How to decide when to retire

https://www.ellisbates.com/wp-content/uploads/2023/06/Deciding-when-to-retire.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

Over a third of over-55s think they will work beyond their state pension age.

We are witnessing a surge in the number of people giving retirement a second thought due to inflation rates and the cost of living crisis. Not only are more individuals looking to work beyond their State Pension age, but some are returning to employment after retiring due to increasing financial pressures.

Over 2.5 million people aged 55 and over will be impacted by the long-term effects of financial insecurity and think they will continue to work past their State Pension age. Additionally, half of those aged 55 and over don’t believe their pension is enough to fund their retirement, a survey has revealed[1].

Increasing cost of living

Nearly four in ten over-55s who are not retired anticipate having to work past their State Pension age due to the increasing cost of living. Financial concerns surrounding retirement funding are the top drivers behind working beyond State Pension age.

A quarter (23%) are uncertain of how long their retirement savings will last, and almost one-fifth (18%) admit to not having made any preparations for when they stop working.

Ability to remain employed

Nearly half (46%) of the millions of older workers expecting to work past their State Pension age are apprehensive that doing so will mean they can’t enjoy their later years.

Health, too, is another major concern, with nearly half (45%) worrying their health will deteriorate as a result of having to continue working and more than a third (35%) concerned it will affect their ability to remain employed.

Heavy financial strain

Worryingly, 16% are concerned about being treated differently or worse at work because of their age and the same number worried about not being able to spend enough time with their family due to work commitments.

Looking ahead, the older workforce is expected to be crucial to the UK’s economic recovery as it will help ease severe labour shortages, yet this warning sign points to heavy financial strain many are facing.

Cash flow forecasting

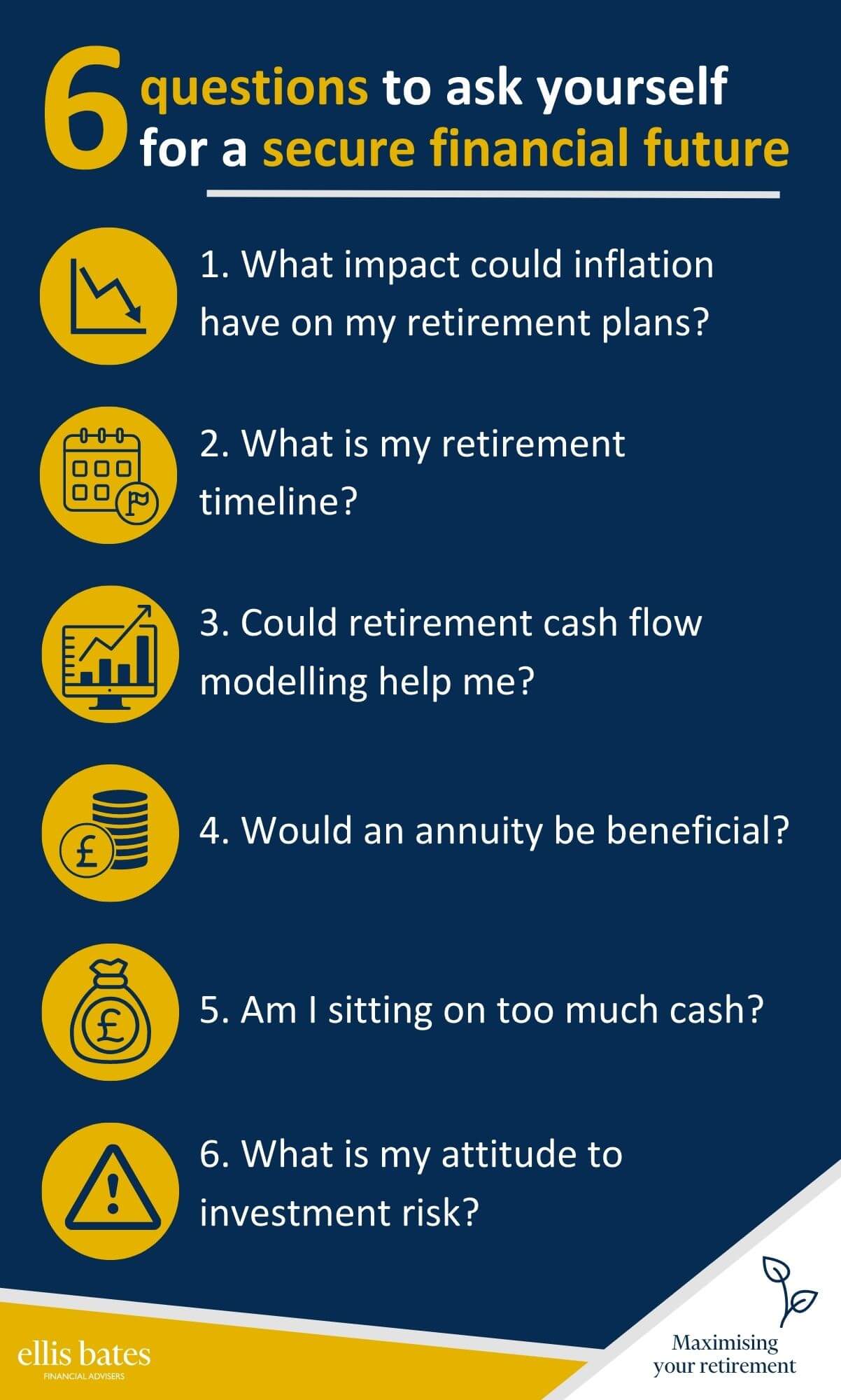

We all want to be in control of our retirement plans and feel confident we can stop working when we want to so that we can enjoy the retirement we deserve.

We use sophisticated cash flow forecasting software and together we can plan and analyse your financial goals, review how changing circumstances could impact this plan and to see how likely it is these financial goals can be achieved.

If you are worried about how your current situation and the cost of living could impact on your retirement savings, we are here to talk through your options. To find out more, please speak to us.

Important information: A pension is a long-term investment not normally accessible until age 55 (57 from April 2028 unless plan has a protected pension age). The value of your investments (and any income from them) can go down as well as up which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

Source data: [1] Survey conducted by Opinium among 2,000 UK adults between 21-25 October 2022.