Preserving Wealth for Future Generations

https://www.ellisbates.com/wp-content/uploads/2024/02/shutterstock_1130964836-1024x683.jpg 1024 683 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g Start your estate and inheritance planning as early as possible and implement in stages

Start your estate and inheritance planning as early as possible and implement in stages

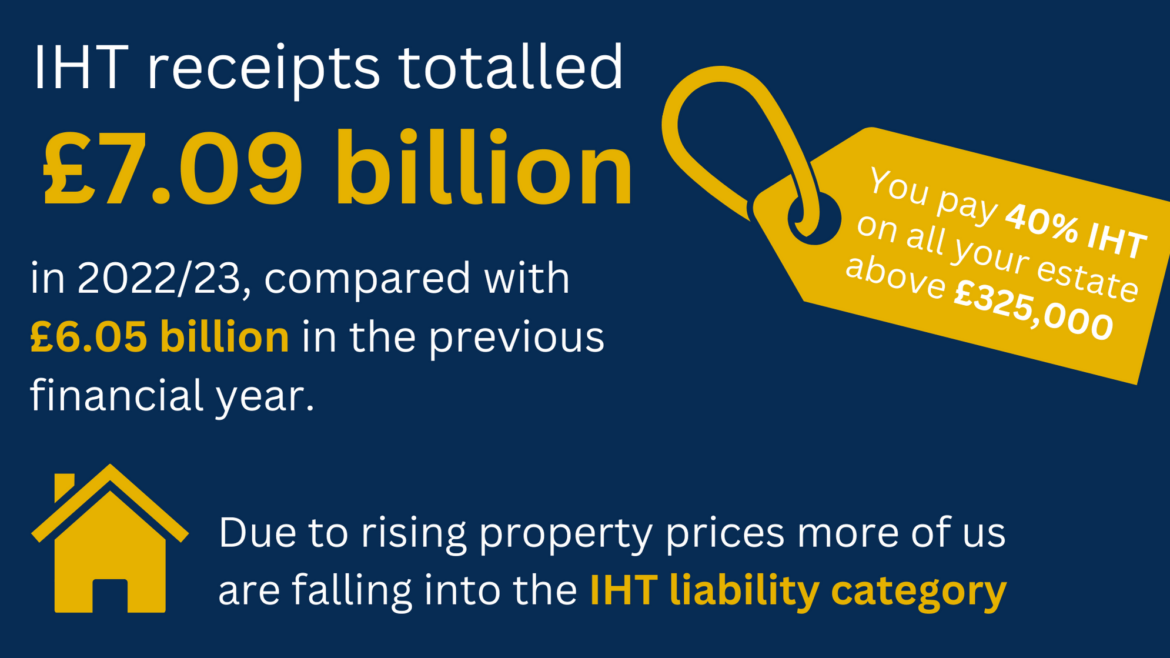

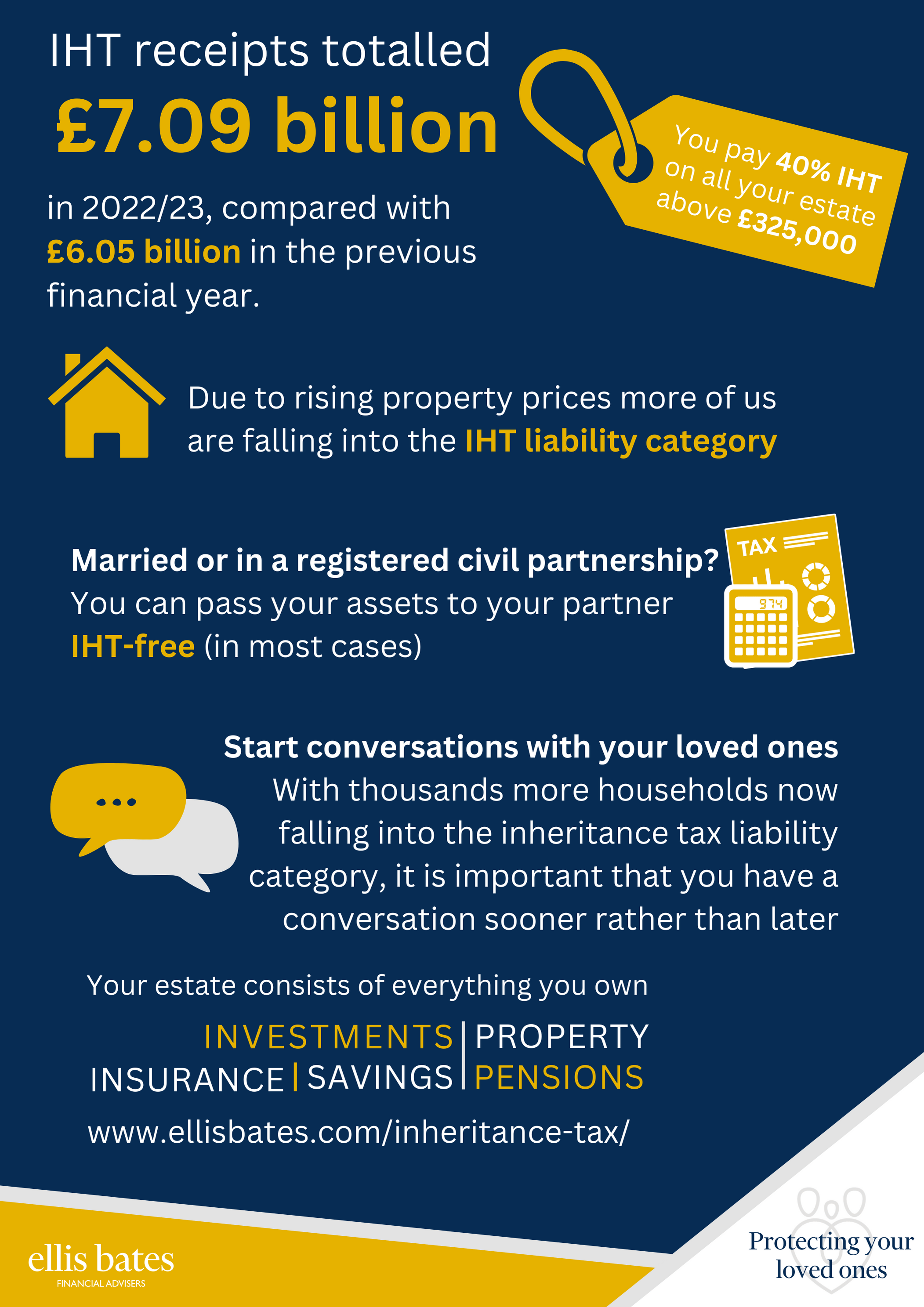

The UK Treasury has been receiving record-breaking Inheritance Tax (IHT) receipts. IHT receipts amounted to approximately £7.09 billion in 2022/23, compared with £6.05 billion in the previous financial year.

For individuals and families who have to pay it, IHT can be emotionally challenging, often requiring the sale of cherished family assets to settle the tax bill. That’s why starting estate planning early and implementing it in stages is essential. Also, having an open conversation about estate planning with family members is very beneficial but depends on family dynamics and wealth levels.

Minimise Tax Liabilities

However, families should take proactive measures to minimise the possibility of facing a substantial IHT bill. By planning ahead and seeking professional advice, individuals can ensure their assets are managed to minimise tax liabilities.

Creating a comprehensive wealth strategy involves considering various factors.

Lifetime Cashflow

We can help you assess your assets and income to ensure we support your desired lifestyle throughout your lifetime. By understanding your cash flow needs, we can assist in structuring investments and creating a sustainable financial plan.

Lifetime Gifting

Gifting can be a valuable tool in wealth planning, allowing you to reduce a potential IHT tax burden. We can guide you on the various gifting allowances and exemptions available, such as the annual gifting allowance, wedding gifts and gifts from normal expenditure out of income.

Trusts

Most trusts offer flexibility and control over how your assets are distributed. They can also help reduce taxes on inheritance. This excludes Absolute Trusts, where control over assets is discretionary. Working closely with us, you can explore different trust options and understand how they can be incorporated into your wealth planning strategy.

Pensions

Pensions are important in wealth planning, offering tax advantages and the potential for long-term financial security. We can help you navigate the complexities of pensions, including risk assessment, accessing pension funds and maximising tax benefits.

Protection Cover

Protecting your loved ones in the event of death or illness is crucial. We can advise on selecting the right protection products to provide liquidity for IHT and other associated costs.

Business Relief

Incorporating business relief into your wealth planning strategy can be advantageous if you own a business or have qualifying assets. We’ll help you understand the eligibility criteria and how to leverage this relief effectively.

Financial Control and Estate Planning

Creating a Will ensures that your assets are distributed according to your wishes. Additionally, appointing a Lasting Power of Attorney provides someone with financial control over your assets and peace of mind if you cannot manage your affairs.

Estate planning is not a one-size-fts-all approach. Although there is no requirement to address IHT, proactive planning can minimise the tax burden on families. Seeking professional advice and taking steps early can help reduce the risk of leaving loved ones with a larger tax bill than necessary.

Do you want the peace of mind of tax efficiently passing on your wealth to your loved ones?

When you’ve worked hard to build up your wealth, you want the peace of mind to pass this on to your loved ones. There’s much to consider, especially if you have a complex estate. Who should it go to? And when? Is it sensible to pass on wealth during your lifetime? To discuss how we can help, do not hesitate to contact us.

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.