Financial commitments and pension planning

https://www.ellisbates.com/wp-content/uploads/2024/05/GettyImages-1319763433-1024x683.jpg 1024 683 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

A Delicate Balance

Financial commitments and pension planning

The challenge of managing bills and other financial obligations while simultaneously saving for a pension may seem daunting. However, it is certainly achievable with the right planning and timely action. The sooner you start, the more advantageous it could be if you contribute to a defined contribution pension.

This is a type of pension where the amount you receive when you retire depends on how much you put in and how much this money grows. Your pension pot is built from your contributions and employer’s contributions (if applicable), plus investment returns and tax relief.

Here are 6 practical strategies you can consider

Utilising Salary Increases for Pension Contributions

Let’s begin with a straightforward approach if you find contributing as much as you’d like to your pension challenging. Initially, contribute an amount you can comfortably afford. Then, whenever you receive a salary increase, allocate a portion of it directly into your pension. This method ensures that you do not become accustomed to spending the additional income while still benefiting from the pay rise.

Maximising Employer Contributions

Many employers offer to increase their contributions if you decide to increase yours (up to a certain limit). Therefore, by contributing an extra per cent or two of your salary, they might also contribute more. It would be beneficial to inquire about your employer’s pension contribution policy.

Boosting your Pension with Lump Sum Payments

If you encounter a windfall, consider making a lump sum payment into your pension. This is a quick and effortless way to enhance your pension fund. As with regular contributions, the government will top up lump sum payments with tax relief (subject to certain limits).

Delaying Access to Your Pension Pot

Allowing your pension to remain untouched for an extended period can potentially lead to its growth. Leaving your pension invested for a few more years could make a substantial difference if you’ve had your pension for a while. However, it’s crucial to remember that there’s no guarantee of growth as investments can fluctuate.

Being Selective with your Investment Choices

Your investment choices for your pension can significantly influence your returns at retirement. For example, your scheme’s ‘default’ investment option may not be the most suitable for you. Therefore, it’s worth examining the investment funds where your money is placed.

The process of making changes to your pension will vary depending on the type of scheme you have. With many modern schemes, alterations can be made online with just a few clicks. Check your policy information or speak to your employer for further details.

Investing more when regular expenditure ends

A similar strategy can be employed when you’ve completed regular payments. For instance, once a car loan is fully paid off, consider redirecting the freed-up funds into your pension plan. Even modest increases like these can yield significant results over time. Plus, should you need to reduce your outgoings in the future, it’s typically possible to decrease your contributions.

If you’d like to discuss your pensions with a professional Financial Adviser, please get in touch:

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

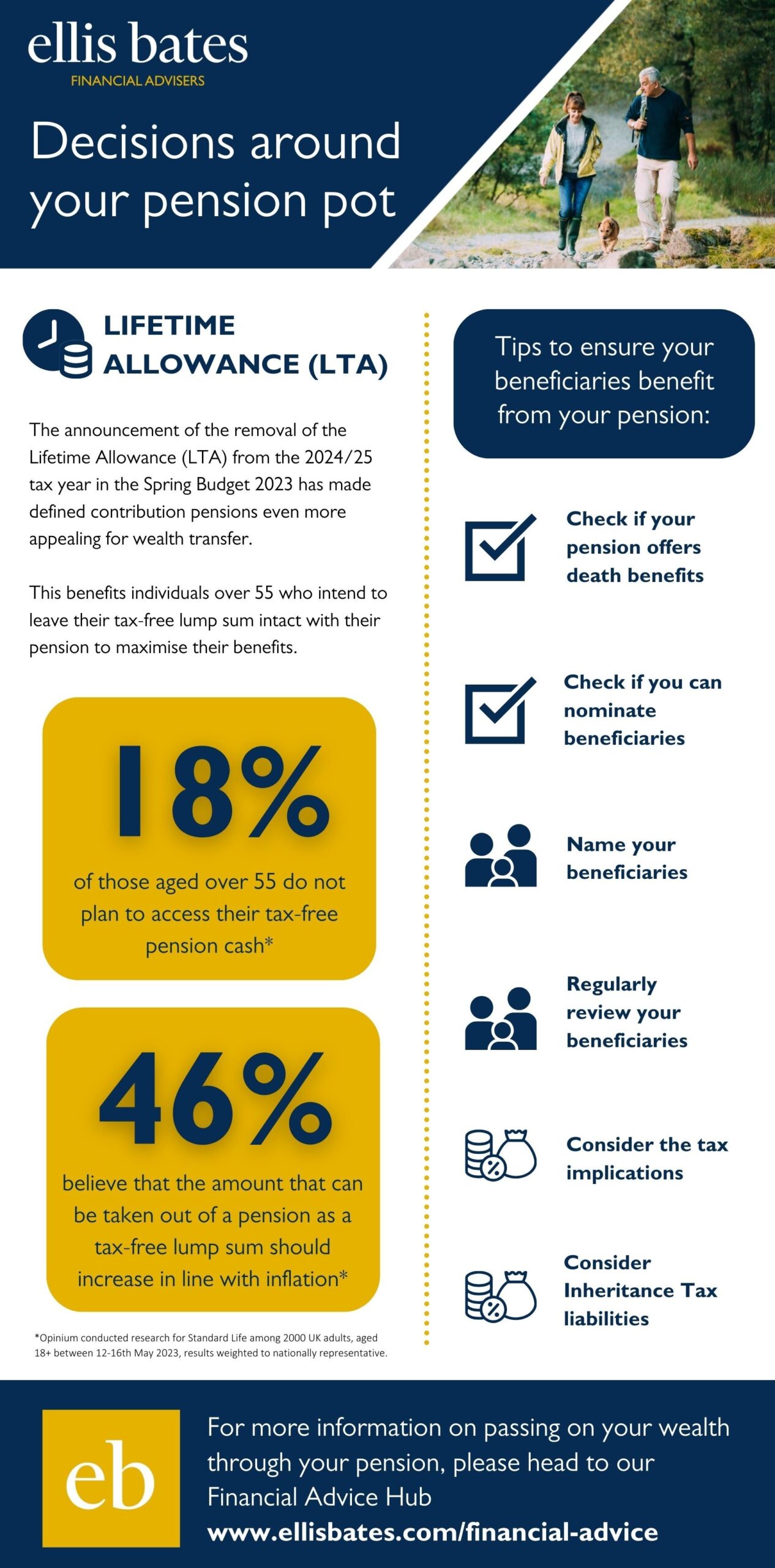

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.