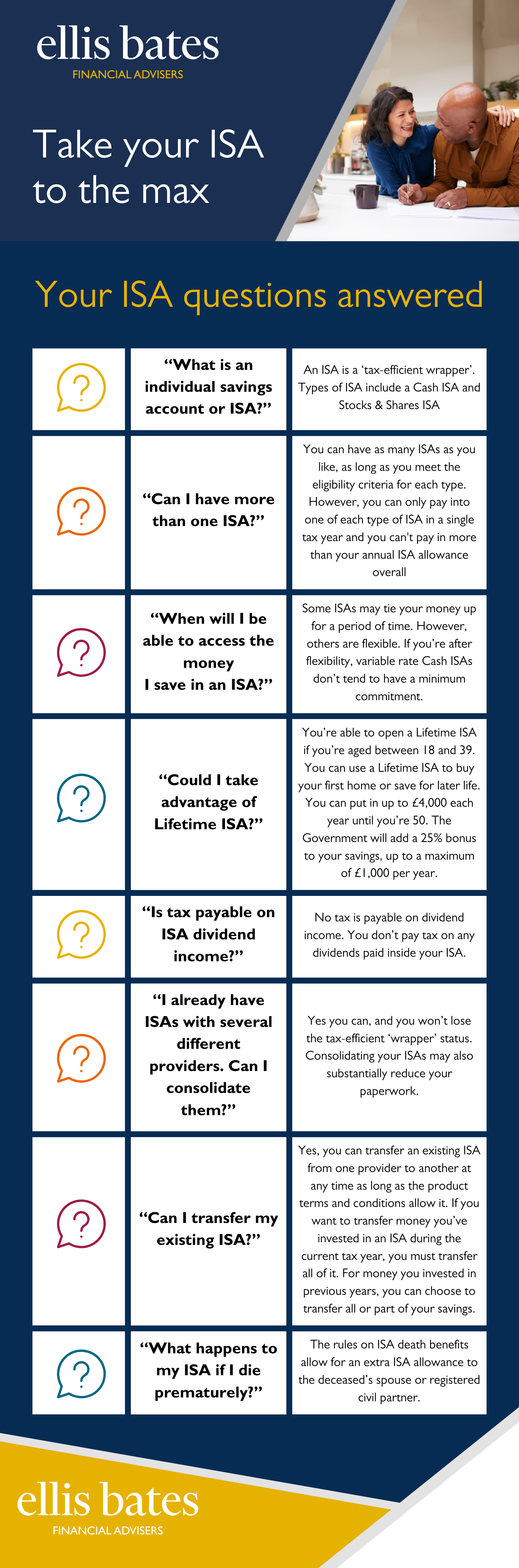

Take your ISA to the max

https://www.ellisbates.com/wp-content/uploads/2024/02/GettyImages-1282868177-1024x853.jpg 1024 853 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

ISAs are one of the most straightforward ways to achieve tax-efficient gains. Remember you can currently invest up to £20,000 this tax year in an ISA, so a couple can put £40,000 out of the reach of the taxman. And don’t forget your children or grandchildren. Parents and guardians can invest up to £9,000 in a Junior ISA.

To find out more or discuss your requirements, please contact us.

"*" indicates required fields

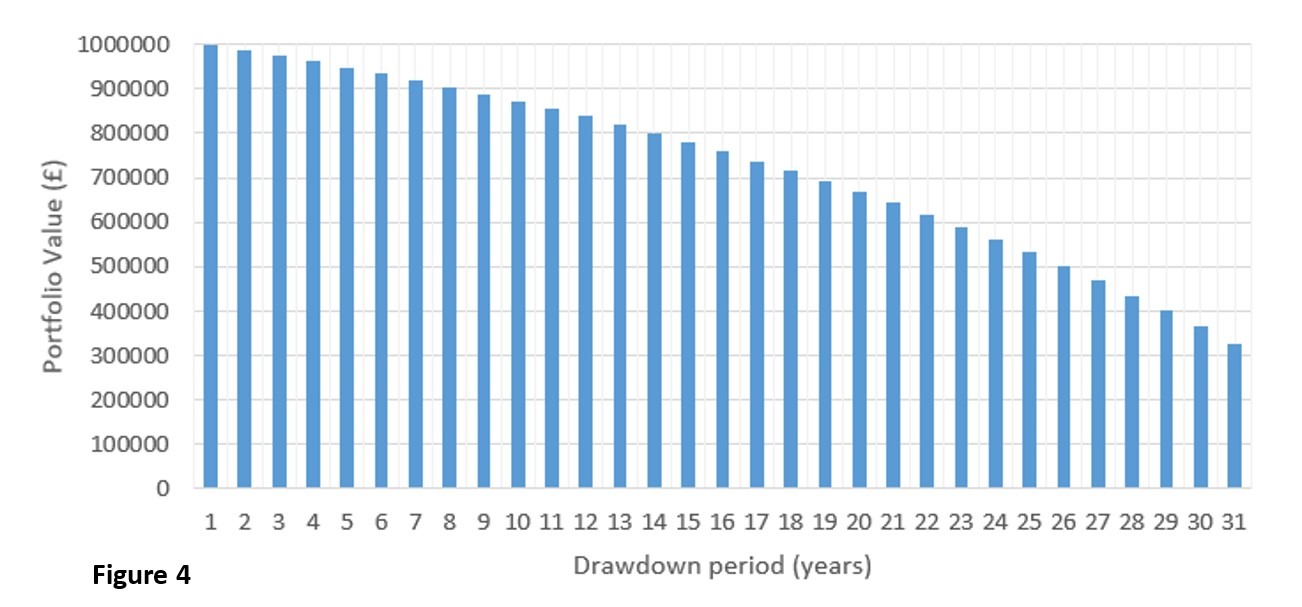

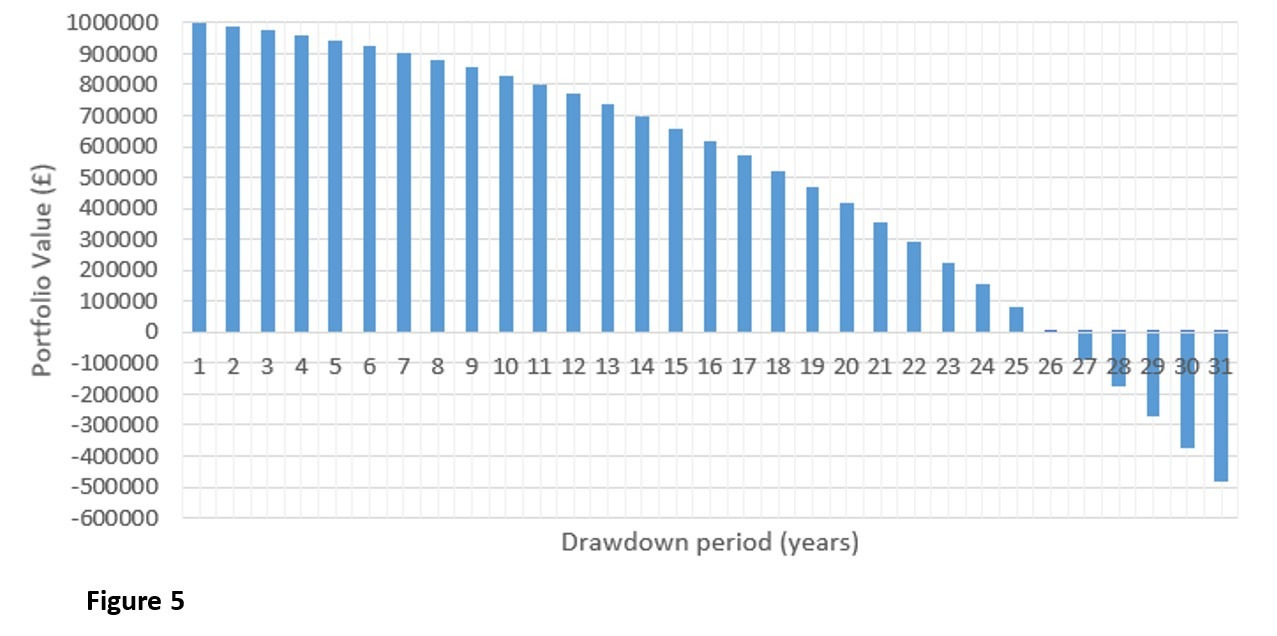

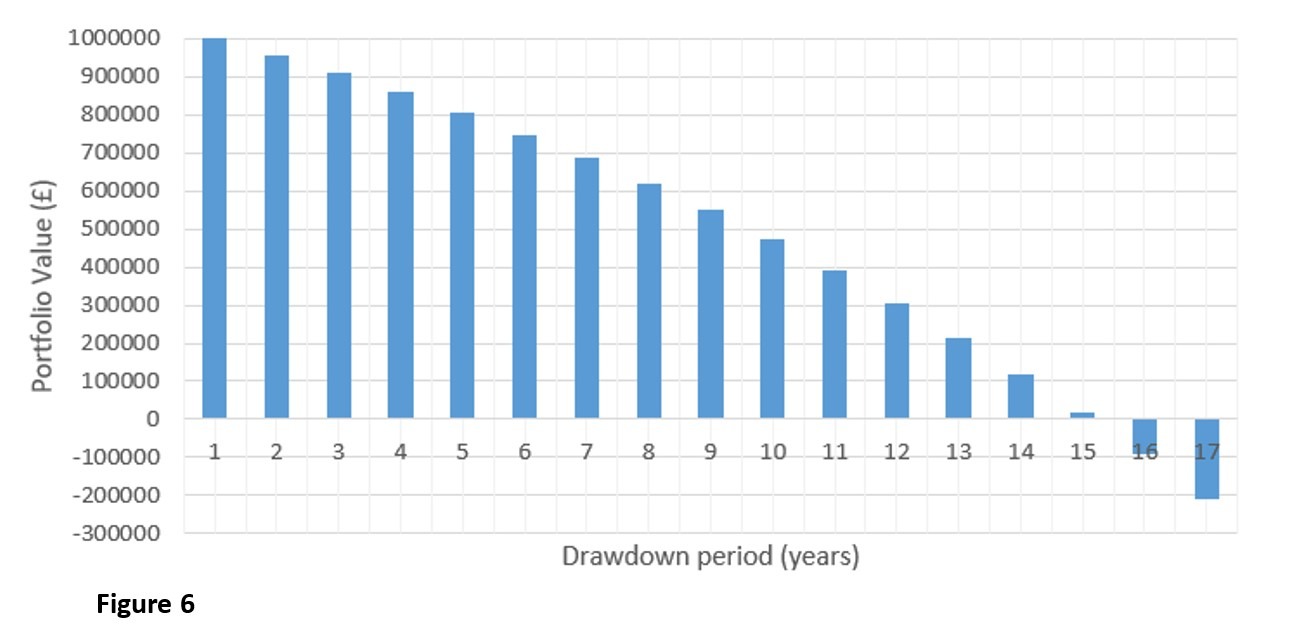

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.