Free Guide: Pre-year-end Tax Planning

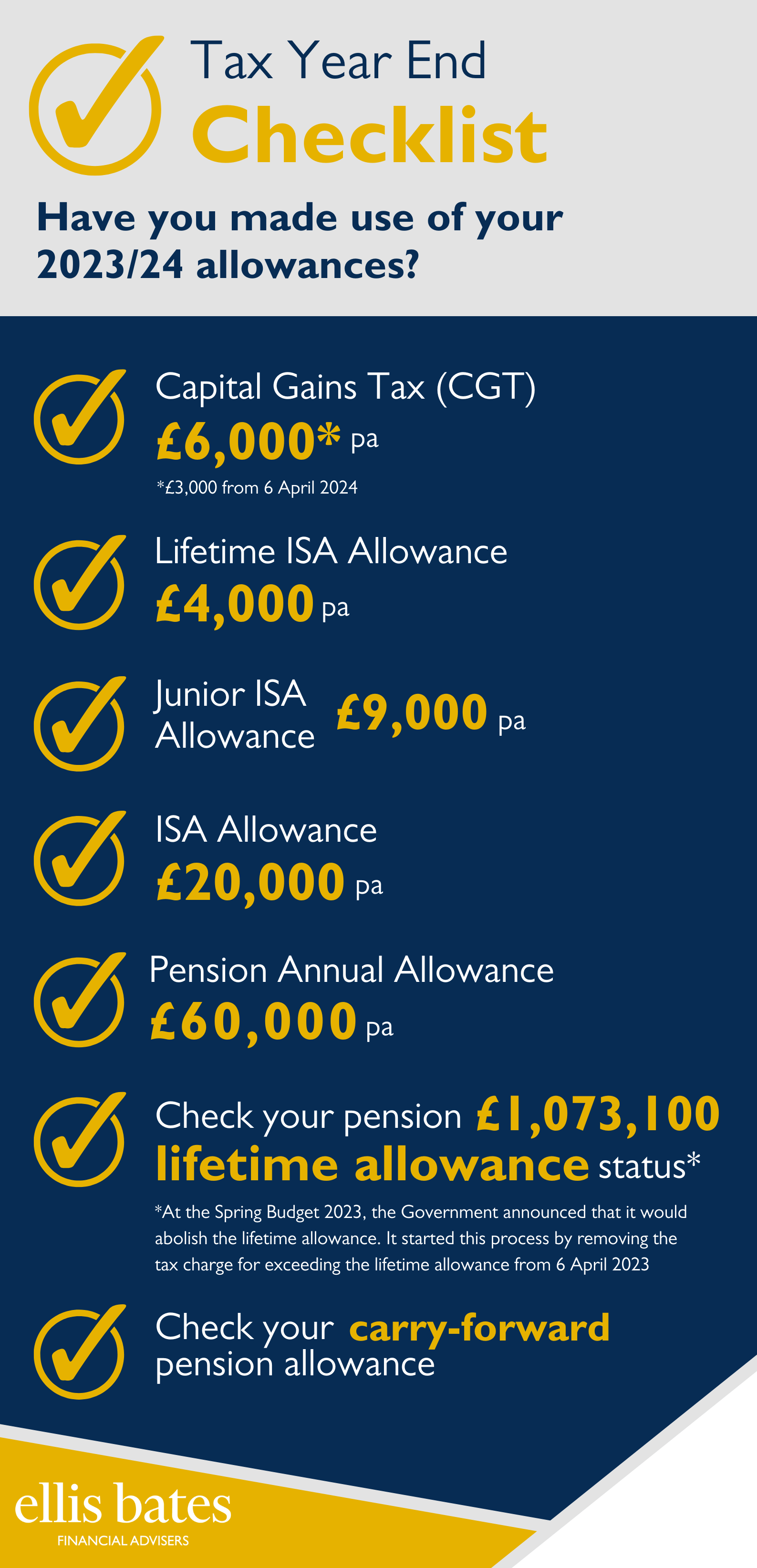

https://www.ellisbates.com/wp-content/uploads/2024/03/Ebookbrochure-socials-1024x535.png 1024 535 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gAs we approach the end of the current tax year on 5 April 2024, it’s an opportune moment to examine both your personal and business finances to ensure they are structured to optimise your tax efficiency.

Despite the ongoing freeze on many tax rates and thresholds, numerous strategies remain for efficiently organising your financial matters.

We have produced a free guide to help you plan for tax year end, to download, please fill out your details below.

Download your free guide

"*" indicates required fields

7 Benefits of Financial Advice

7 Benefits of Financial Advice