Millions of married couples have no idea about their spouse’s pensions & retirement plans

https://www.ellisbates.com/wp-content/uploads/2022/08/Retirement-taboo-holder.png 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

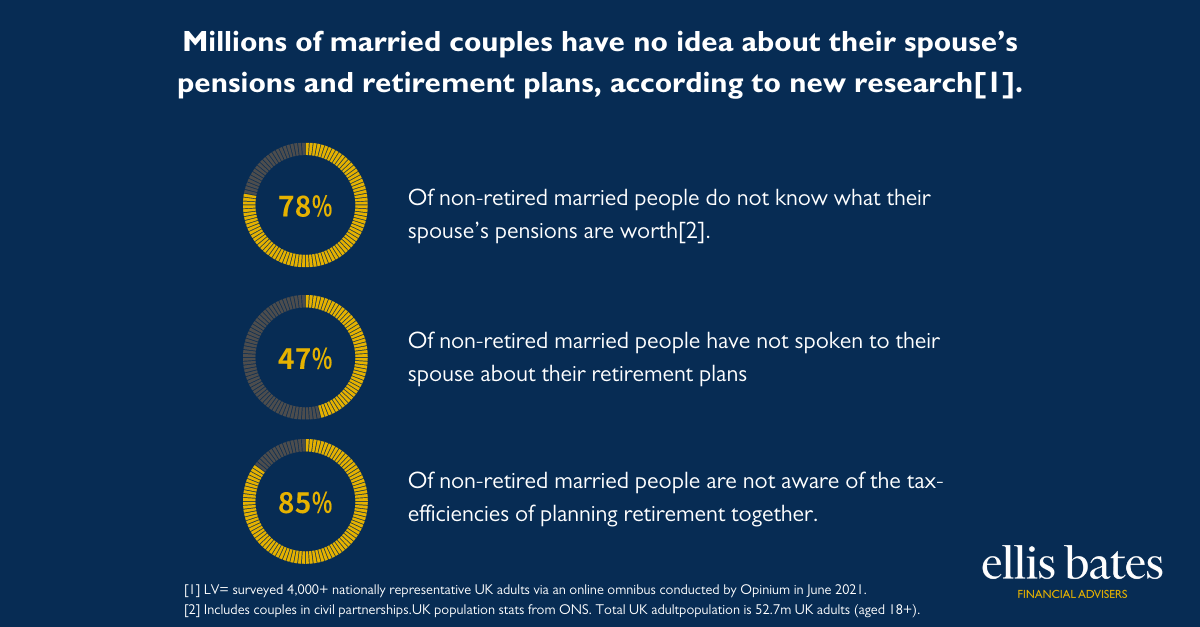

Millions of married couples have no idea about their spouse’s pensions and retirement plans, according to new research

78% of non-retired married people do not know what their spouse’s pensions are worth.

47% of non-retired married people have not spoken to their spouse about their retirement plans

85% of non-retired married people are not aware of the tax-efficiencies of planning retirement together

Women are being urged to think about their long term savings

Women are being urged to think about their long term savings

A more popular and increasingly common option many are considering.

A more popular and increasingly common option many are considering.

Time to review your financial plans with a financial check-up?

Time to review your financial plans with a financial check-up?

Planning your future has arguably never been more important.

Planning your future has arguably never been more important.

How to create a personal financial plan in 8 steps

How to create a personal financial plan in 8 steps