Pension Drawdown

https://www.ellisbates.com/wp-content/uploads/2022/08/How-much-drawdown-should-I-take-from-my-pension-holder.png 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

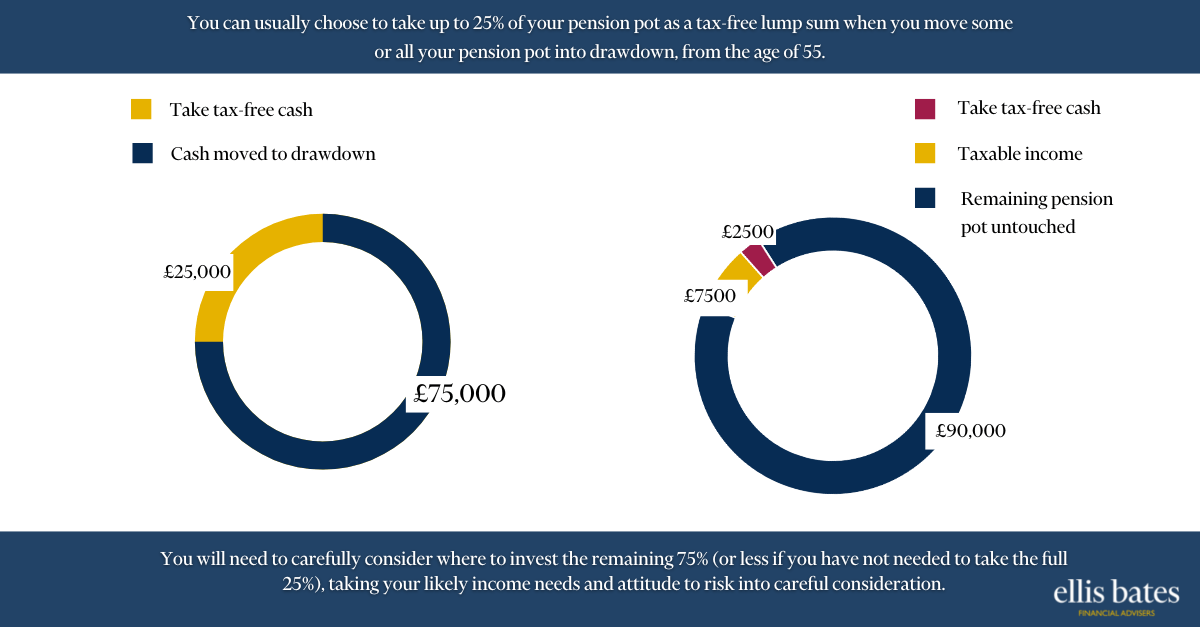

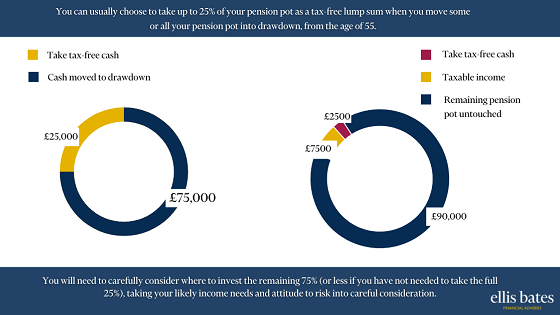

You can usually choose to take up to 25% of your pension pot as a tax-free lump sum when you move some or all your pension pot into drawdown, from the age of 55.

You will need to carefully consider where to invest the remaining 75% (or less if you have not needed to take the full 25%), taking your likely income needs and attitude to risk into careful consideration.

Women are being urged to think about their long term savings

Women are being urged to think about their long term savings

Are you scared of running out of money in retirement?

Are you scared of running out of money in retirement?

Pension Awareness Day

Pension Awareness Day

What you need to consider at every life stage during your retirement planning journey.

What you need to consider at every life stage during your retirement planning journey.

Pension Freedoms – Looking for a wider choice of investment options?

Pension Freedoms – Looking for a wider choice of investment options?

Answers to the myths about your pension questions. If you are approaching retirement age, it’s important to know your pension is going to finance your plans.

Answers to the myths about your pension questions. If you are approaching retirement age, it’s important to know your pension is going to finance your plans.