How much tax will you pay on your pension pots?

https://www.ellisbates.com/wp-content/uploads/2024/08/Picture1.jpg 794 427 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g Since 2015, individuals over the age of 55 with defined contribution (DC) pension pots have enjoyed full freedom to decide how to manage their pensions; purchasing an annuity (a guaranteed income for life) is no longer mandatory. More than 221 people fully withdrew a pension pot of £250,000 or more between October 2022 and March 2023[1], resulting in a tax bill of at least £97,500 each[2], according to new analysis of FCA figures.

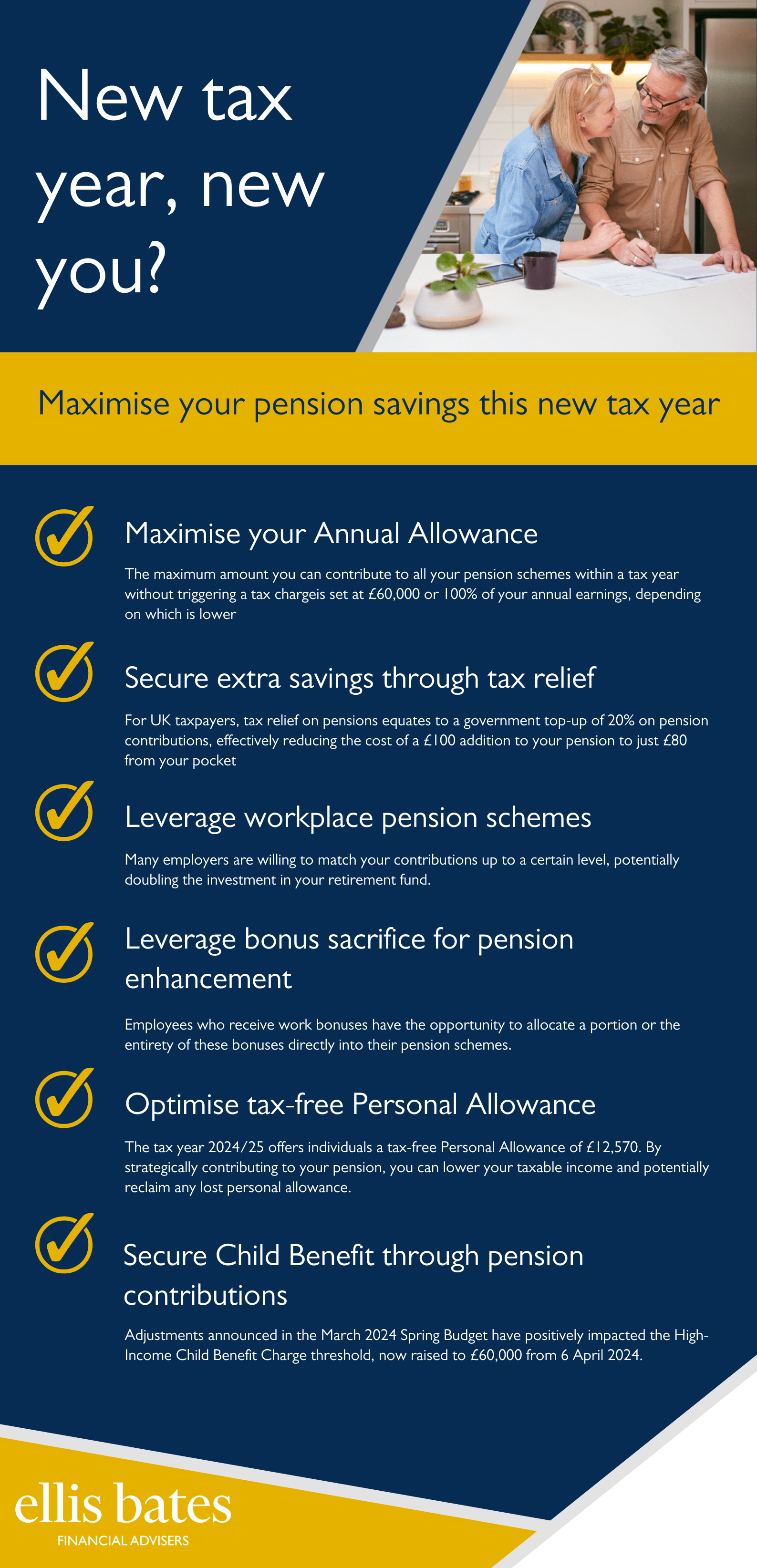

Since 2015, individuals over the age of 55 with defined contribution (DC) pension pots have enjoyed full freedom to decide how to manage their pensions; purchasing an annuity (a guaranteed income for life) is no longer mandatory. More than 221 people fully withdrew a pension pot of £250,000 or more between October 2022 and March 2023[1], resulting in a tax bill of at least £97,500 each[2], according to new analysis of FCA figures.

Following the reduction of the 45p rate of tax from £150,000 to £125,140 from April 2023, a pot of £250,000 withdrawn in the current tax year (2024/25) would lead to a tax bill of at least £ 8,700 each – over £1,000 more. In the same period, October 2022 to March 2023, 1,537 people fully encashed a pot of between £100,000 and £24 ,000, leading to a minimum £27,400 tax bill for each person.

Someone fully withdrawing a pot of £174,500, the middle point of that range, would have paid at least £63,500 in 2022/23 and a minimum of £64,700 now. These figures only consider the pension – people with other sources of income at the time of withdrawal would pay even more tax.

Paying significant amounts of tax to access pensions

This is because when people fully encash their pension, HMRC taxes anything above their 25% tax-free pension cash as income, subject to the LSA position of the individual, so it’s taxed like an ongoing salary. The analysis shows there are hundreds of people out there paying significant amounts of tax to access their pensions.

It’s impossible to know whether their circumstances warranted them being subject to a big tax hit, but for most people, it’s something you’ll want to avoid.

It’s important to remember that most pension income is subject to tax, like other income. Fully encashing a large pot will almost always mean a very large tax bill, sometimes taking away many years’ worth of savings. Often, when people fully withdraw their pension, it is simply to move the money to their bank account. Not only does this mean their savings become eligible for tax, but they’re also potentially giving up investment returns.

Withdrawing retirement savings more tax-efficiently

The good news is that there are ways to make withdrawing your retirement savings more tax- efficient, and it’s possible to spread your withdrawals over many years, which can be more efficient. Taking just one option at retirement, such as cash or an annuity, could mean you miss out on an opportunity to maximise tax efficiency and consider your financial needs in the round.

It’s worth considering a ‘mix and match’ approach to your retirement income, which could help you achieve the best of all worlds – you could, for example, annuitise a portion of your pension fund to cover essential outgoings and leave the rest in drawdown to access as and when you need it. Annuitising is the process of converting a lump sum of money into a stream of regular payments that are made over a specified period of time. Be sure to speak to your pension provider about your options, and we’d strongly recommend seeking advice or guidance when taking your pension.

How much tax will I pay on my pension pots?

First, most individuals will receive 25% of their pension pot tax-free, while the remaining 75% is taxable. The amount of tax payable on that 75% depends on factors such as your tax code, the amount you withdraw at a time and whether you have any other income sources.

It is important to remember that the total amount you can typically take tax-free across all your pension pots is now £268,275 unless you have specific protections in place. Most people cannot access their pension pots until they reach age 55 (rising to 57 on 6 April 2028).

Understanding your personal allowance

Everyone is entitled to a tax-free Personal Allowance each tax year, just like when working. For the 2024/25 tax year, the Personal Allowance is £12,570, which has been fro]en at this level for several years. Any amount above this will be taxed as earned income according to your tax band. The simplest way to avoid paying excessive tax is to ensure you do not withdraw more from a pension pot than necessary. Taking it in small, regular amounts could help keep your tax bill down.

Remember, you only pay Income Tax on anything over your Personal Allowance. Therefore, if a pension pot is your sole income source, you could withdraw

£12,570 from it each tax year without paying any tax. Conversely, taking large lump sums in the same tax year (outside of your 25% tax-free entitlement) could push you into a higher tax bracket.

Combining tax-free with taxable withdrawals

You do not necessarily need to take all of your tax-free lump sum at once. Often, you can take it in chunks over several months or years, provided your pension plan allows this. For instance, you could withdraw from the taxable portion of your pot and top it up with some of your tax-free amount.

Exploring ISAs as an income source

Unlike your pension pots, savings in your Individual Savings Accounts (ISAs) are generally not taxed upon withdrawal. You can contribute up to £20,000 in the 2024/25 tax year (across all your ISAs) and will not pay tax on withdrawals or gains. If you have savings in an ISA, consider using them to supplement your pension income to help reduce your tax burden. Alternatively, you could use your ISA to cover your entire retirement income before touching your pension.

For some, the early years of retirement can be more costly, necessitating a higher income. Hence, using tax-efficient withdrawals from your ISA to cover this period might be sensible. As you age and settle further into retirement, your expenses may decrease. Perhaps you have paid off your mortgage, enjoy less expensive hobbies or your children no longer rely on you financially. This could mean you can eventually afford to live off a more modest pension income, thus reducing your tax liability.

Ready to discuss how to manage your pension efficiently?

For further information and personalised advice on managing your pension withdrawals efficiently, please contact us so we can guide you in the most appropriate way for your unique situation.

Source data:

- Retirement income market data 2021/22 FCA

- Calculated using Which’s tax calculator, Income Tax calculator and salary calculator for 2024/25, 2023/24 and 2022/23 – Which? Figures rounded to the nearest £100.