Inheritance Tax Planning Services

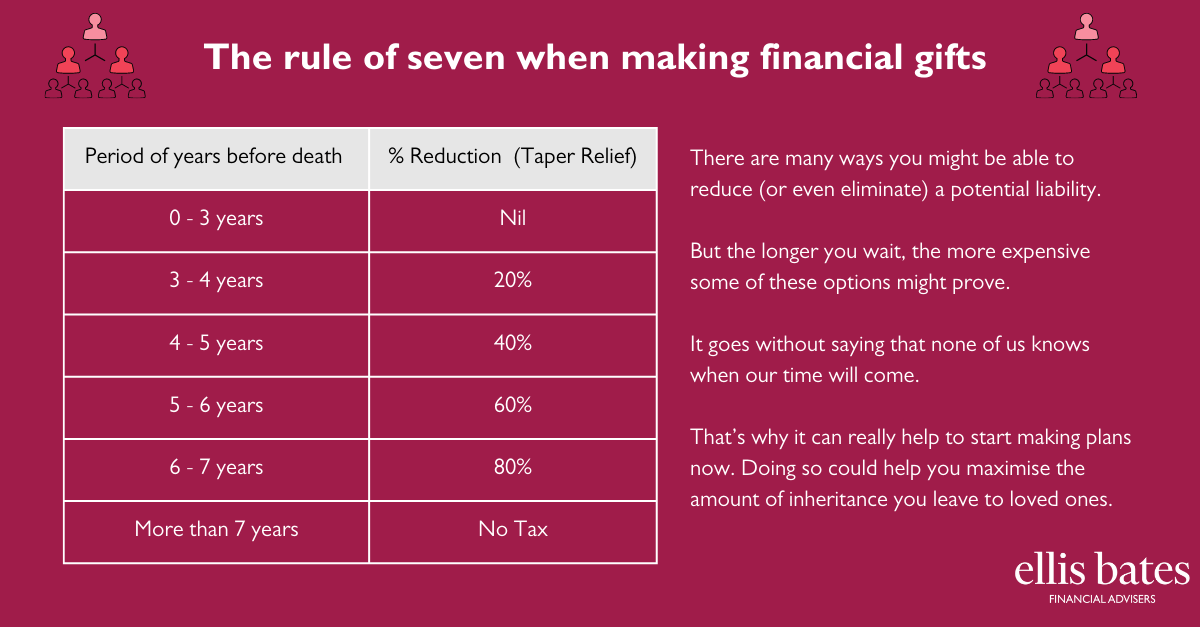

https://www.ellisbates.com/wp-content/themes/osmosis/images/empty/thumbnail.jpg 150 150 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gHead of Estate Planning and Chartered Financial Planner, Mark Chandler, outlines our tax planning services and inheritance tax planning services including making a Will, trusts and probate.