Navigating the ins and outs of Retirement Planning

https://www.ellisbates.com/wp-content/uploads/2024/04/Ebookbrochure-socials-5-1024x535.png 1024 535 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gThe past few decades have witnessed significant transformations in retirement planning. The security of a fixed income from a final salary pension is now a rarity, and eligibility for the State Pension now comes at a later age.

The sooner you initiate your retirement planning, the higher your chances are of amassing sufficient savings to maintain your desired lifestyle post-retirement.

We have produced a guide to Navigating the ins and outs of Retirement Planning to help you begin your financial journey:

To download the guide, fill out your details:

"*" indicates required fields

Time to kickstart your retirement plans?

Time to kickstart your retirement plans?

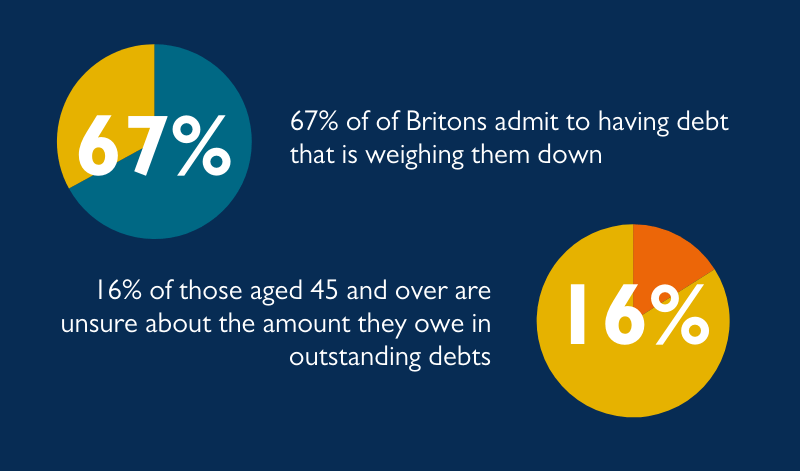

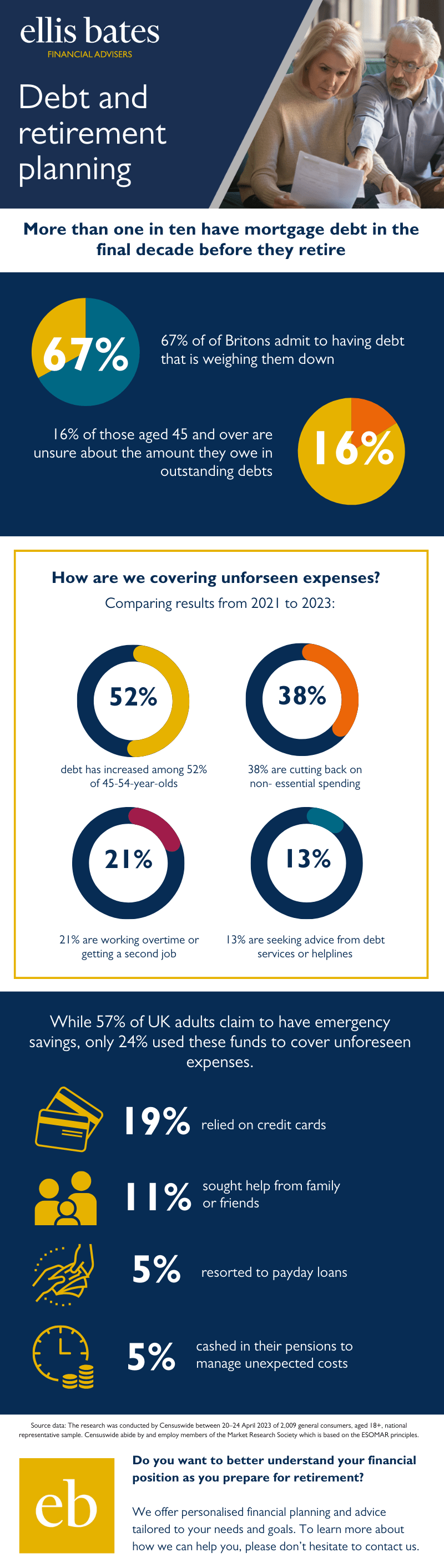

More than one in ten have mortgage debt in the final decade before they retire

More than one in ten have mortgage debt in the final decade before they retire

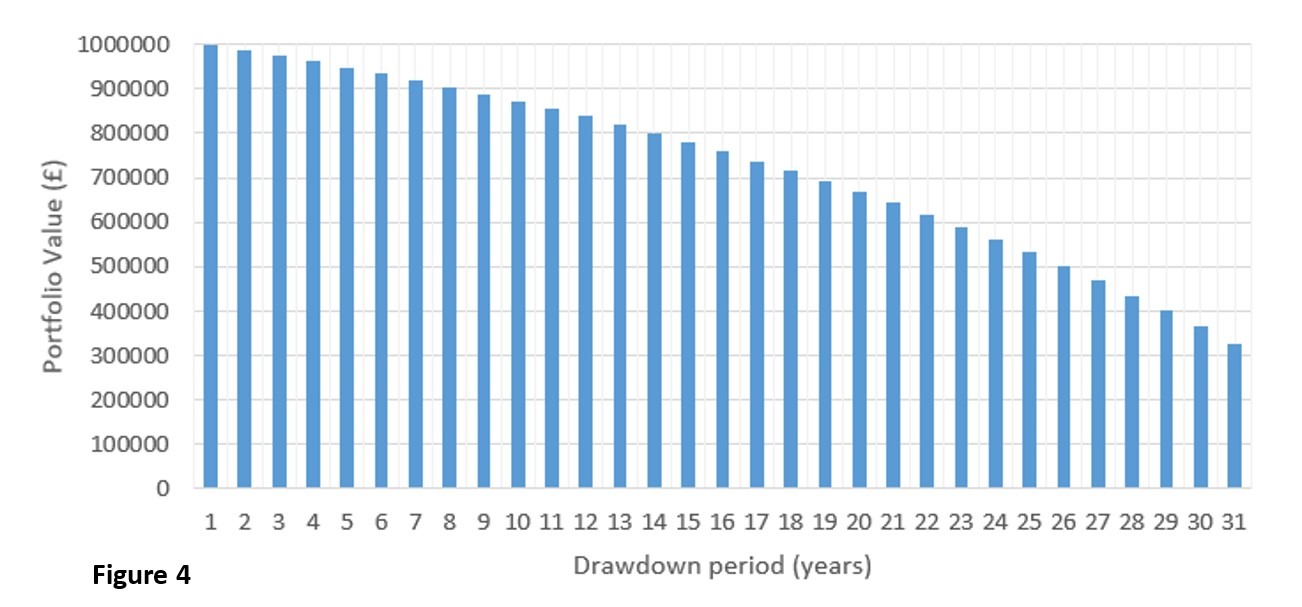

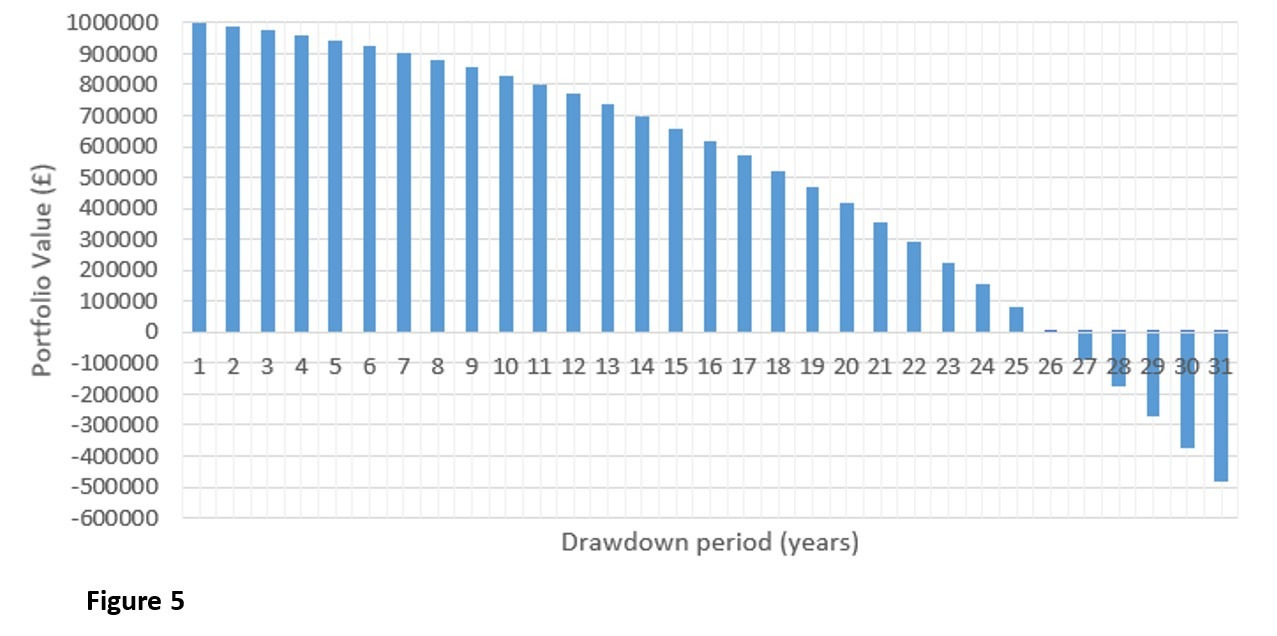

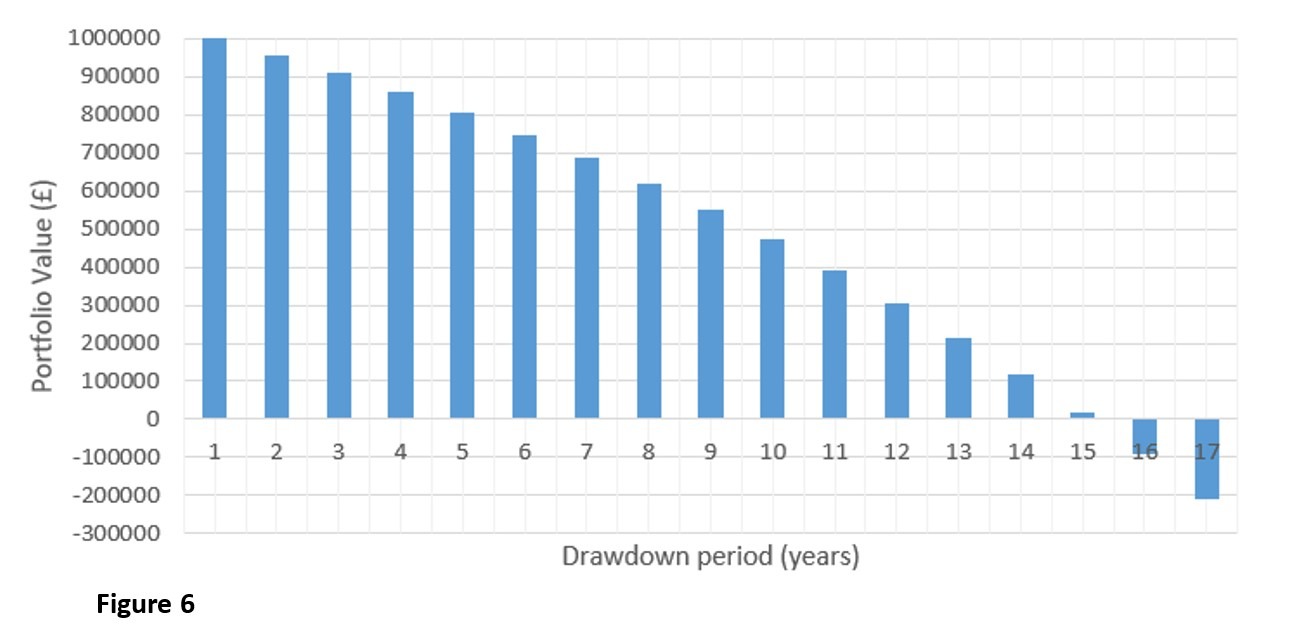

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.