Consumer Duty: Principle 12

https://www.ellisbates.com/wp-content/uploads/2023/08/Consumer-Duty-diagram-holder.png 561 316 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

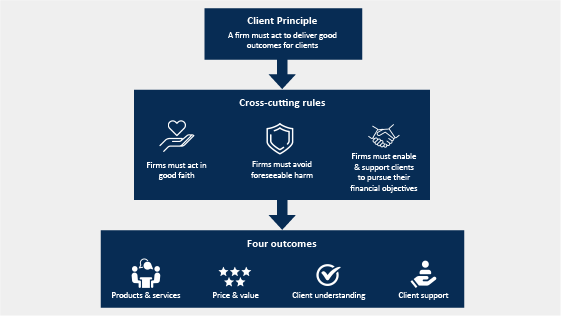

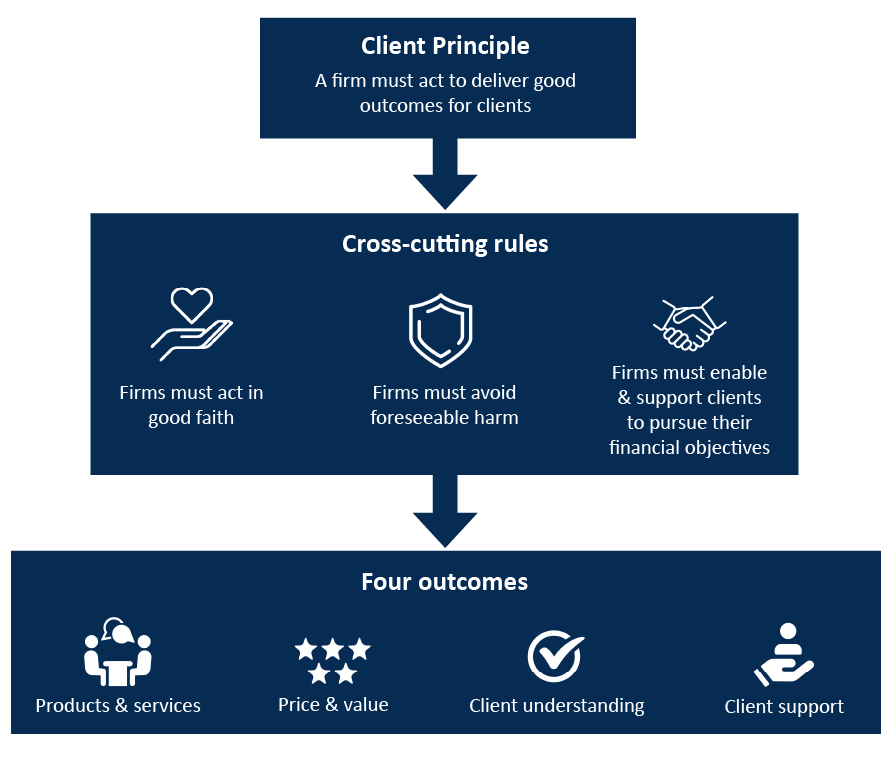

The Consumer Duty legislation has been put in place to focus on ensuring fair value, providing products and services designed to meet client needs, delivering high levels of client service and improving consumer confidence and client understanding.

Client Principle

- A firm must act to deliver good outcomes for clients

Cross-cutting rules

- Firms must act in good faith

- Firms must avoid foreseeable harm

- Firms must enable and support clients to pursue their financial objectives

Four outcomes

- Products and services

- Price and value

- Client understanding

- Client support

For more information on the legislative backdrop to the new regulations, watch our consumer duty video by Director of Financial Planning, Ben Clapham.