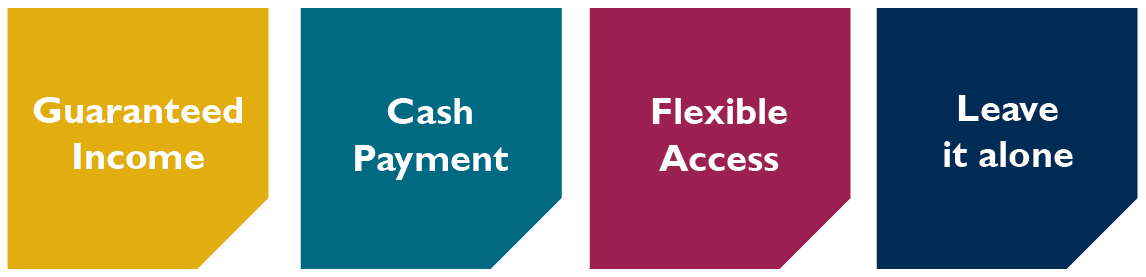

Pension tax free lump sum

If you’ve got a personal pension or a defined contribution pension, you can take up to 25% of its value as a tax-free lump sum. In some cases you can take your whole pension fund.

The remainder of your pension fund is potentially taxable and may either be taken as cash, used to buy an annuity (a guaranteed income for a specific period or for the rest of your life), or you may leave the money invested and take withdrawals on a regular basis or as and when you need.

Leave your pension alone

You can of course choose to leave your pension money alone if you do not need the tax free cash and or income. There are several benefits to consider in delaying any of the above options, firstly that your pension funds will continue to grow tax free and secondly your entire pension savings are free of income tax and inheritance tax for example, if you leave them untouched, should you die before the age of 75. If you are taking your dependents into account in your pension planning tax considerations are crucial.

Buying an annuity – guaranteed income for life

Annuities enable you to exchange your pension pot for a guaranteed income for life. These were once the most common pension option to fund retirement, but changes to the pension freedom rules have given savers increased flexibility. The amount you will receive depends on a number of factors, for example, how long the insurance company expects you to live and other benefits the annuity provides, such as a guaranteed payment period or payments to a spouse or dependent.

Annuity rates, which dictate the income you get, have consistently fallen in recent years, as they are linked to the interest rate on government bonds and central bank rates. However, annuities still appeal to those who need a guaranteed income on top of the state pension for example and provide a secure, regular income throughout retirement (which is still taxable).

Many people make the mistake of taking the annuity rate offered by their current pension provider. It is vital to scan the whole marketplace for the best annuity rate as you approach retirement or ask a Financial Advisor to do so for you.

Flexible access options

When it comes to assessing pension options, flexibility is the main attraction offered by income drawdown, which allow you to access your money while leaving it invested, meaning your funds can continue to grow.

Pension drawdown normally allows you to draw 25% of your pension fund as a tax-free lump-sum, or series of smaller sums. You have complete control over how much or how little you draw down but remember anything over 25% is subject to tax. This ‘tax-free cash’ is known as the Pension Commencement Lump Sum, or PCLS.

The rest of the fund remains invested and is used to provide you with a taxable income, via withdrawals on a regular basis or as and when you need. You set the income you want, though this might be adjusted periodically depending on the performance of your investments. You need to manage your investments carefully because, unlike a lifetime annuity, your income isn’t guaranteed for life.

Uncrystallised Funds Pension Lump Sum (UFPLS)

You do not have to draw your pensions commencement lump sum at the outset. Instead you may use your pension fund to take cash as and when you need it and leave the rest untouched where it can continue to grow tax-free. For each withdrawal, the first 25% (quarter) is tax-free and the rest counts as taxable income. There might be charges each time you make a cash withdrawal and/or limits on how many withdrawals you can make each year.

Combination of options

It may suit you better to use a combination of the options outlined above. You might want to use some of your savings to buy an annuity to cover the essentials (rent, mortgage or household bills), with the rest placed in an income drawdown scheme that allows you to decide how much you wish, and can afford, to withdraw and when.

Alternatively, you might want more flexibility in the early years of retirement, and more security in the later years. If that is the case, this may be a good reason to delay buying an annuity until later.

Different levels of risk and security and potentially different tax implications.

The different ways of taking your money have different levels of risk and security, and potentially different tax implications too. As with all retirement decisions, it’s important to take professional financial advice on what’s best for you. Everybody’s situation is different, so how you combine the options is up to you.

We offer cashflow forecasting to highlight any shortfalls and to help plan a sustainable retirement income.

It is never too early to start and never too late to review your pensions.

Pensions can be a confusing and overwhelming subject and our team of Financial Advisors are here to take you through your options, without using any industry jargon.

Pensions can be a confusing and overwhelming subject and our team of Financial Advisors are here to take you through your options, without using any industry jargon.