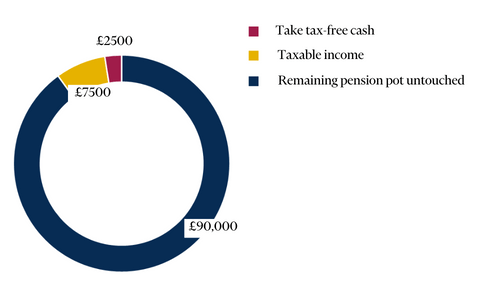

You also have the options of phased or partial drawdown and we can explain these further as part of a personalised consultation. We use sophisticated cashflow modelling software to help you develop lifetime financial plans and to bring your pension planning to life, so you can see the financial impact of the pension options you choose.

As Financial Advisors we are here to help you make good decisions about using your pension fund and how it’s accessed and invested.

Learn more about cashflow modelling and how it can bring your financial future to life.

Pension Lifetime Allowance

Following the 2023 Spring Budget, Jeremy Hunt has announced that the Lifetime Allowance charge will be removed from April 2023 before it is abolished entirely from April 2024.

Those with large pension pots will also need to consider the pension lifetime allowance implications: the lifetime allowance is currently £1.731m, and the amount you can withdraw from your pension in your lifetime before paying the hefty 55% tax charge on everything you take above this limit.

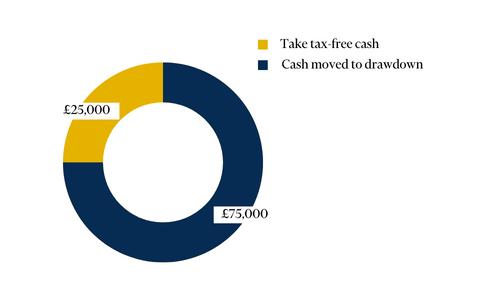

When you move to drawdown, you crystallise part of your pension pot (known as a benefit crystallisation event) and if you move your whole pension to drawdown at once you crystallise the entire pot and could then be hit with the lifetime allowance charge as soon as you access your pension.

It is vital to take expert professional advice if you think you may exceed your pension lifetime allowance or you are unsure how this is calculated before making any drawdown decisions, as the taxation implications could be very costly.

How much does pension drawdown cost?

It is important for you to understand any charges associated from pension drawdown, these may include ongoing charges for managing your investments and the associated charges and taxation of complying with HMRC pension withdrawals. Again, ideally your pension investments should grow enough to cover these extra costs and we are here to help you accurately calculate and understand your pension options.

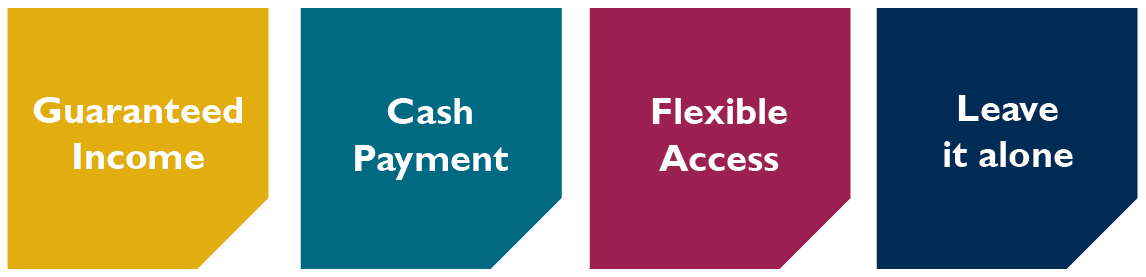

You have several options with regards accessing your pension pot but before you do anything with your hard-earned cash, it’s important to take the time to understand your options, as the decisions you make will affect your income in retirement.

You have several options with regards accessing your pension pot but before you do anything with your hard-earned cash, it’s important to take the time to understand your options, as the decisions you make will affect your income in retirement.