Generation Covid-19

https://www.ellisbates.com/wp-content/uploads/2021/04/Covid-19-Generation-blog-image.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g Financial support to younger members as a direct result of the pandemic.

Financial support to younger members as a direct result of the pandemic.

The coronavirus (COVID-19) pandemic has led to more people supporting younger family members financially. New research shows that 5.5 million older family members expect to provide additional financial support to younger members as a direct result of the pandemic[1].

Of these, 15% estimate they will provide an additional sum of £353 in financial aid. The most common reasons given for the payments were to help cover household bills, rent payments, allowing them to move back to the family home or paying off debts. This equates to £1.9 billion being given to younger family members needing financial support.

Regular Gifts

This COVID-19 specific support comes in addition to regular ongoing financial support provided by older family members. Over a third (39%) of young adults, around 3.3 million people, receive regular financial support from their older family members and depend on it to cover their monthly outgoings.

Older family members provide on average £113 a month, collectively giving £372 million to loved ones each month in the form of regular gifts. While the majority (31%) say they use monthly gifts to save for ‘big ticket’ items like a housing deposit, over a quarter use it to pay for everyday essentials (29%) and a similar number to pay their bills (27%).

Financial Aid

Despite the significant sums handed out, 80% of older family members who gift money feel it is only natural to provide support to their younger relatives and are more than happy to do so. Of the 50% of adults who have received financial aid from a family member, many have sought further support during this year.

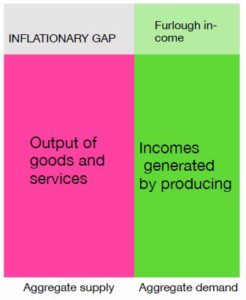

16% have utilised the government furlough scheme, 15% moved back to their family home to live rent free and 13% have taken out a one-off

loan. The trend of younger family members moving back home is becoming more common, with the most recent data from the Office for

National Statistics (ONS) showing that over the last two decades, there has been a 46% increase in the number of young people aged 20-34 living with their parents, up to 3.5 million from 2.4m[2].

Gift Money

While the majority (62%) of those who give away money do so knowing they can afford to maintain their current lifestyle, the research suggests that selfless relatives are occasionally making changes to their own finances to meet the expense. Over a third (38%) of those who gift money to family members have made sacrifices in order to do so. While many (31%) reported cutting back on some day-to-day spending in order to gift money, a fifth (21%) admitted they struggled to pay some bills having helped out a loved one.

Most parents and grandparents will gladly help out when they can, but people are often making personal compromises to provide this support. Giving money to a family member has the potential to be a special experience, but the key is not to lose sight of your longer-term plan.

Property Wealth

There is a risk that people could be underestimating what they need to fund a comfortable retirement, and therefore it’s important to gift sensibly. Utilising property wealth, by either downsizing or using equity release, can often be helpful here as it allows the opportunity to give a living inheritance without touching your income.

These decisions aren’t easy, and the tax rules mean gifting money can be complicated. When gifting, HM Revenue & Customs stipulates you

must be able to maintain your current standard of living from your remaining income to take advantage of tax exemptions and there are

tax implications for anything gifted over the £3,000 annual allowance.

“Bank of Mum and Dad” Open for Financial Support

Younger generations, who stand to be impacted most by the crisis, may need to call on you – the ‘Bank of Mum and Dad’ – for financial support. If this is the case you need to evaluate how any cash calls could impact your own retirement plans. To discuss any concerns that you may have, please contact us.

Source data:

[1]Opinium Research ran a series of online interviews among a nationally representative panel of 4,001 UK adults between the 25 September and 3 October 2020

[2]https://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/families/datasets/youngadultslivingwiththeirparents

Responsible, sustainable and environmentally friendly investing is here to stay. But, while demand is growing among all age groups, genders and income bands, some savers and investors are missing their biggest opportunity for responsible investing, which is through their pension.

Responsible, sustainable and environmentally friendly investing is here to stay. But, while demand is growing among all age groups, genders and income bands, some savers and investors are missing their biggest opportunity for responsible investing, which is through their pension.

Make the most of the tax breaks before it’s too late. If you hold a Cash Individual Savings Account (ISA) you may be dissatisfied with the low rates of interest you receive, which could make it difficult to grow your money even at a rate that keeps pace with inflation.

Make the most of the tax breaks before it’s too late. If you hold a Cash Individual Savings Account (ISA) you may be dissatisfied with the low rates of interest you receive, which could make it difficult to grow your money even at a rate that keeps pace with inflation.

What was announced in Chancellor Rishi Sunak’s speech?

What was announced in Chancellor Rishi Sunak’s speech?

Achieving your financial goals through investing, and one size does not fit all Even as we hope to put the coronavirus (COVID-19) pandemic in the rearview mirror in 2021, uncertainty regarding both the virus and Brexit is likely to continue to weigh on the UK and global economies as well as on our personal finances during this year. While we hope volatility is less elevated this year, financial markets and the economy could still remain at the mercy of COVID-19 developments.

Achieving your financial goals through investing, and one size does not fit all Even as we hope to put the coronavirus (COVID-19) pandemic in the rearview mirror in 2021, uncertainty regarding both the virus and Brexit is likely to continue to weigh on the UK and global economies as well as on our personal finances during this year. While we hope volatility is less elevated this year, financial markets and the economy could still remain at the mercy of COVID-19 developments.

Saving and investing for a future that matters. Yours. Each tax year, we are given an annual Individual Savings Account (ISA) allowance. This can build up quickly, letting you accumulate a substantial tax-efficient gain in the long-term.

Saving and investing for a future that matters. Yours. Each tax year, we are given an annual Individual Savings Account (ISA) allowance. This can build up quickly, letting you accumulate a substantial tax-efficient gain in the long-term.

How to get your finances in order to make more of your money.

How to get your finances in order to make more of your money.

Placing money in companies that bring positive change. Issues such as climate change and sustainability have become increasingly hot topics globally and often the subject of conversation. As a result, Environmental, Social and Governance-linked (ESG) investment strategies continue to dominate financial headlines.

Placing money in companies that bring positive change. Issues such as climate change and sustainability have become increasingly hot topics globally and often the subject of conversation. As a result, Environmental, Social and Governance-linked (ESG) investment strategies continue to dominate financial headlines.

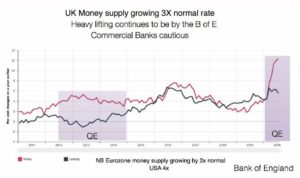

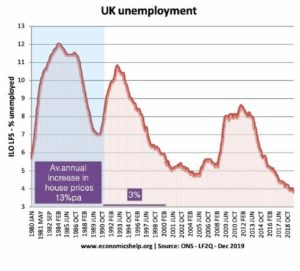

House prices from 1980-1990 rose at an average annual rate of 13%. In the nineties unemployment steadily fell but house prices remained subdued on average growing at 3% per annum. The reasons are found in the behaviour of banks. In the eighties Barclays and NatWest were both determined to be the UK’s biggest banks, measured by total assets. Mortgages are nearly 60% of banks’ assets. So they slugged it out, and then Building Societies were allowed to become banks which meant they could start manufacturing money. Thus regardless of employment levels the wall of money was created.

House prices from 1980-1990 rose at an average annual rate of 13%. In the nineties unemployment steadily fell but house prices remained subdued on average growing at 3% per annum. The reasons are found in the behaviour of banks. In the eighties Barclays and NatWest were both determined to be the UK’s biggest banks, measured by total assets. Mortgages are nearly 60% of banks’ assets. So they slugged it out, and then Building Societies were allowed to become banks which meant they could start manufacturing money. Thus regardless of employment levels the wall of money was created.