Planning for Inheritance Tax

https://www.ellisbates.com/wp-content/uploads/2024/04/shutterstock_1188687559-1024x683.jpg 1024 683 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g Plan for Inheritance Tax

Plan for Inheritance Tax

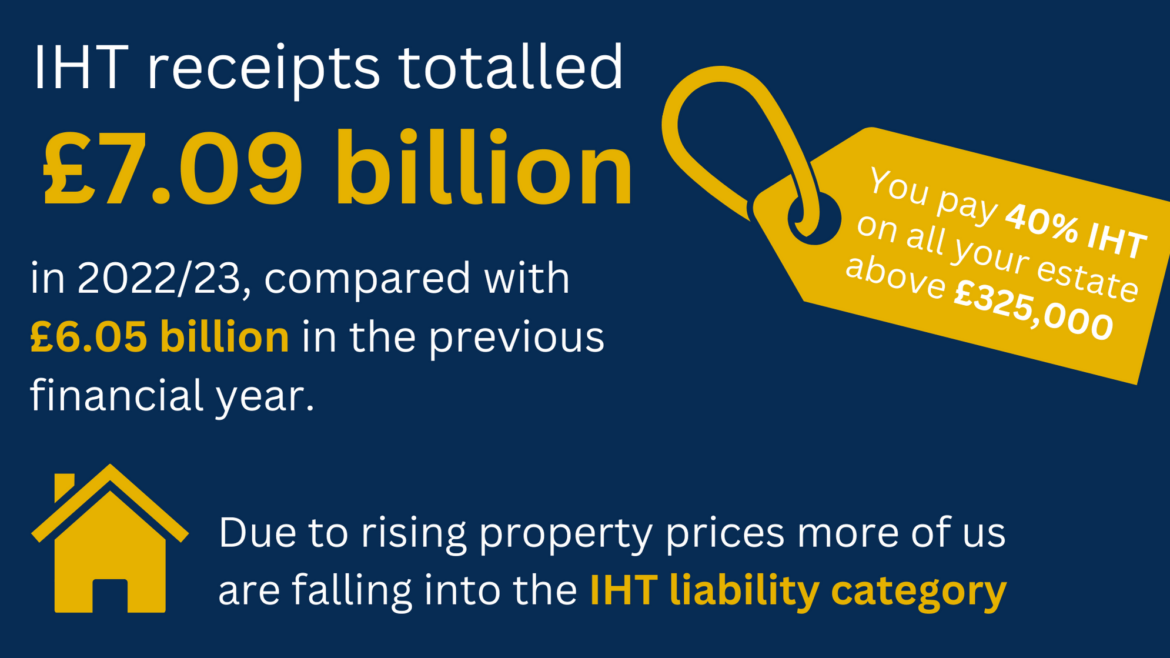

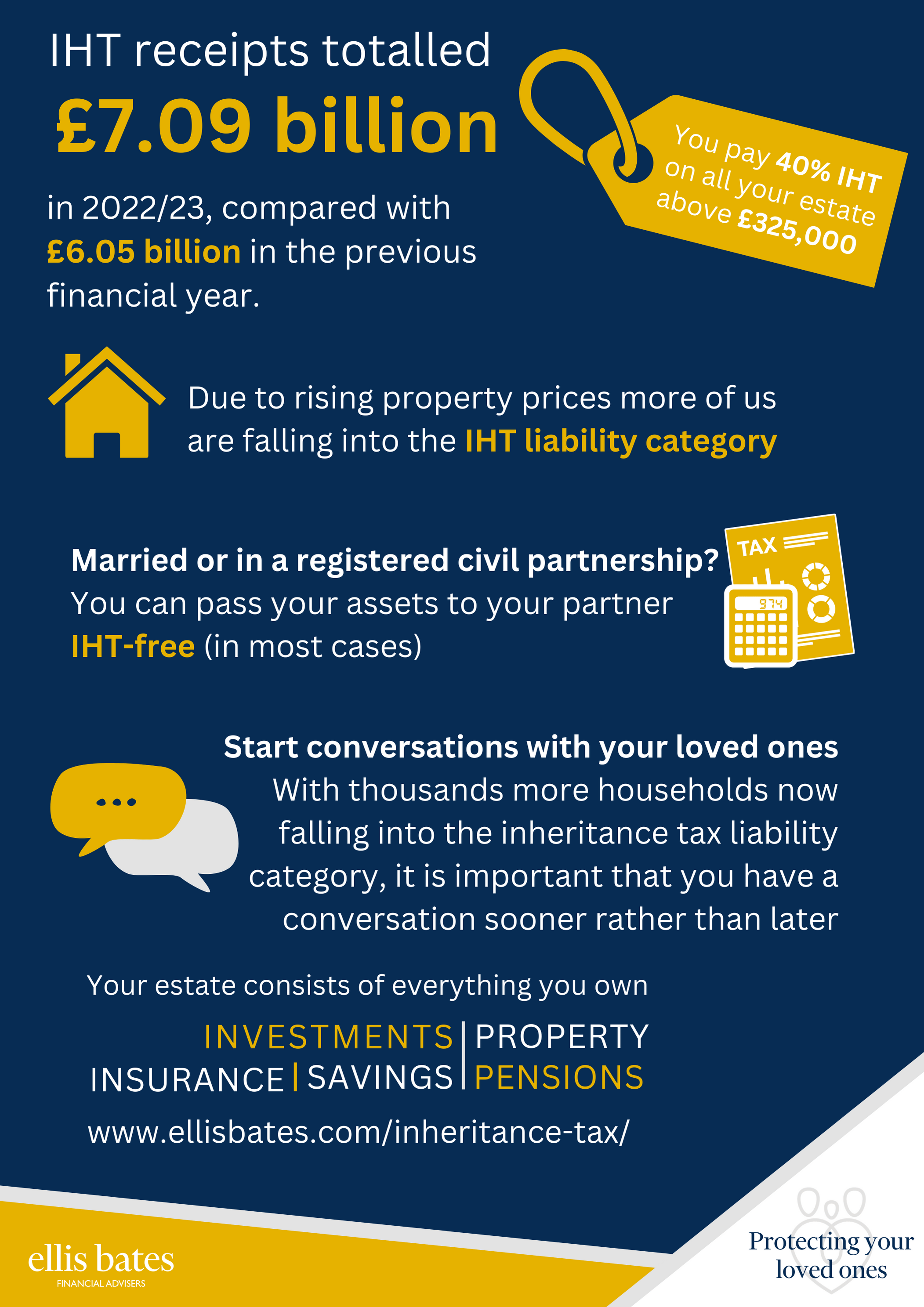

Whenever someone dies, the value of their estate may become liable for Inheritance Tax. If you are domiciled in the UK, your estate includes everything you own, including your home and certain trusts in which you may have an interest.

Inheritance Tax is potentially charged at a rate of 40% on the value of everything you own above the ‘nil-rate band’ (NRB) threshold. The nil-rate band is the value of your estate that is not chargeable to UK Inheritance Tax.

Gift assets while you’re alive

The amount is set by the government and is currently £325,000, which is frozen until 2026. In addition, since 6 April 2017, if you leave your home to direct lineal descendants, the value of your estate before tax is paid will increase with the addition of the ‘residence nil-rate band’ (RNRB). For the 2023/24 tax year, the RNRB is £175,000.

One thing that’s important to remember when developing an estate preservation plan is that the process isn’t just about passing on your assets when you die. It’s also about analysing your finances now and potentially making the most of your assets while you are still alive. By gifting assets to younger generations while you’re still around, you could enjoy seeing the assets put to good use, while simultaneously reducing your Inheritance Tax bill.

Make use of gift allowances

A non-exempt gift from one individual to another constitutes a Potentially Exempt Transfer (PET) for Inheritance Tax. If you survive for seven years from the date of the gift, no Inheritance Tax arises on the PET.

Some exempt gifts are immediately out of your estate: Each tax year, you can give away £3,000 worth of gifts (your ‘annual exemption’) tax-free. You can also give away wedding or registered civil partnership gifts up to £1,000 per person (£2,500 for a grandchild and £5,000 for a child). In addition, you can give your children regular sums of money from your surplus income.

You can also give as many gifts of up to £250 to as many individuals as you want, although not to anyone who has already received a

larger gift from you that tax year. None of these gifts are subject to Inheritance Tax.

Invest into IHT-exempt assets

For experienced suitable investors, another way to potentially minimise Inheritance Tax liabilities is to invest in Inheritance Tax exempt assets. These schemes are higher risk and are therefore not suitable for all investors, and any investment decisions should always be made with the benefit of professional financial advice.

One example of this is the Enterprise Investment Scheme (EIS). The vast majority of EIS-qualifying investments attract 100% Inheritance Tax relief via Business Relief (BR) because the qualifying trades for EIS purposes are very similar to those which qualify for BR. Qualification for BR is subject to the minimum holding period of two years (from the later of the share issue date and trade commencement).

Life insurance within a trust

If you’re looking to potentially minimise any Inheritance Tax your estate may be subject to, then consider placing life insurance within an appropriate trust. This allows the pay out from the policy to be given directly to your beneficiaries, which won’t be included in the calculations for any Inheritance Tax.

Taking this step can offer peace of mind for you and financial security for your heirs. Remember your life insurance policy is likely to be a significant asset – by putting it in an appropriate trust, you can manage the way your beneficiaries receive their inheritance.

Keep wealth within a pension

A defined contribution pension is normally free of Inheritance Tax, unlike many other investments. It is not part of your taxable estate. Keeping your pension wealth within your pension fund and passing it down to future generations can be very tax-efficient estate planning.

If you die before 75, your pension will be passed on tax-free (as long as no Lifetime Allowance charge applies). However, if you die after 75, your beneficiaries will pay tax on any payments they receive at their marginal Income Tax rate. Your pension will not usually be covered by your Will, so you will need to ensure that your pension provider knows who your nominated beneficiaries are.

Preserved wealth for future generations

We all have one thing in common: we can’t take our assets with us when we die. If you want to ensure that your wealth is preserved for future generations and passed on efficiently, an estate plan is crucial.

If you want to know more about Inheritance Tax and planning for your future, please get in touch

"*" indicates required fields

Start your estate and inheritance planning as early as possible and implement in stages

Start your estate and inheritance planning as early as possible and implement in stages