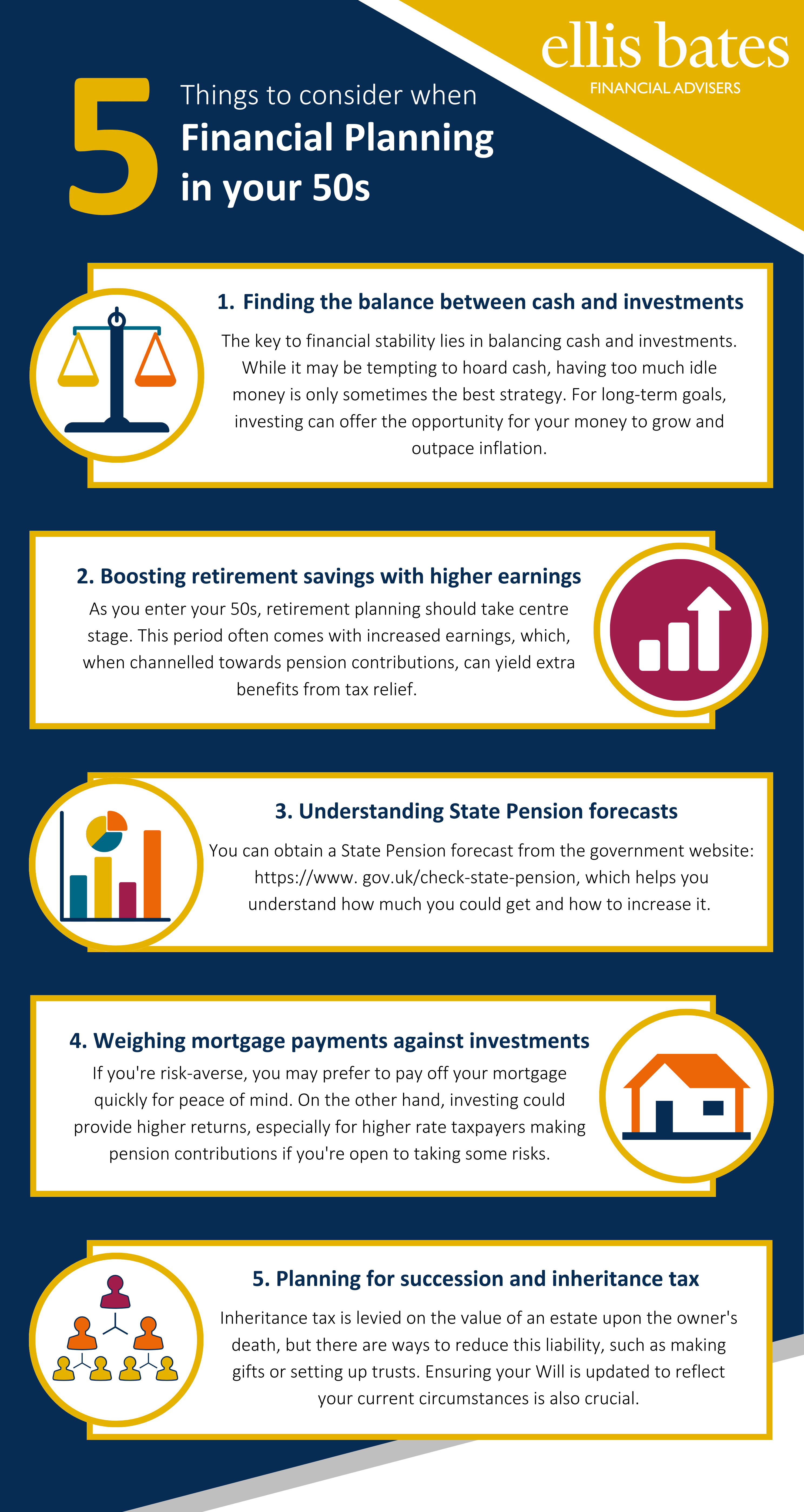

5 things to consider when financial planning

https://www.ellisbates.com/wp-content/uploads/2023/11/Financial-Planning-in-your-50s-1-1024x616.png 1024 616 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

As you sail into your 50s, it becomes pivotal to consider your financial strategy. Life has likely found a steady rhythm by now. Children have probably taken flight, becoming financially self-sufficient, and the idea of reducing work hours or even retiring completely starts to surface.

Each person’s life journey is unique and has different resources and challenges. However, there are shared goals and steps that one can take during this stage. Knowing where to begin can be daunting, whether you aim to maximise your earnings or lay down a robust financial plan.