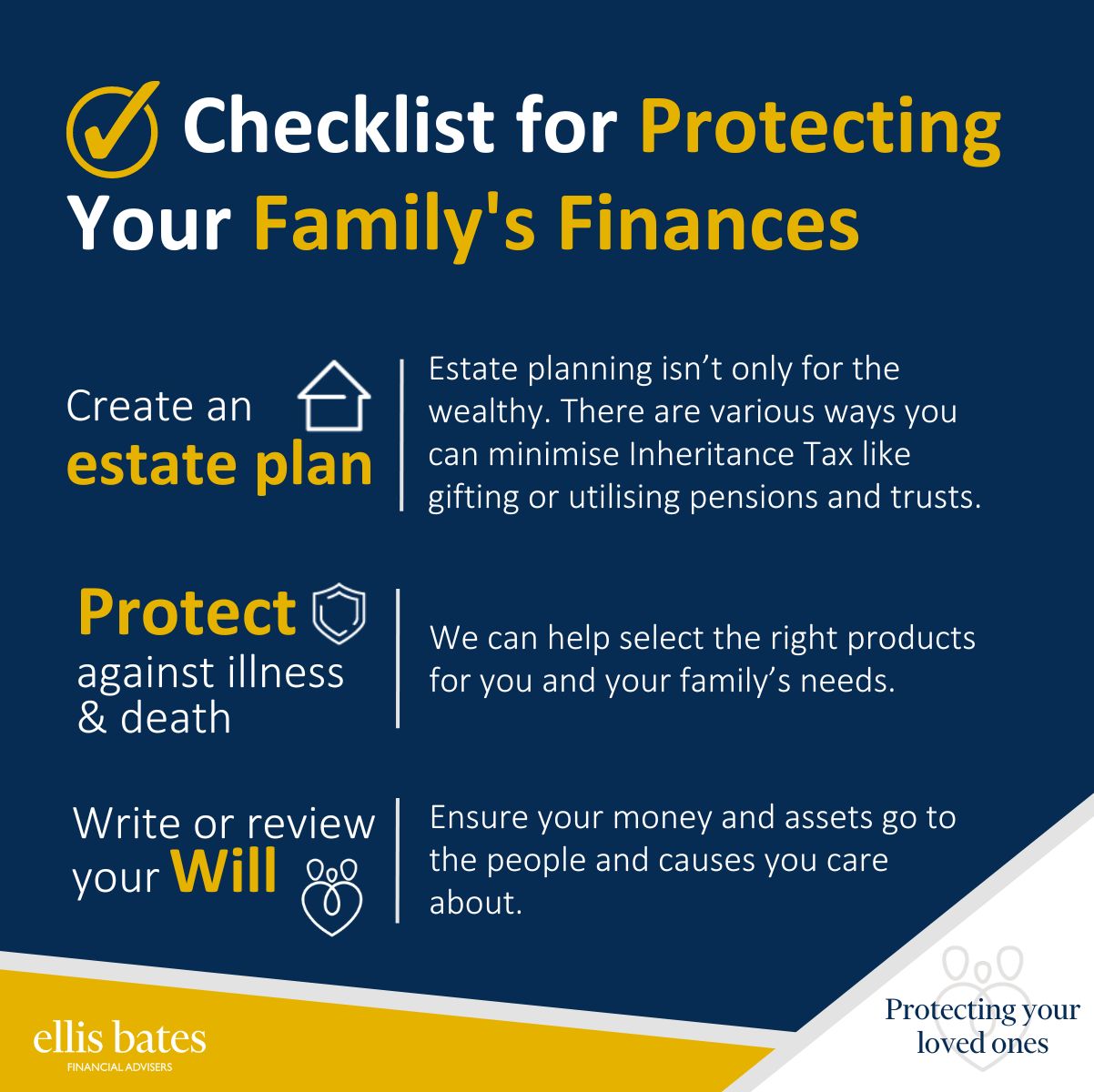

Checklist for Protecting your Family’s Finances

https://www.ellisbates.com/wp-content/uploads/2023/02/Checklist-for-Protecting-Your-Familys-Finances-infographic-holder.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gChecklist for Protecting your Family’s Finances

Create an estate plan

Estate planning isn’t only for the wealthy. There are various ways you can minimise Inheritance Tax like gifting or utilising pensions and trusts.

Protect against illness and death

We can help select the right products for you and your family’s needs.

Write or review your Will

Ensure your money and assets go to the people and causes you care about.

Get in touch

For more information on our inheritance tax planning services, please get in touch.

Financial support to younger members as a direct result of the pandemic.

Financial support to younger members as a direct result of the pandemic.

By Grant Ellis, Director Ellis Bates Group

By Grant Ellis, Director Ellis Bates Group

One in five self-employed and contract workers unable to survive a week without work. The world of work has changed enormously over the past 20 years. Being self-employed, freelance or working on a contract basis has become the norm for all sorts of professions. Although it has many benefits, working for yourself means that the responsibility for providing a financial safety net shifts from the employer to the individual. New research has highlighted the precarious nature of self-employed people’s finances.

One in five self-employed and contract workers unable to survive a week without work. The world of work has changed enormously over the past 20 years. Being self-employed, freelance or working on a contract basis has become the norm for all sorts of professions. Although it has many benefits, working for yourself means that the responsibility for providing a financial safety net shifts from the employer to the individual. New research has highlighted the precarious nature of self-employed people’s finances.

How to secure your family’s financial future.

How to secure your family’s financial future.

Over six million adults refuse to discuss their will with loved ones. Making a Will is very important if you care what happens to your money and your belongings after you die, and most of us do. But have you tried to talk with your children about your Will? If that conversation isn’t happening, you’re not alone.

Over six million adults refuse to discuss their will with loved ones. Making a Will is very important if you care what happens to your money and your belongings after you die, and most of us do. But have you tried to talk with your children about your Will? If that conversation isn’t happening, you’re not alone.

Welcome to our Guide to Life Insurance Protection. It’s not easy to think about how you would secure your family’s future if you were no longer around. Understandably, we would rather not think of the time when we’re no longer around. But it’s important to protect the things that really matter – like our loved ones, home and lifestyle – in case the unexpected happens.

Welcome to our Guide to Life Insurance Protection. It’s not easy to think about how you would secure your family’s future if you were no longer around. Understandably, we would rather not think of the time when we’re no longer around. But it’s important to protect the things that really matter – like our loved ones, home and lifestyle – in case the unexpected happens.