Money and Divorce

https://www.ellisbates.com/wp-content/uploads/2024/04/GettyImages-1355459739-1024x731.jpg 1024 731 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

Untangling your finances and navigating the financial aspects of divorce

Divorce is a complex process that often comes with various financial considerations, and preparing for a divorce is undoubtedly challenging, especially when it involves untangling your finances. The emotional strain can make it difficult to make clear-headed decisions, and the long-term consequences may not be immediately apparent.

It is crucial to carefully consider the financial aspects of divorce to ensure you can sustain the lifestyle you desire post-separation. It’s desirable to seek legal and financial advice from professionals specialising in divorce cases. Our team is here to assist you in navigating the financial aspects of divorce.

Here are some financial considerations:

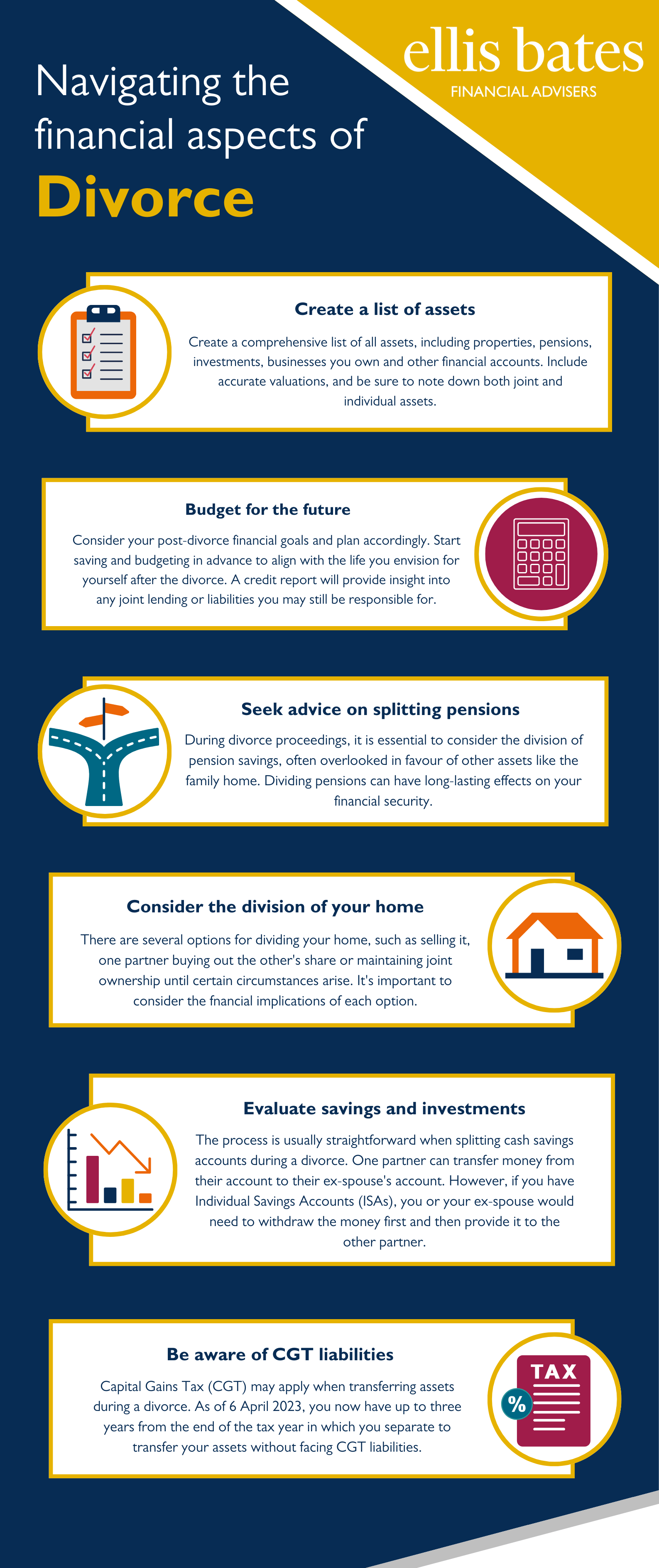

Create a list of assets

Create a comprehensive list of all assets, including properties, pensions, investments, businesses you own and other financial accounts. Include accurate valuations, and be sure to note down both joint and individual assets. Additionally, document your income and outgoings, both joint and individual, to clearly understand your financial standing.

This will clarify what needs to be divided and help with accurate valuation.

Budget for the future

Consider your post-divorce financial goals and plan accordingly. Start saving and budgeting in advance to align with the life you envision for yourself after the divorce. Remember that what you desire financially from the divorce may not necessarily align with the outcome. Obtain a copy of your credit report, especially if you anticipate needing a new mortgage or taking on new financial responsibilities. A credit report will provide insight into any joint lending or liabilities you may still be responsible for after the divorce.

Consider the division of your home

There are several options for dividing your home, such as selling it, one partner buying out the other’s share or maintaining joint ownership until certain circumstances arise. It’s important to consider the financial implications of each option. Keeping the home may be challenging, especially if managing mortgage repayments on a single income becomes difficult. Consult a financial professional to assess the financial viability of each option.

Seek advice on splitting pensions

During divorce proceedings, it is essential to consider the division of pension savings, often overlooked in favour of other assets like the family home. Dividing pensions can have long-lasting effects on your financial security.

There are two commonly used methods for dividing pensions during a divorce or separation. Pension sharing involves splitting one or more pensions between the separating partners.

Alternatively, with pension offsetting, the value of the pension rights is balanced against other assets, such as property or savings. This approach allows for a more flexible and customised asset division based on the separating partners’ unique circumstances.

Evaluate savings and investments

The process is usually straightforward when splitting cash savings accounts during a divorce. One partner can transfer money from their account to their ex-spouse’s account. However, if you have Individual Savings Accounts (ISAs), you or your ex-spouse would need to withdraw the money first and then provide it to the other partner. It’s important to note that dividing investments and savings may have tax implications and involve charges. Therefore, seeking professional financial advice is crucial to ensure that the division is done appropriately and is financially beneficial.

Be aware of CGT liabilities

Capital Gains Tax (CGT) may apply when transferring assets during a divorce. As of 6 April 2023, new rules have been implemented that extend the time frame for separating partners to transfer assets without incurring CGT. Under the new rules, you now have up to three years from the end of the tax year in which you separate to make these transfers without facing CGT liabilities.

Do you need professional advice to take the first step towards a secure financial future? We understand the complexities of divorce and finances and are here to help you make informed decisions. Contact us today to discuss your specific needs:

"*" indicates required fields

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

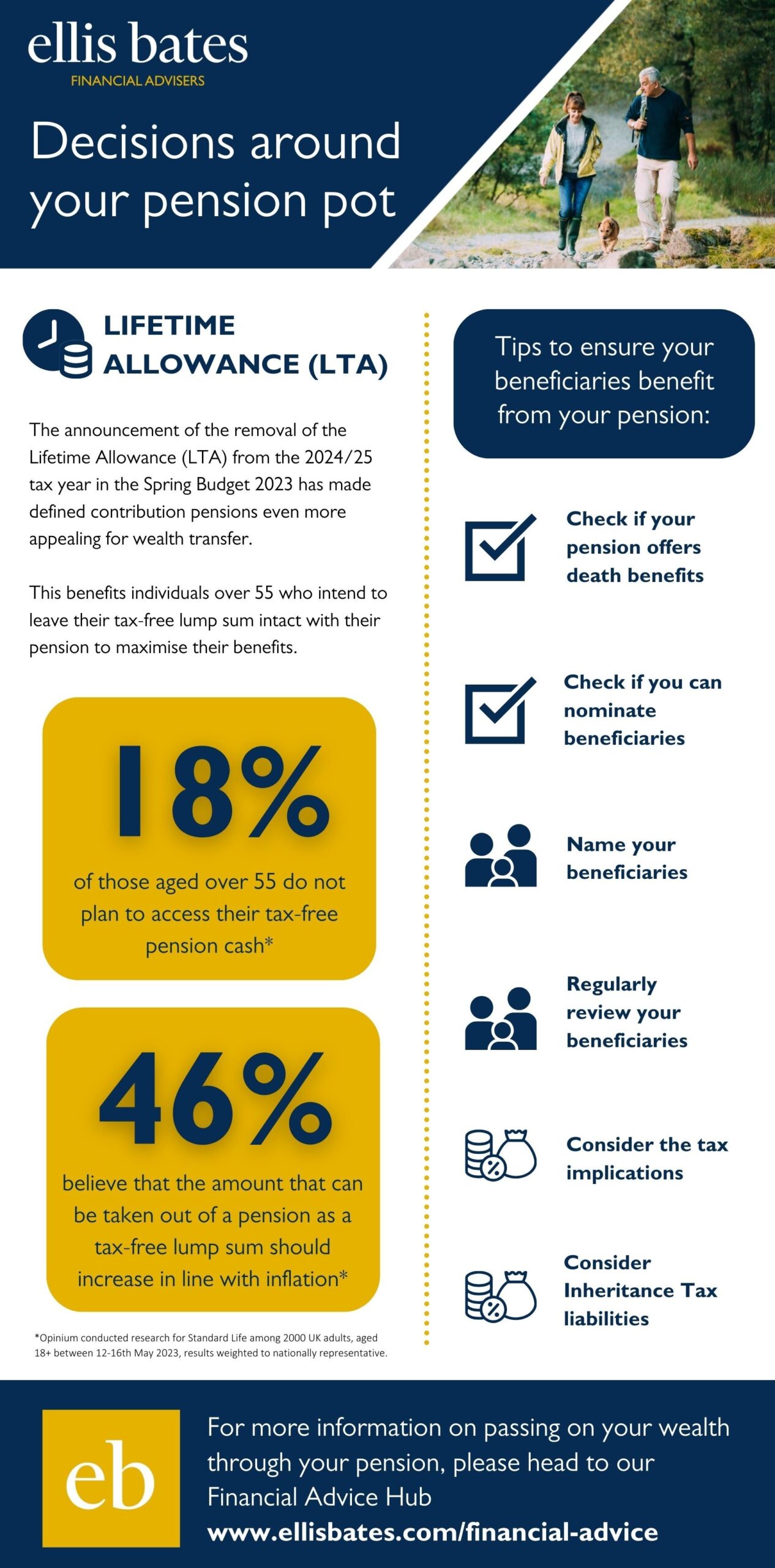

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.