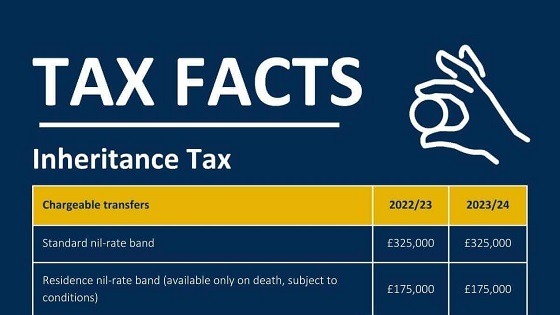

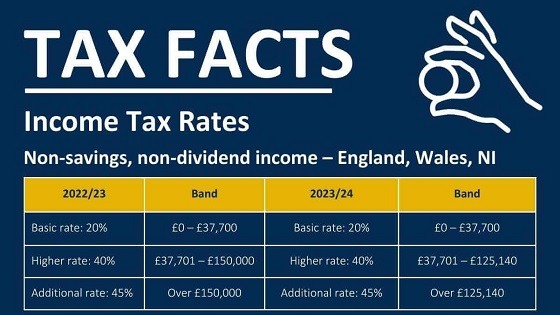

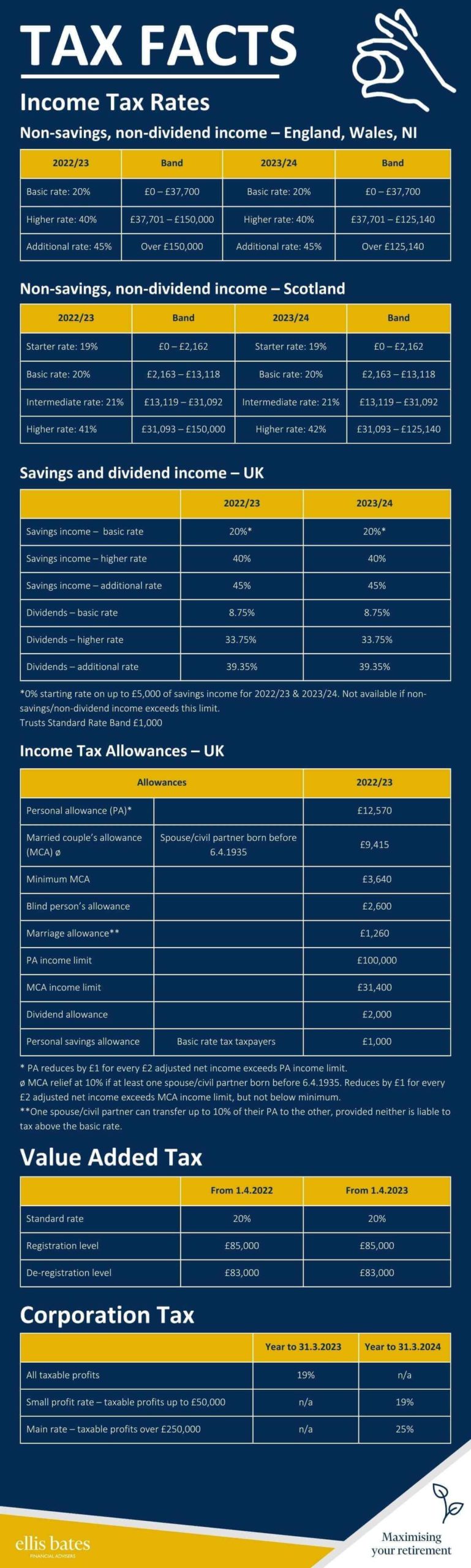

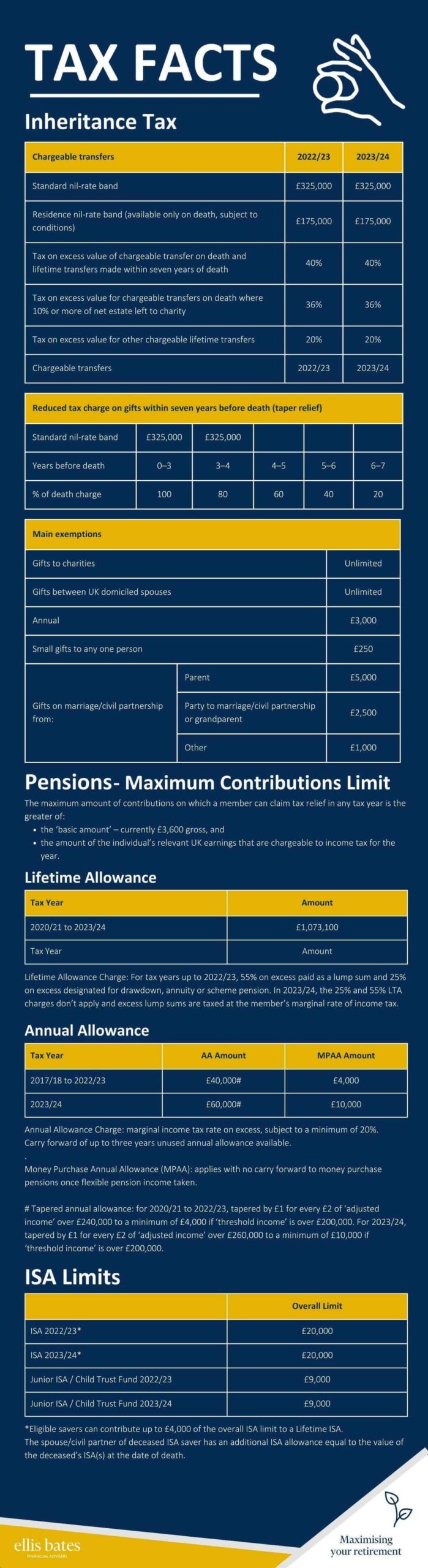

IHT, pensions & ISAs

https://www.ellisbates.com/wp-content/uploads/2023/04/Tax-Facts-2-Infographic-holder.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

The UK tax system is notoriously complex, but the benefits of structuring your finances tax efficiently can be significant.