Free Guide: Enhancing Pension Contributions

https://www.ellisbates.com/wp-content/uploads/2024/05/Ebookbrochure-socials-8-1-1024x535.png 1024 535 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gPlanning for your retirement is one of the most important financial decisions you will make and no matter what your age or how far away from retirement you are, putting savings plans in place as early as possible to maximise your pension pot is vital.

We have produced a free Guide to Enhancing Pension Contributions for a Brighter Future to help you decide how to maximise your pension savings :

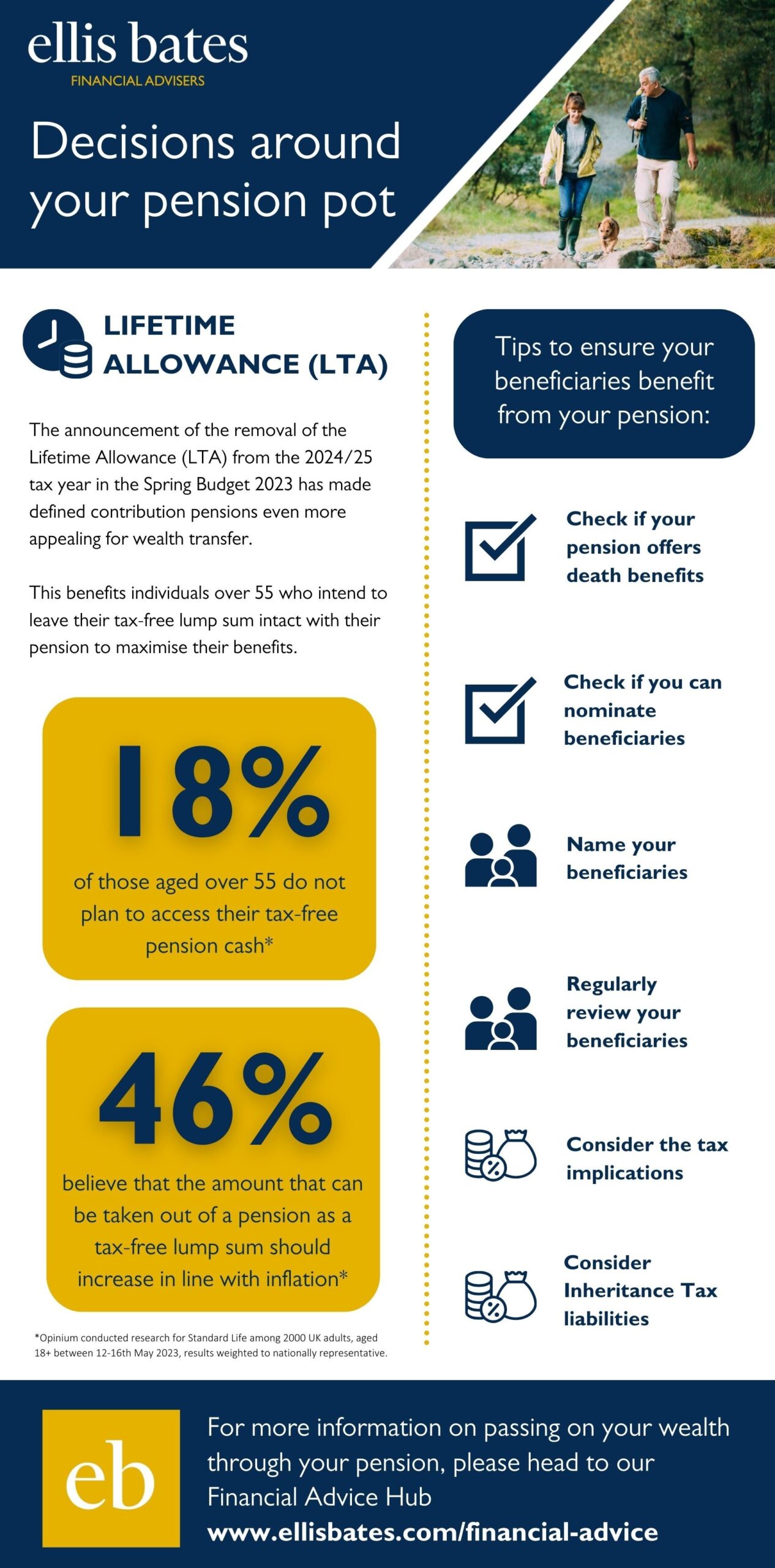

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.