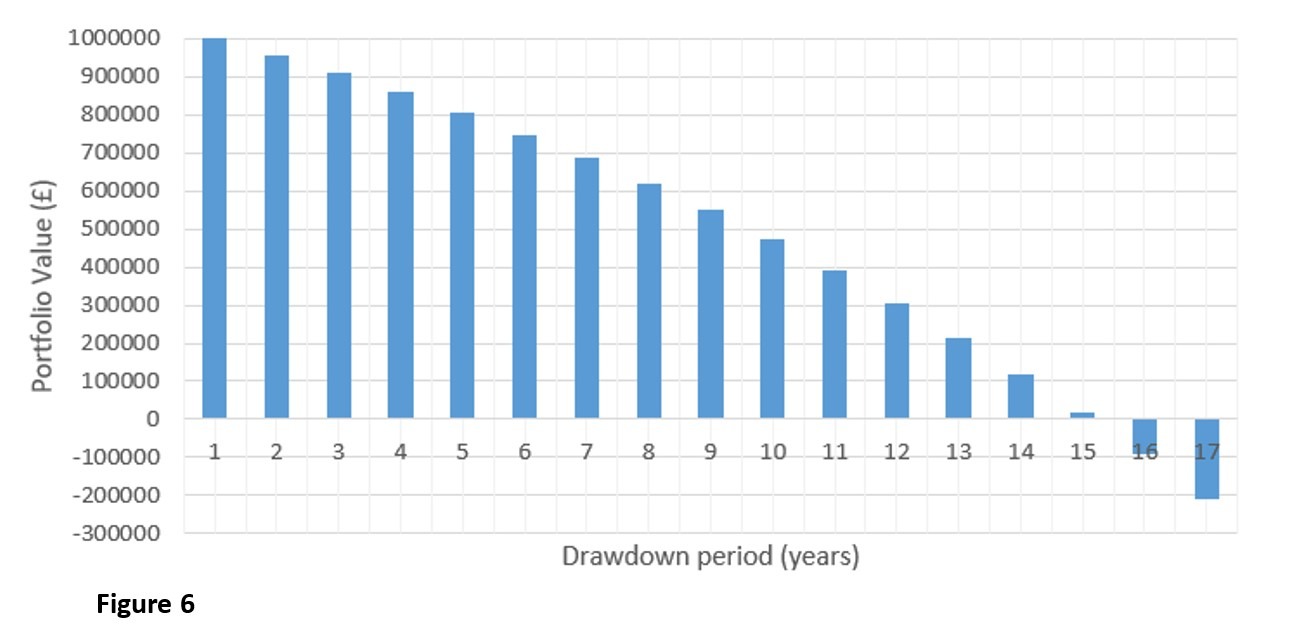

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.