Put simply, an individual’s life can be split into two phases: the accumulation phase, and the decumulation phase.

| Accumulation Phase | Decumulation Phase |

| Most retirement planning advice focuses on the accumulation phase – that is, how large a pension pot will need to be; and, to achieve that size of pot, how much you will need to regularly save and in which assets you must invest those savings. | During this phase, you start to rely on their savings to finance all or part of their living costs. Within this, there are two main objectives:

Ensure you enjoy the best quality of life possible. Ensure you do not outlive your savings! |

There are many uncertainties that can complicate your and your Adviser’s decisions when planning a long-term investment strategy.

- Longevity Risk – you live longer than anticipated, so you could run out of money.

- Inflation Risk – your money does not stretch as far as it used to.

- Market Volatility – the value of your investments and the income generated by them can fall as well as rise, meaning you have less in your pension fund when you retire.

- Withdrawal Strategy / Pound Cost Averaging – if withdrawals are made when markets are falling or low, more of the assets need to be sold to cover the withdrawal. This impacts the ability of the remaining portfolio to generate returns for the future.

- Healthcare Costs – as people age, they are more likely to need healthcare, which can be costly.

- Government Policy – changes in government policy can affect the spending power of your savings, the attractiveness of pension products, among other things.

- Personal Circumstances – risks specific to your individual circumstances.

Many individuals will retire with a number of different assets and savings vehicles such as a pension, ISA, cash accounts and property. Each type is subject to different risk/return profiles, as well as different tax treatments with regard to income, capital gains and inheritance tax.

While some people may find that the income provided by external sources is sufficient to cover their day-to-day expenditure in retirement, others may want or need to draw on their EB portfolio – some may draw down the capital, while others may rely solely upon the income generated by the investments (the ‘natural income’) and seek to leave the capital intact.

Whichever approach is taken, a strategy that is suitable for you today may not be suitable in the years to come, due to factors such as inflation.

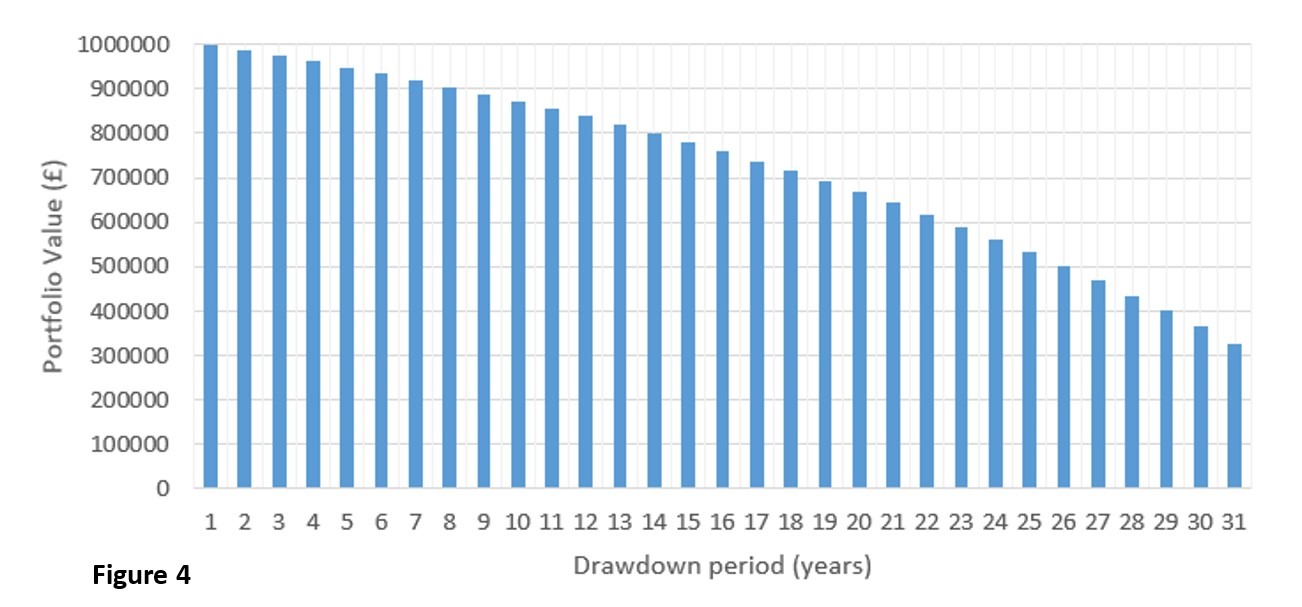

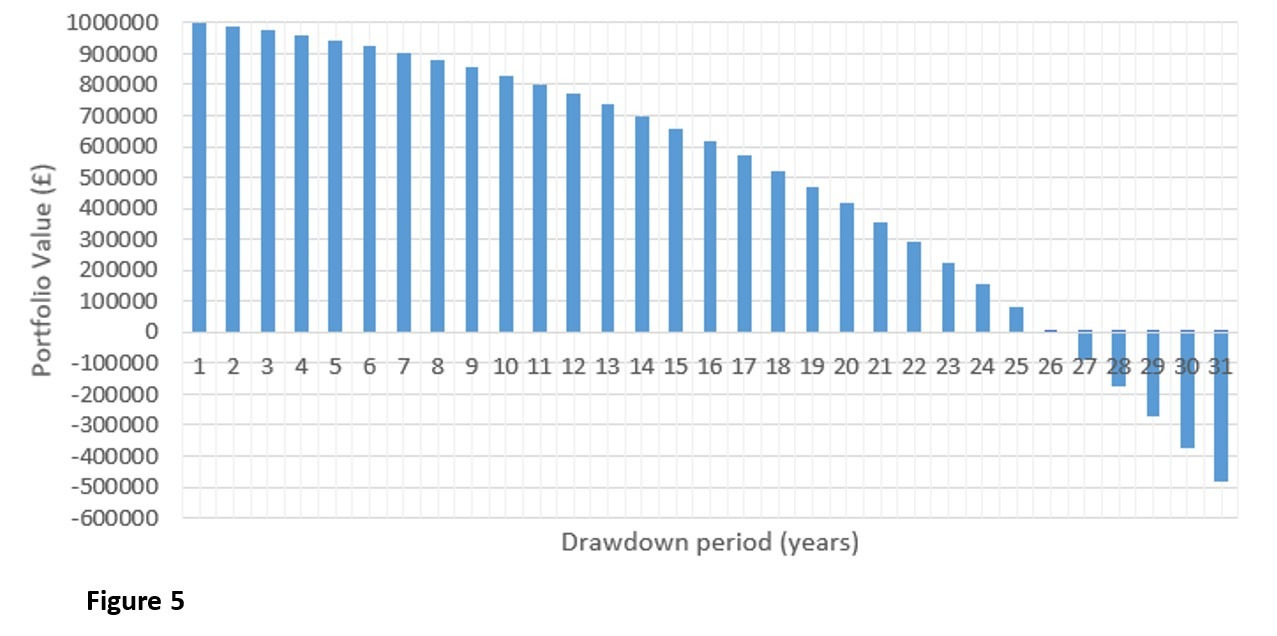

This is demonstrated in Figure 4 and Figure 5. These charts assume:

- an initial portfolio value of £1 million

- a withdrawal of 5% of the original invested amount (i.e. £50,000) a year

- the amount withdrawn increases by inflation each year (0% in Figure 4, and 2% in Figure 5), and

- the balance remaining invested in stock/bond markets to generate capital growth and income (i.e. a total return), growing at a steady rate of 4% a year.

No Inflation: How long will a client’s portfolio last?

Withdrawing 5%, inflation 0%, investment growth 4%

2% Inflation: How long will a client’s portfolio last?

Withdrawing 5%, inflation 2%, investment growth 4%

Sustainable Withdrawal Rates

A general rule of thumb is you can withdraw up to 4% a year if you do not wish to run out of money during your lifetime. This is based on average life expectancy, and accounts for 25 years of returns even without any growth in markets – in reality, the long-term average for portfolios is greater than this, and we would expect above-zero returns in most years over the long term.

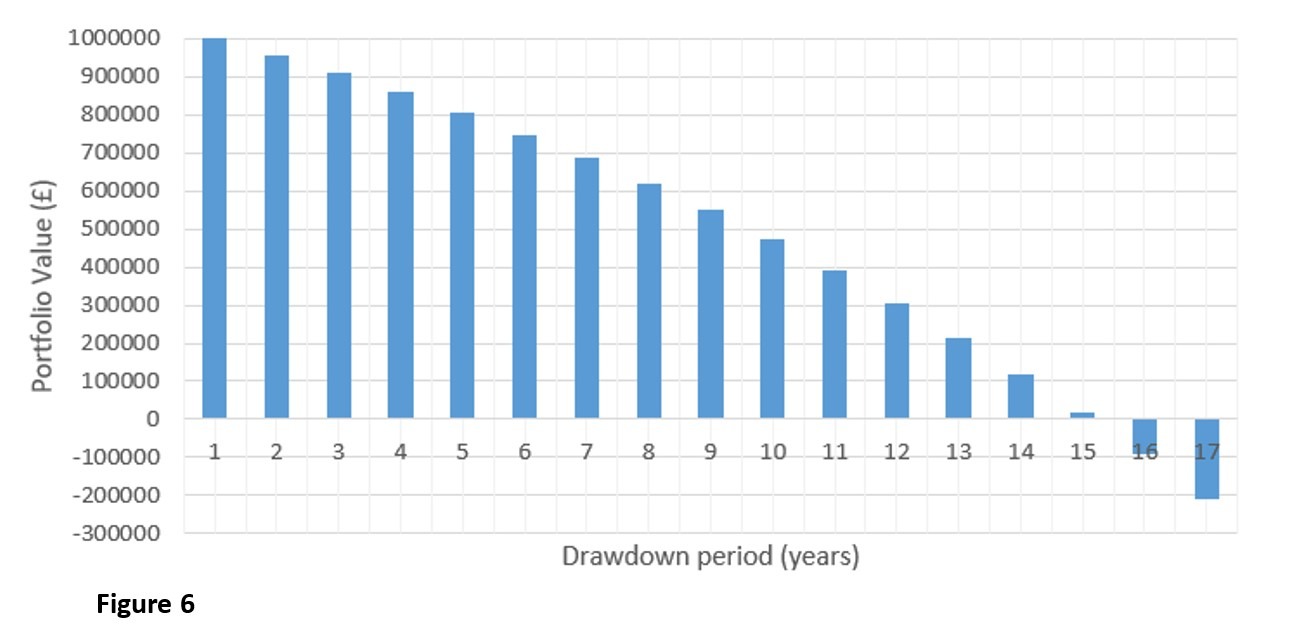

That said, there may be circumstances when someone can withdraw more each year (say, 8% – for example, they have a short life expectancy, as shown in Figure 6) or less (say, 2% – for example, they wish to keep the capital value of their remaining portfolio intact).

Increased Withdrawal Rate: How long will a client’s portfolio last?

Withdrawing 8%, inflation 2%, investment growth 4%

Find out more

Whatever your investment experience, our teams are here to help and support you on your investment and retirement journey. Find out more about investing with Ellis Bates Financial Advisers, or alternatively please get in touch by filling out the form below.

How can we help you?

"*" indicates required fields