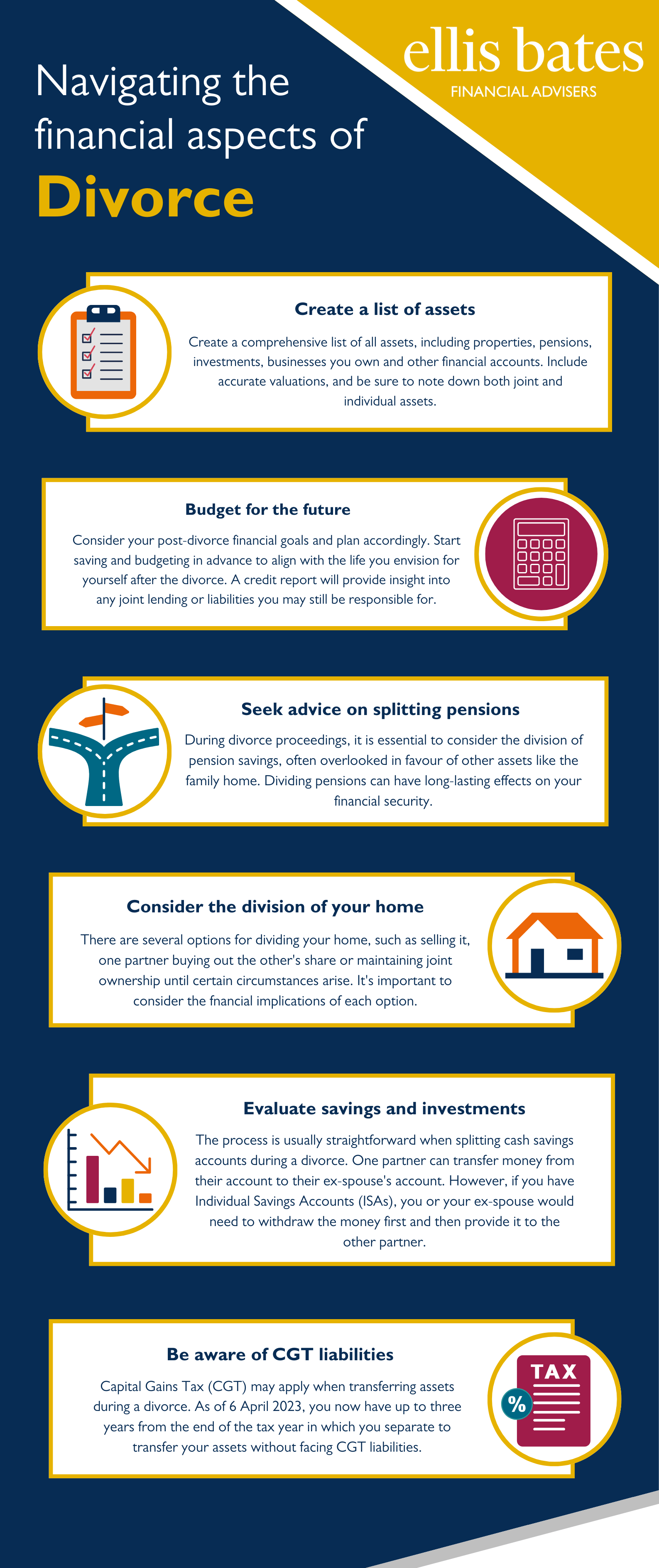

Navigating the Financial Aspects of Divorce

https://www.ellisbates.com/wp-content/uploads/2024/04/1000_F_203084026_sZ0iS7K8z7a6cMRxhBd15va7rYsNuOTc-transformed-transformed-1024x670.jpeg 1024 670 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

We understand the complexities of divorce and finances and are here to help you make informed decisions. If you’d like more information on Pensions and divorce, please download our free guide:

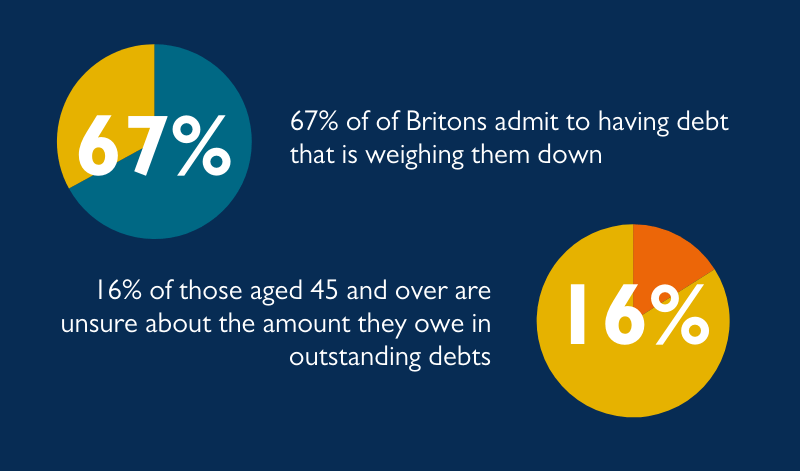

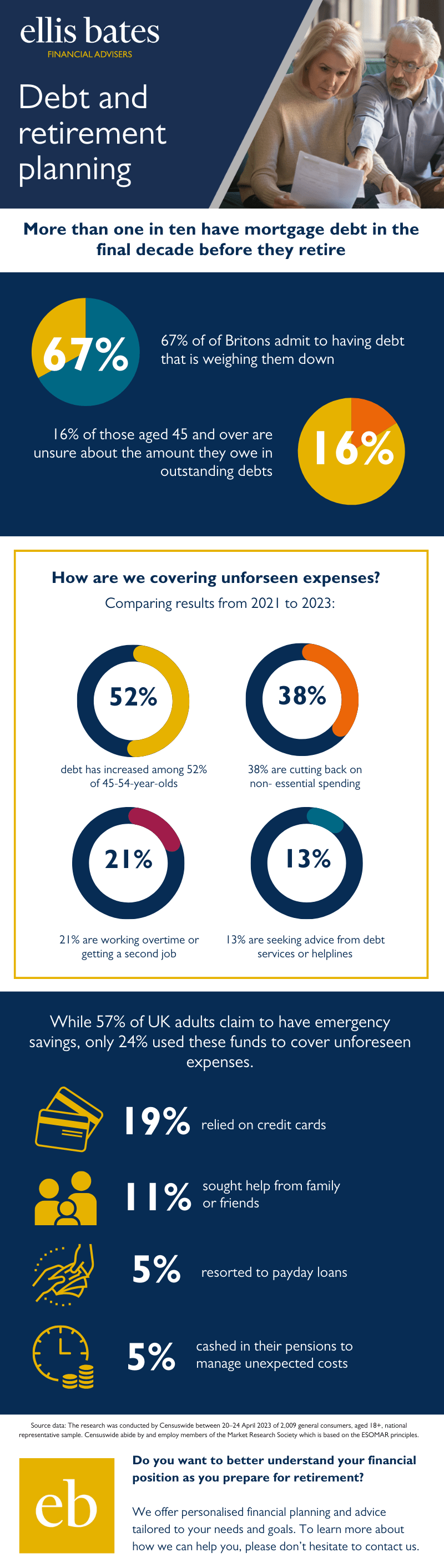

More than one in ten have mortgage debt in the final decade before they retire

More than one in ten have mortgage debt in the final decade before they retire