Early Retirement

https://www.ellisbates.com/wp-content/themes/osmosis/images/empty/thumbnail.jpg 150 150 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gRegional Manager and Financial Planner, Dax Bayley, shares how he enhanced someone’s life by using cashflow modelling to help them to retire earlier than they had planned.

Planning your future has arguably never been more important.

Planning your future has arguably never been more important.

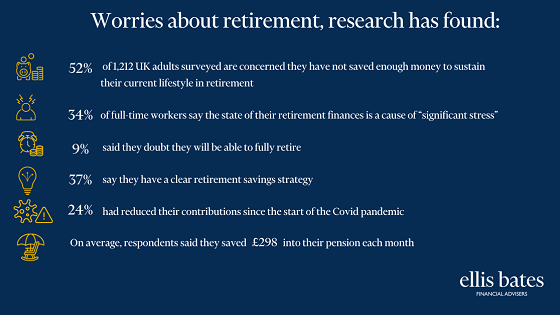

Are you scared of running out of money in retirement?

Are you scared of running out of money in retirement?

What you need to consider at every life stage during your retirement planning journey.

What you need to consider at every life stage during your retirement planning journey.

Creating a comfortable, secure retirement takes care and forethought. If you’re 10 to 15 years from retirement, you’re probably starting to think more about how you’ll spend your life after work. You might be contemplating travelling more, dedicating more time to your passions or enjoying more free time with your family.

Creating a comfortable, secure retirement takes care and forethought. If you’re 10 to 15 years from retirement, you’re probably starting to think more about how you’ll spend your life after work. You might be contemplating travelling more, dedicating more time to your passions or enjoying more free time with your family.