What is pension drawdown?

https://www.ellisbates.com/wp-content/themes/osmosis/images/empty/thumbnail.jpg 150 150 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=gFinancial Planner, Amy Burge, explains what Pension Drawdown is, what pension planning services we offer and how she has helped a client with their pension planning.

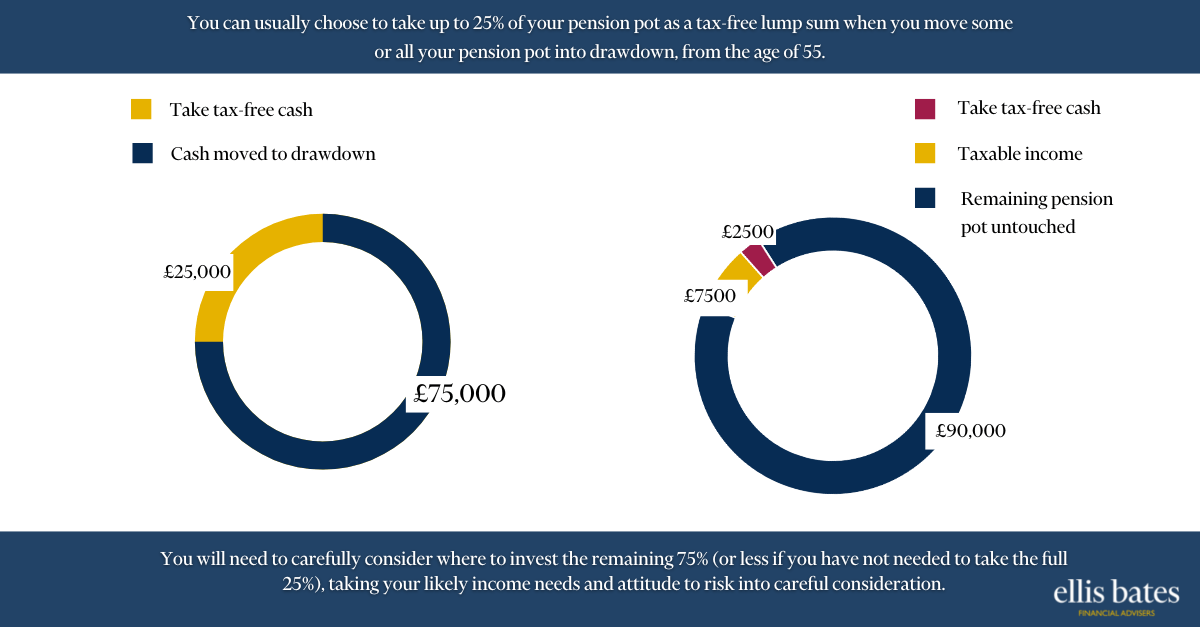

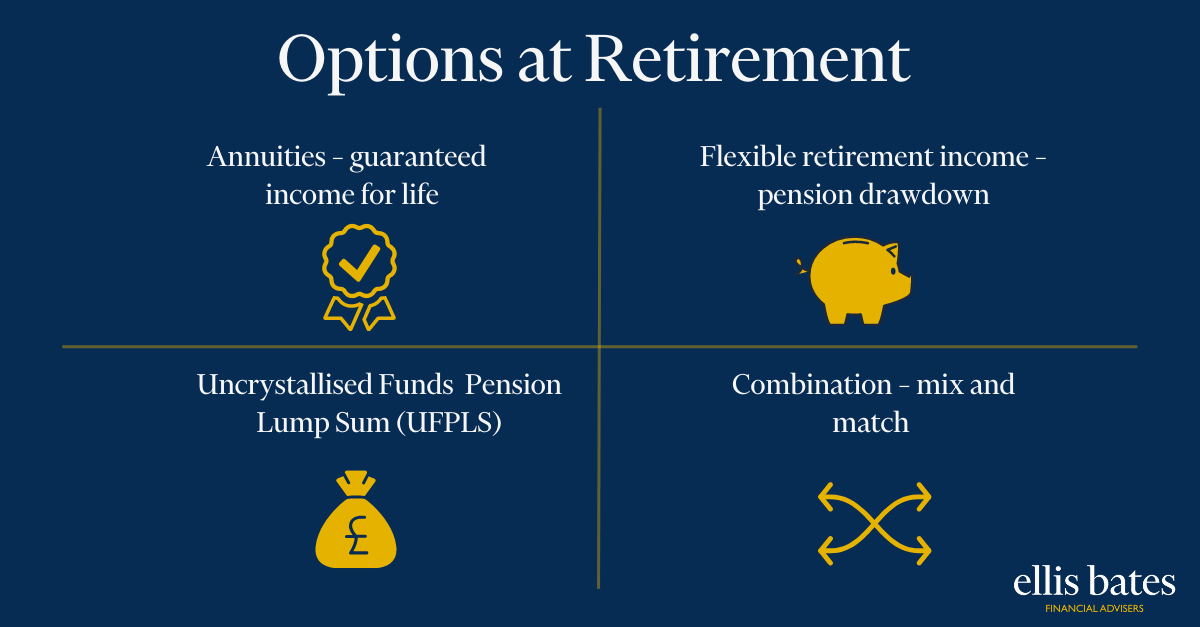

Pension Freedoms – Looking for a wider choice of investment options?

Pension Freedoms – Looking for a wider choice of investment options?