Free Guide: The Principles of Growing your Money

https://www.ellisbates.com/wp-content/uploads/2024/09/Ebookbrochure-socials-5-1024x535.png 1024 535 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gInvesting to beat inflation and market fluctuations to build a nest egg for the future

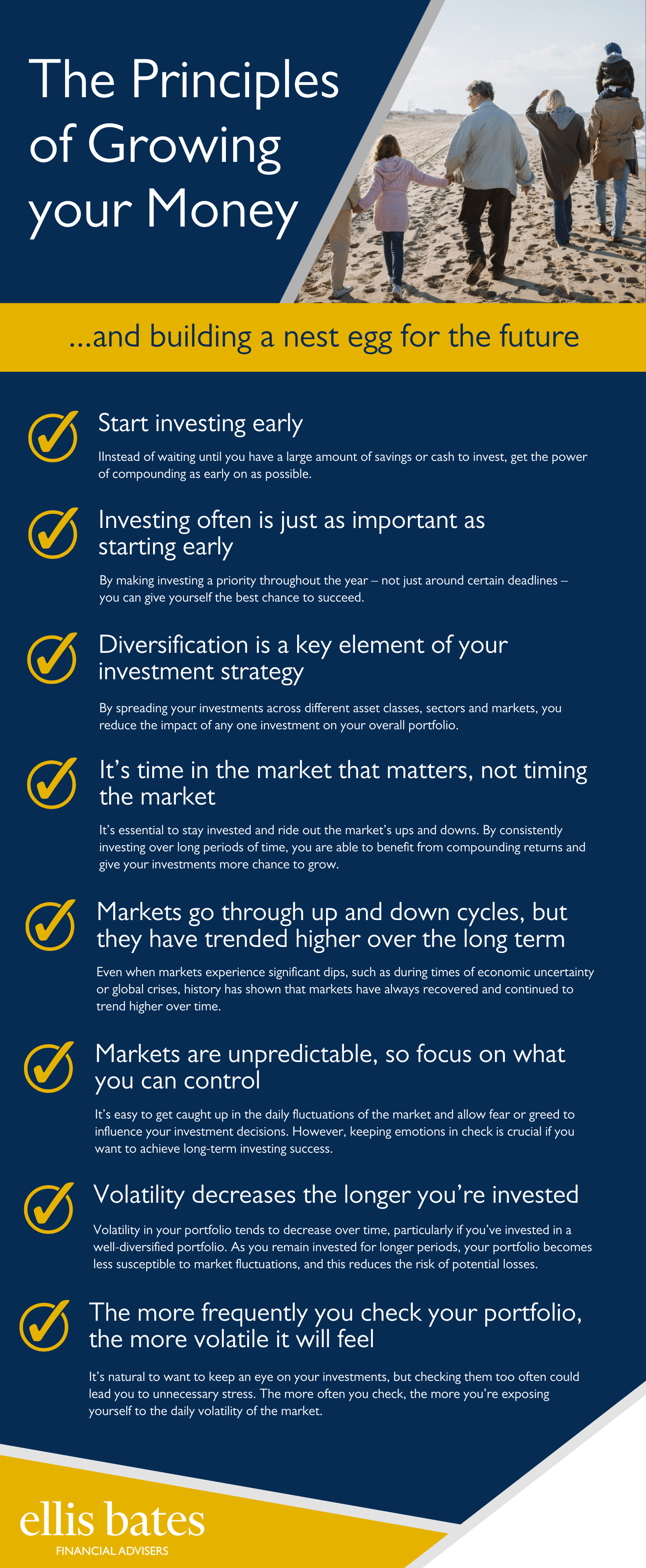

Investing can be an intimidating and complex topic, but it doesn’t have to be with professional financial advice.

Understanding the basic truths of investing will help you make better decisions, regardless of how much money you may or may not have.

By understanding these principles, you’ll be one step closer to achieving your long-term goals.

If you would like to know more about investing to beat inflation, please download your free guide below:

"*" indicates required fields

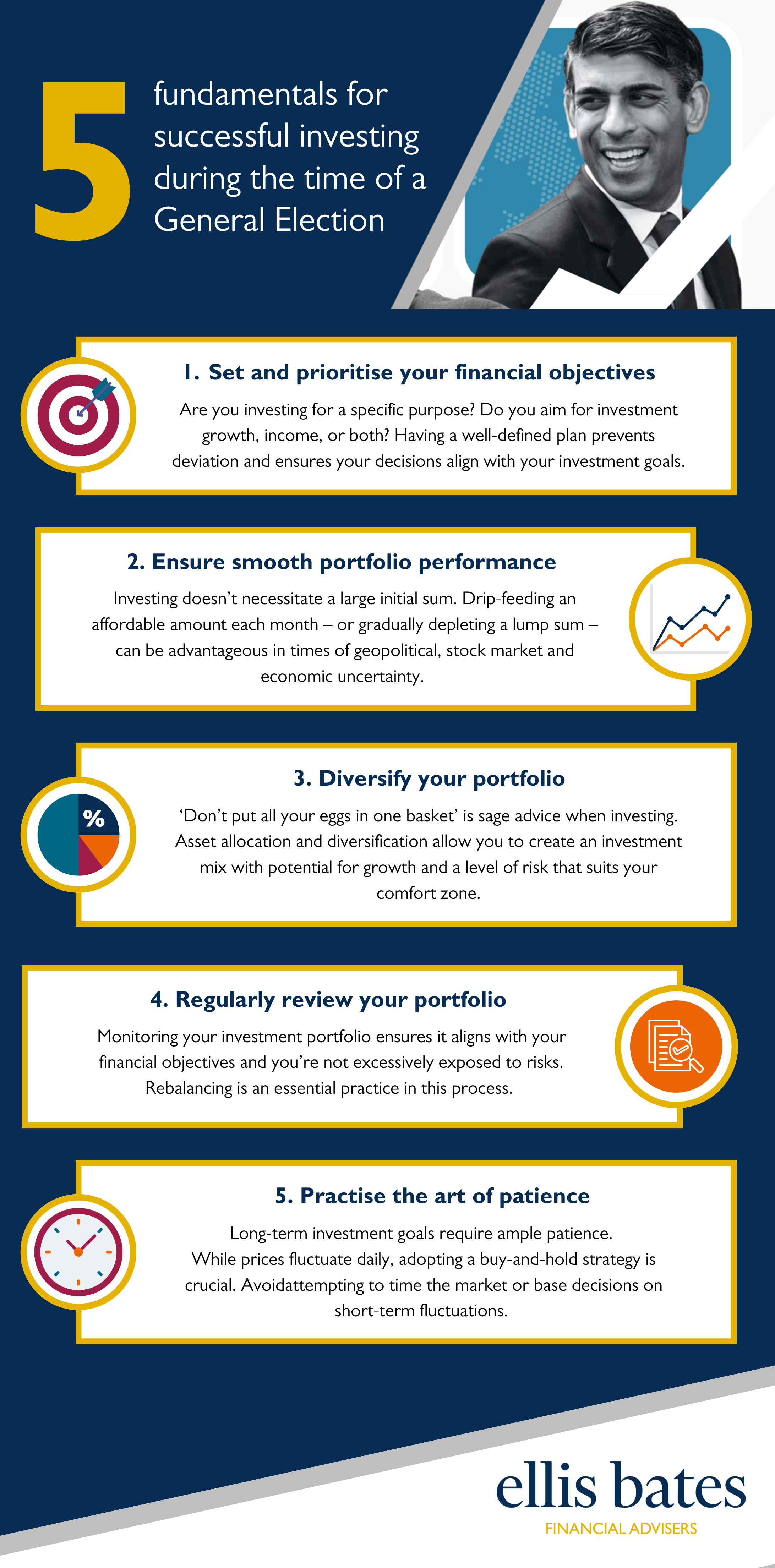

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.

Research shows that many individuals have not saved sufficiently for their retirement, so they are becoming increasingly reliant on stock market returns to maintain their lifestyle after they finish working. However, volatility in the markets post-COVID has raised concern over expectations of market returns in the years ahead. This leaves investors vulnerable to market shocks.