Free Guide: Trusts

https://www.ellisbates.com/wp-content/uploads/2024/09/Ebookbrochure-socials-3-1024x535.png 1024 535 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

To download your free guide to Placing Assets into a Trust, please fill out your details below:

"*" indicates required fields

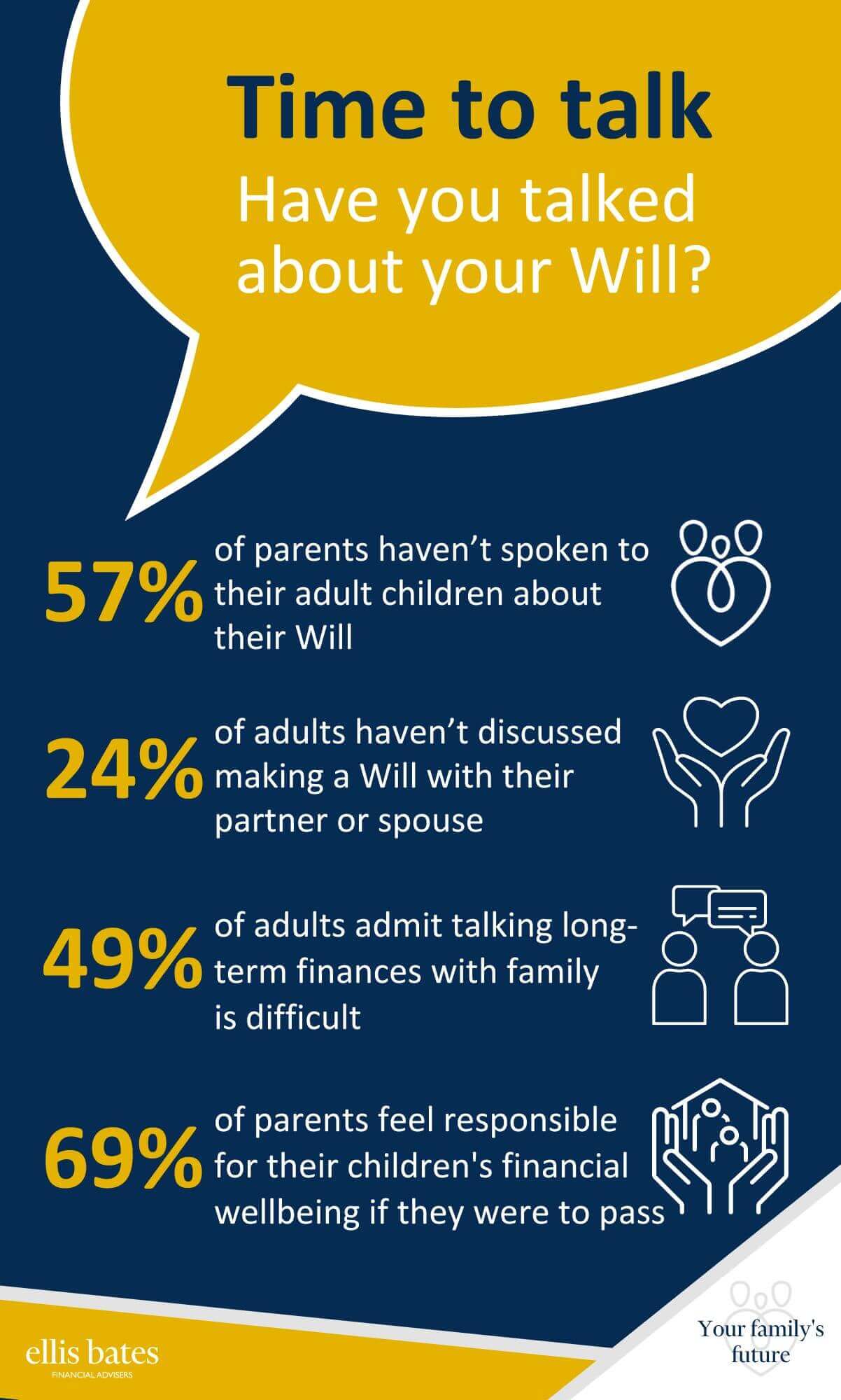

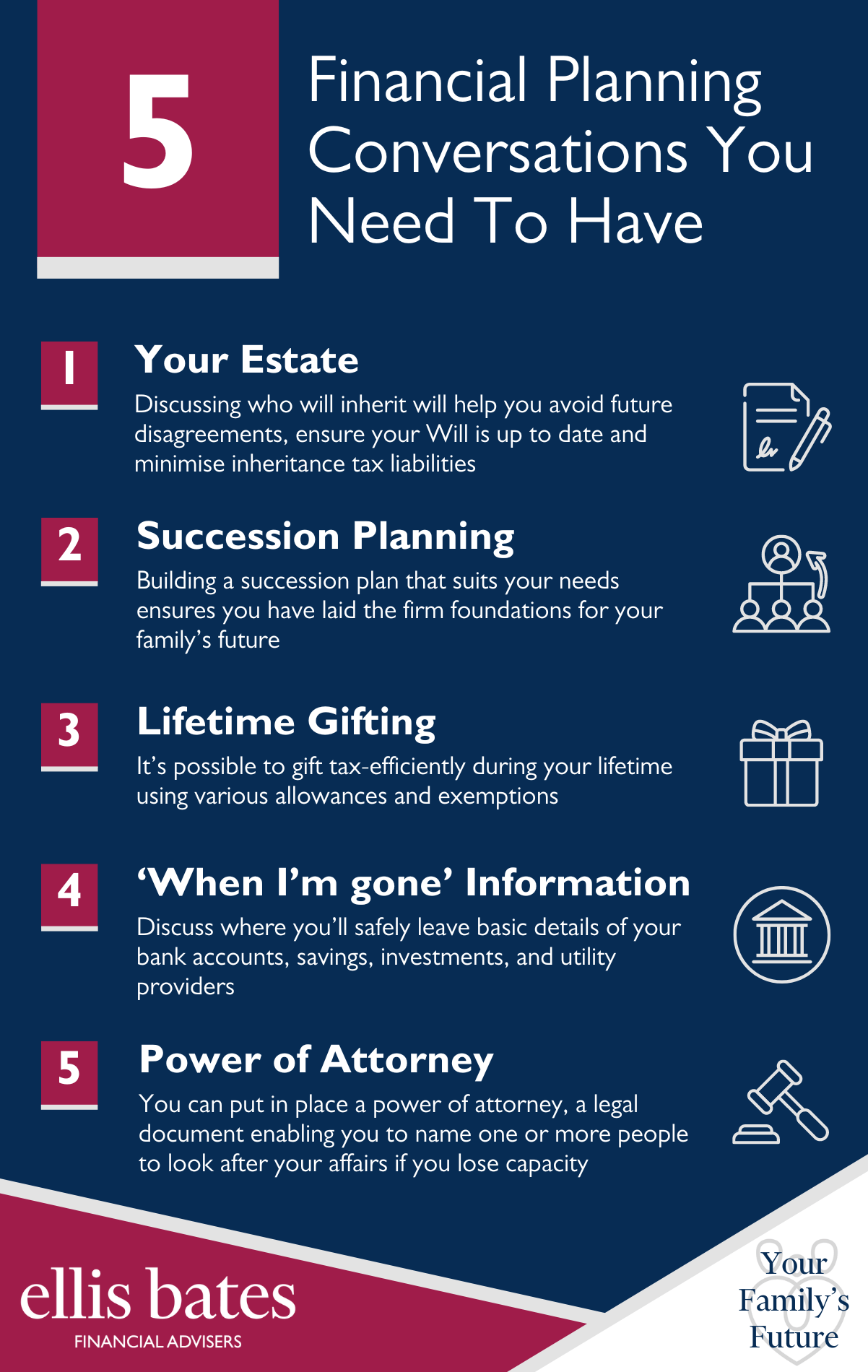

Protecting your legacy and boosting your children’s financial security

Protecting your legacy and boosting your children’s financial security