Divorce and Finances

https://www.ellisbates.com/wp-content/uploads/2023/09/Divorce-and-Finances-holder.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g Protecting your assets and preparing you for going forward on your own.

Protecting your assets and preparing you for going forward on your own.

Divorce involves many loose ends, both emotional and financial. It can generate high levels of uncertainty and financial stress, as it impacts on all areas of your life, from living arrangements to assets and pensions. That’s why financial planning through a divorce is essential to help protect your assets and prepare you for going forward on your own.

Making the right financial decisions during your divorce can be difficult. You may be worried about your future and how you will support yourself and your family. Divorce is a difficult time emotionally and financially. It is important to obtain professional financial advice to help you through this challenging period.

This will help protect your interests, ensuring that you receive a fair outcome and your future is secure. It will also enable you to have a clear understanding of your current financial situation. This includes knowing what assets and debts you have, as well as what income and expenses you have each month.

Future finances

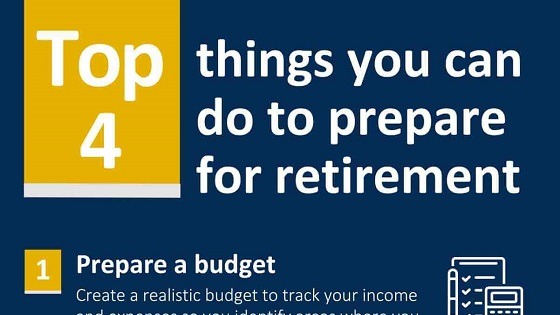

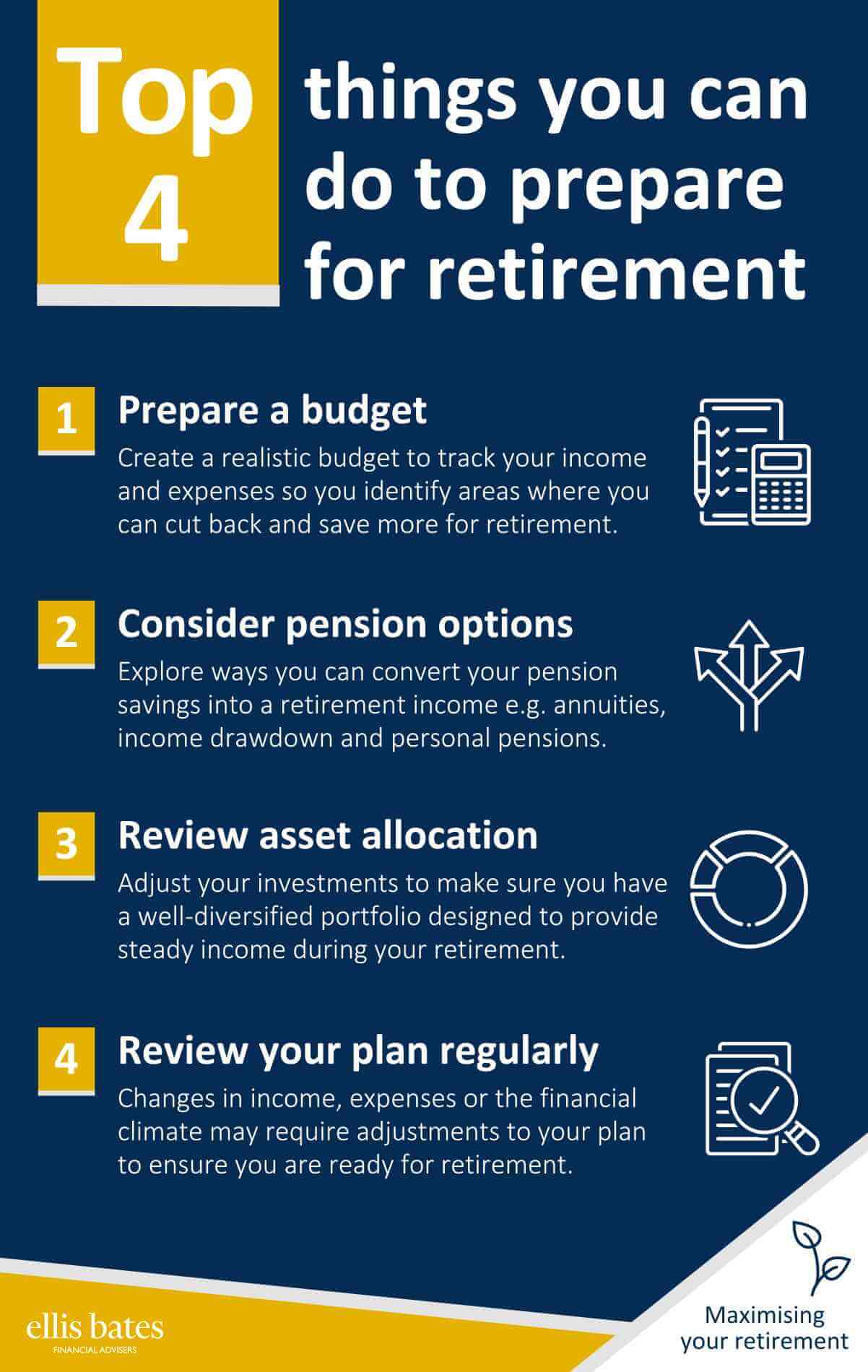

You’ll need to be realistic about your future income and expenses. That means putting a realistic budget in place so that you can make informed decisions about your future finances.

Don’t overlook any tax implications based on any financial decisions you make. This is especially important if you are considering selling assets or transferring property.

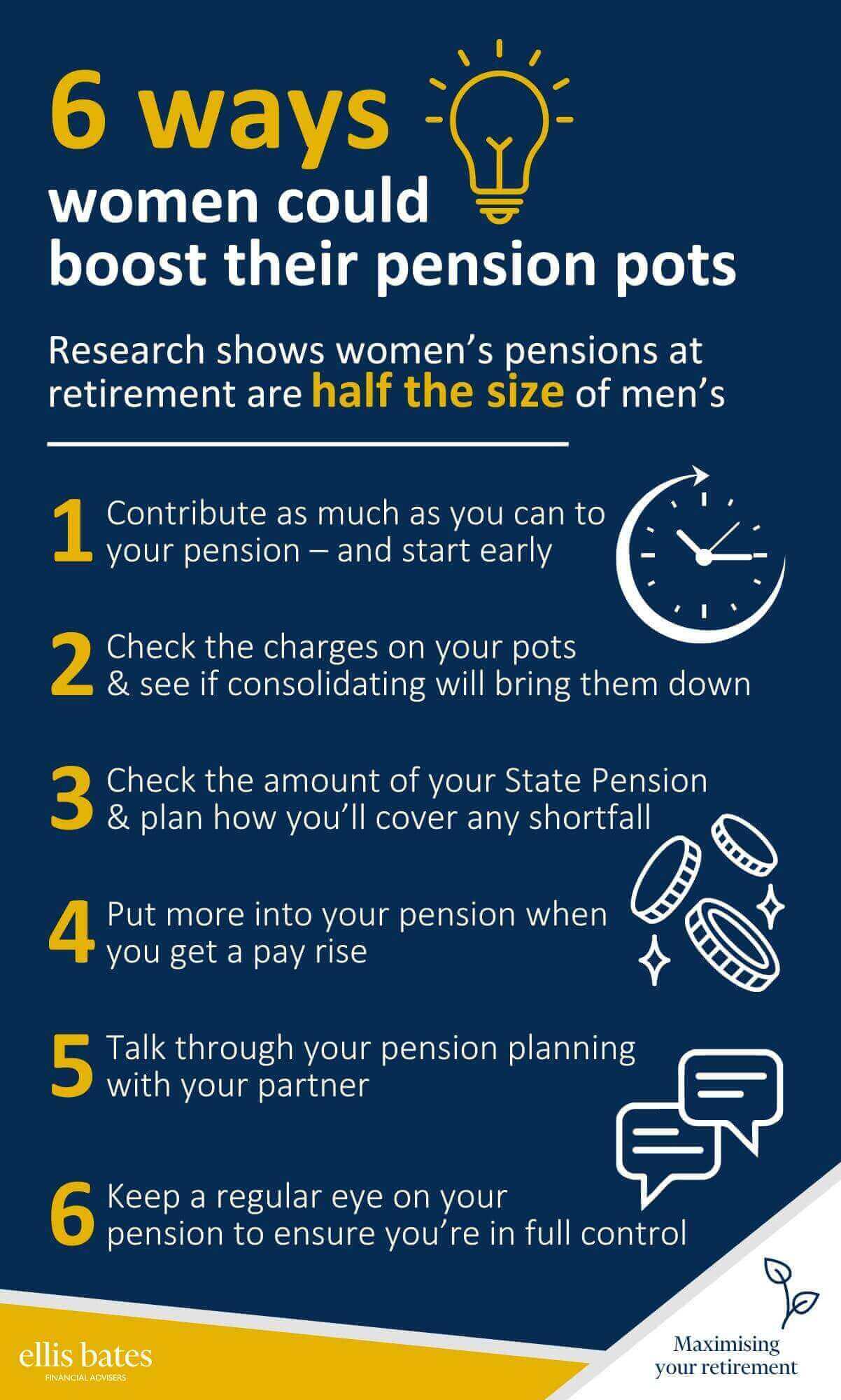

Dividing pensions in divorce

One of the most important assets to consider is your pension. Pensions are often overlooked in divorce settlements, but they can be worth a significant amount of money. It is important to get professional advice to make sure that pensions are taken into account in any settlement.

There are several options for dividing pensions in a divorce, and the best option will depend on your individual circumstances. You may be able to keep your pension in its current form, or you may need to transfer some or all of it to your ex-partner.

Divorce settlement

Whatever you do, make sure that you obtain professional advice before making any decisions about your pension. It is one of the most important financial assets you have, and you need to make sure that it is taken care of in your divorce settlement.

With careful planning and communication, you can make the transition as smooth as possible to help you move on with your life and make a fresh start.

5 top tips when it comes to finances and divorce

- Get organised

Gather your financial documents to help you and your lawyer understand your financial situation and make the best decisions.

- Make a budget

Be honest with yourself about your income and expenses. This will help you make informed decisions about your finances going forward.

- Understand your rights

Speak with a lawyer to understand your rights and responsibilities during the divorce process. This will help you make decisions that are in your best interests.

- Communicate with your spouse

If you have children, it is important to communicate with your spouse about financial matters. This can be difficult, but it is important to try to reach an agreement on child support and other financial issues.

- Obtain professional financial advice

This will help ensure that you are making sound decisions with your finances during this difficult time. There are many factors to consider when going through a divorce. The advice will help you understand the financial implications of the decisions you make, and provide guidance on how best to protect your interests.

If you have any questions about your pension or other financial assets during a divorce, please contact us.

Important information: Divorce settlements are not regulated by the financial conduct authority.

7 Benefits of Financial Advice

7 Benefits of Financial Advice