What is an Equity?

An equity is a share of ownership in a company. An investor who owns the shares (a shareholder) is therefore a part-owner of the company, and confers upon them a number of rights, depending on the type of share they own.

Ordinary shares are the most common form of shares issued by companies. Among other rights, shareholders have the right to share in the company’s profits in the form of a dividend. If the company makes larger-than-expected profits, ordinary shareholders can participate in a higher dividend.

Preference shares are the second most common form of shares. One characteristic is that they pay a fixed rate of dividend. While preference shareholders do not participate in higher dividends like ordinary shareholders can, preference shares are often seen as a less risky form of investment than ordinary shares.

Dividends on equities are not guaranteed, though, and can be cut, suspended or cancelled entirely.

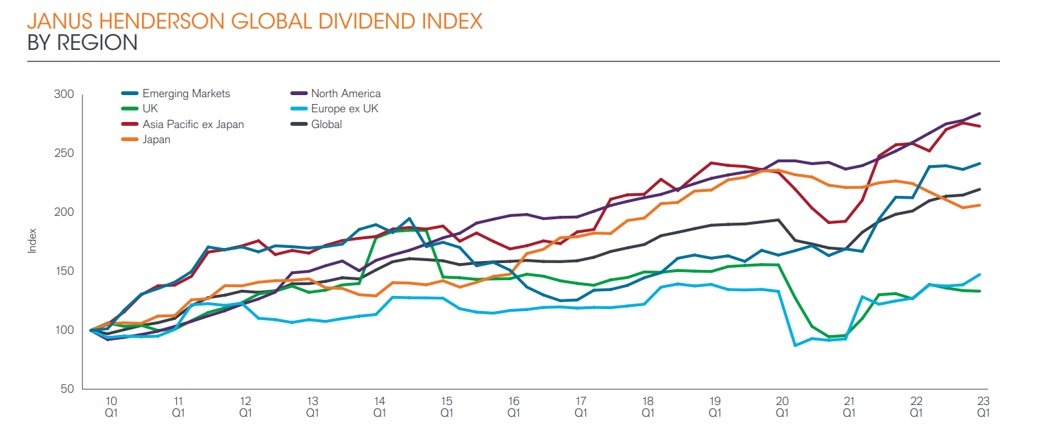

Figure 1 shows that the trend in global dividends by geographic region, as measured by the Janus Henderson Global Dividend Index (a long-term study of global dividend trends), and whether companies on the whole are paying out a rising or falling amount to shareholders over time.

Janus Henderson Global Dividend Index (by geographic region)

Figure 1: Janus Henderson Global Dividend Index (by geographic region). Source: Janus Henderson. Used with permission.

Dividends are generated when companies pay out a proportion of their profits to shareholders as cash, and this generally rises over time as cash flows improve and profitability increases. Hence, profitability is one internal factor (i.e. a factor that is specific to a company) that influences dividend policy.

However, as well as internal factors, company dividend policies are also influenced by external ones that are outside of a company’s control, such as the general state of the economy. One example is the COVID-19 (coronavirus) pandemic, during which time many businesses closed and consumers were unable to go out and spend. Janus Henderson estimates that the pandemic caused global dividend cuts of $220 billion in 2020, as companies sought to shore up their balance sheets to weather the financial impacts of the crisis (or, in the case of banks, required to do so by their respective regulators). The extent of these cuts is represented by the falling line in Figure 1.

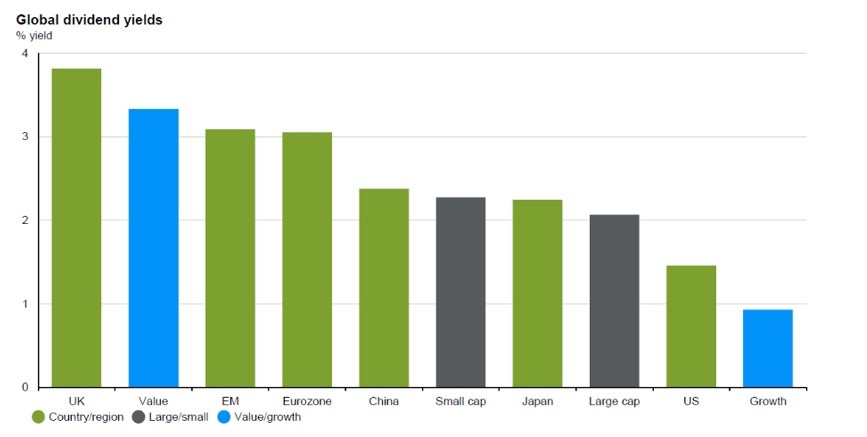

The UK and Europe were the most severely affected regions, and Australia in the Asia Pacific ex Japan region. Traditionally, Income portfolios have a natural bias towards the UK and Europe on the basis that these developed areas of the market have provided high and attractive dividend yields historically (Figure 2).

Global Dividend Yields

Figure 2: Global Dividend Yields. Source: JP Morgan; data as at 31 July 2023. Used with permission.

In contrast, Japan and North America were very resilient in 2020 (as shown by the orange and purple lines in Figure 1).

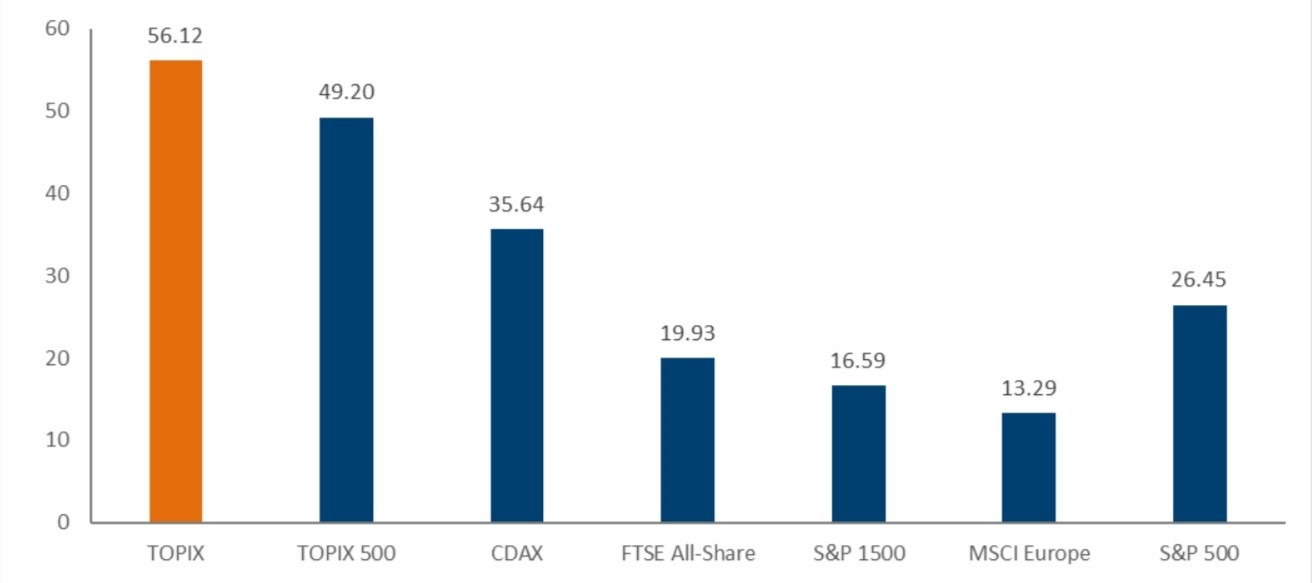

Japanese companies are known to have high levels of cash and low levels of debt on their balance sheets, which helped to support dividend distributions during the pandemic. Corporate governance reforms in Japan (as well as Asia more broadly) have led to noticeable improvements in shareholder-friendly practices over the years, such as dividend pay-outs. Further, companies in Japan are more effectively using their capital to generate profits and, subsequently, returns to shareholders (Figure 3).

% of Companies with Net Cash

Figure 3: % of Companies with Net Cash. Source: Trustnet; data as at 31 May 2022. Used with permission.

In the US, share buybacks are a common practice as they can be more tax-efficient for companies than paying a dividend. This involves a company buying back its own shares from investors and subsequently cancelling the repurchased stock; as there are fewer shares in circulation, shareholders’ stake in the company (and the amount they are due from future dividends) increases. US companies typically spend billions of dollars a year in share buybacks.

On the whole, dividends have been reinstated since the COVID falls, as shown by the general upwards-moving line since 2020. From a geographic perspective, according to Figure 2, UK and European companies continue to offer attractive dividend yields. As with any portfolio, though, diversification is a key strategy as this helps to build resilience in an unpredictable global environment.

Find out more on how our expert in-house Investment team work hand in hand with your Financial Advisor.