Financial advice when planning retirement

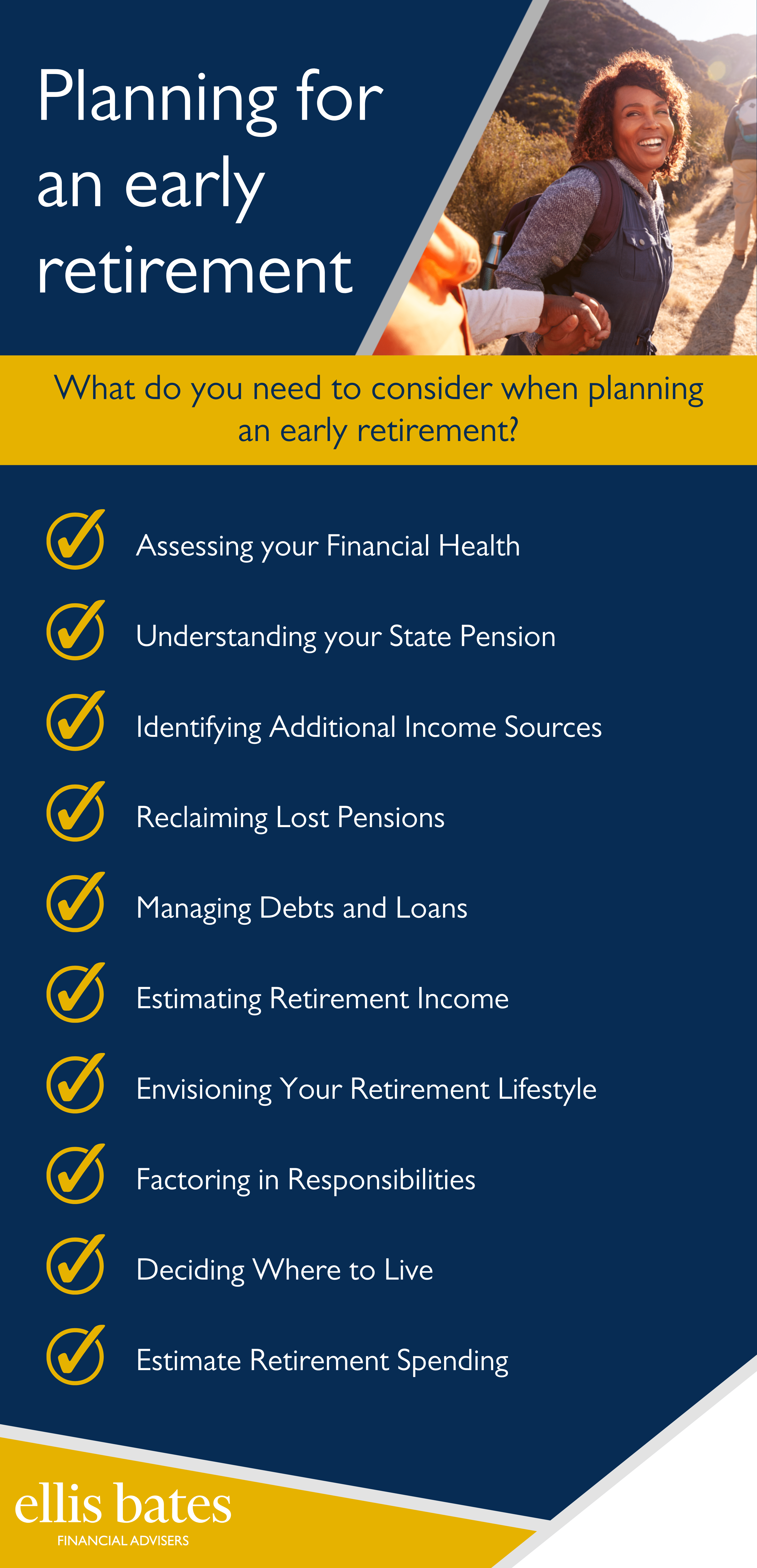

https://www.ellisbates.com/wp-content/uploads/2024/04/Screenshot-2024-04-09-134614-1024x573.png 1024 573 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gPeople who are confident about their retirement are most likely to have specific retirement goals and know what steps they need to take to reach them. But sadly, we see many people do not feel confident that they will have enough savings to live comfortably after they retire.

Many people have a fear of outliving their money, but most don’t have a clear idea of how much money they need during retirement. It’s important to remember that retirement doesn’t happen at a certain age, it happens when you have enough money to live on.

Seeking professional financial advice can help create a clear direction and understanding which will give you peace of mind that you are on the right track.

If you’d like to discuss your retirement, and would like to speak to an expert Financial Adviser, please get in touch:

"*" indicates required fields

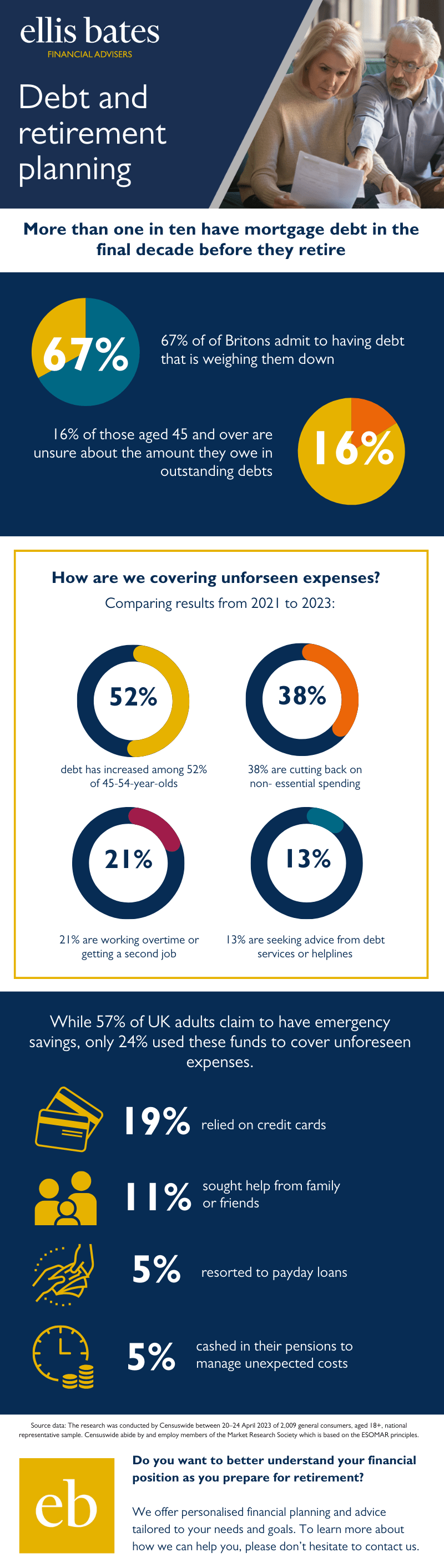

Time to kickstart your retirement plans?

Time to kickstart your retirement plans?

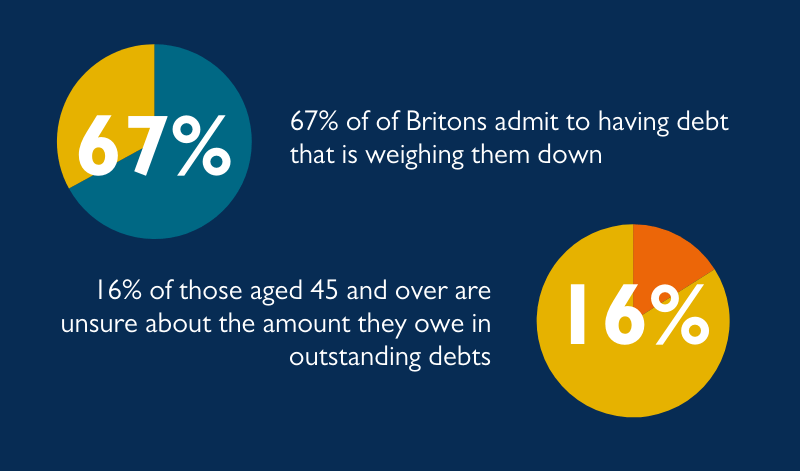

More than one in ten have mortgage debt in the final decade before they retire

More than one in ten have mortgage debt in the final decade before they retire