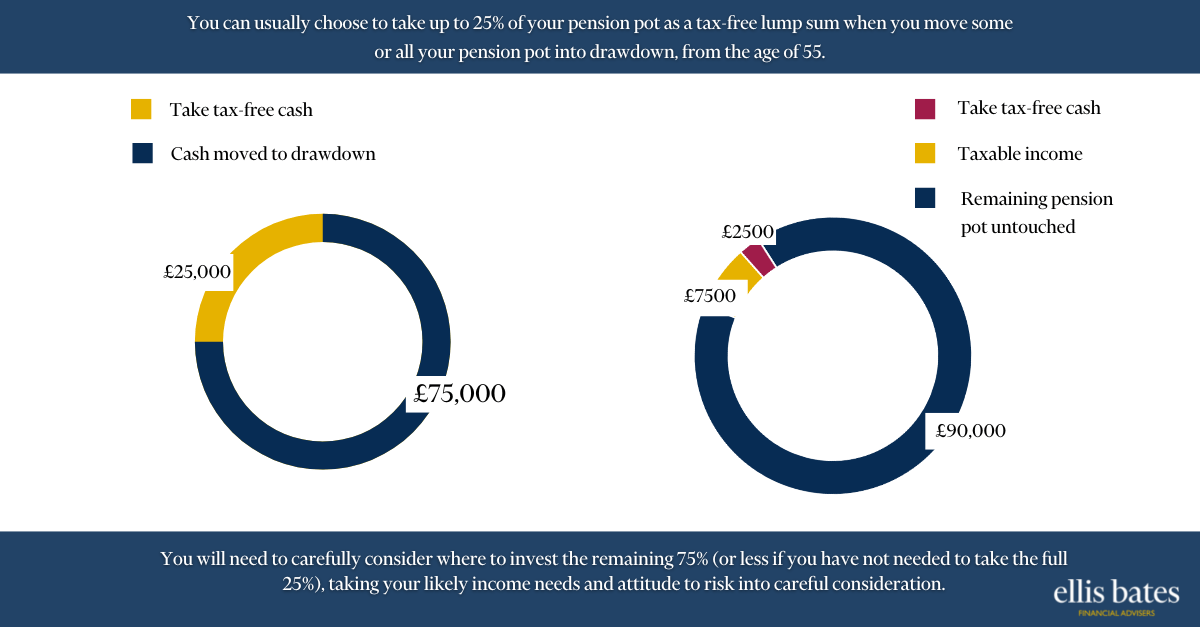

You can usually choose to take up to 25% of your pension pot as a tax-free lump sum when you move some or all your pension pot into drawdown, from the age of 55.

You will need to carefully consider where to invest the remaining 75% (or less if you have not needed to take the full 25%), taking your likely income needs and attitude to risk into careful consideration.