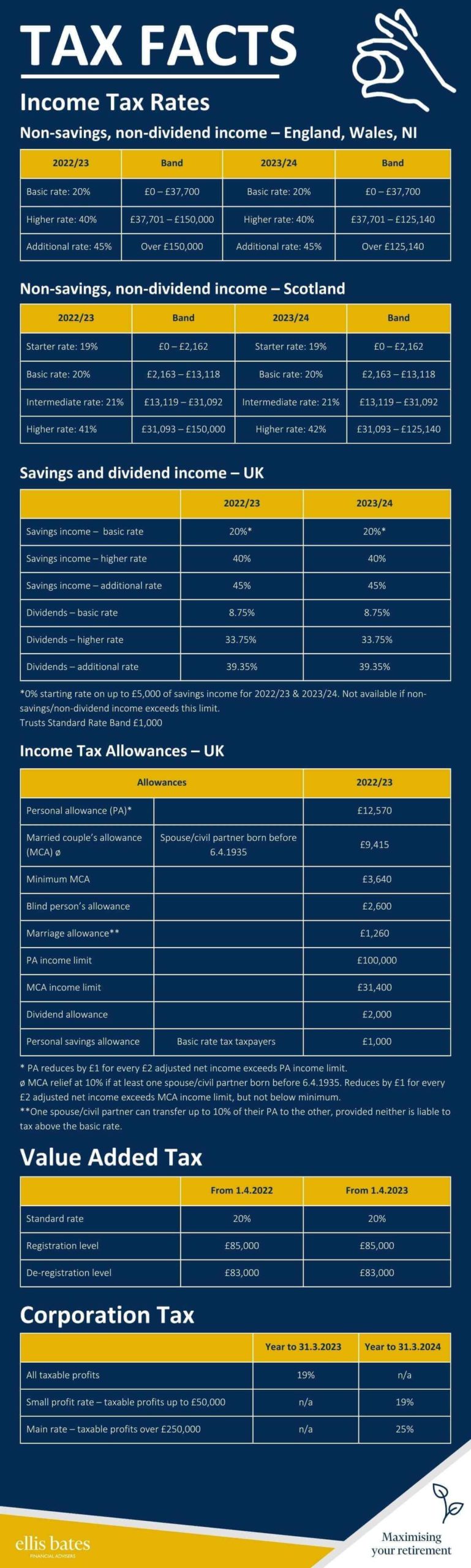

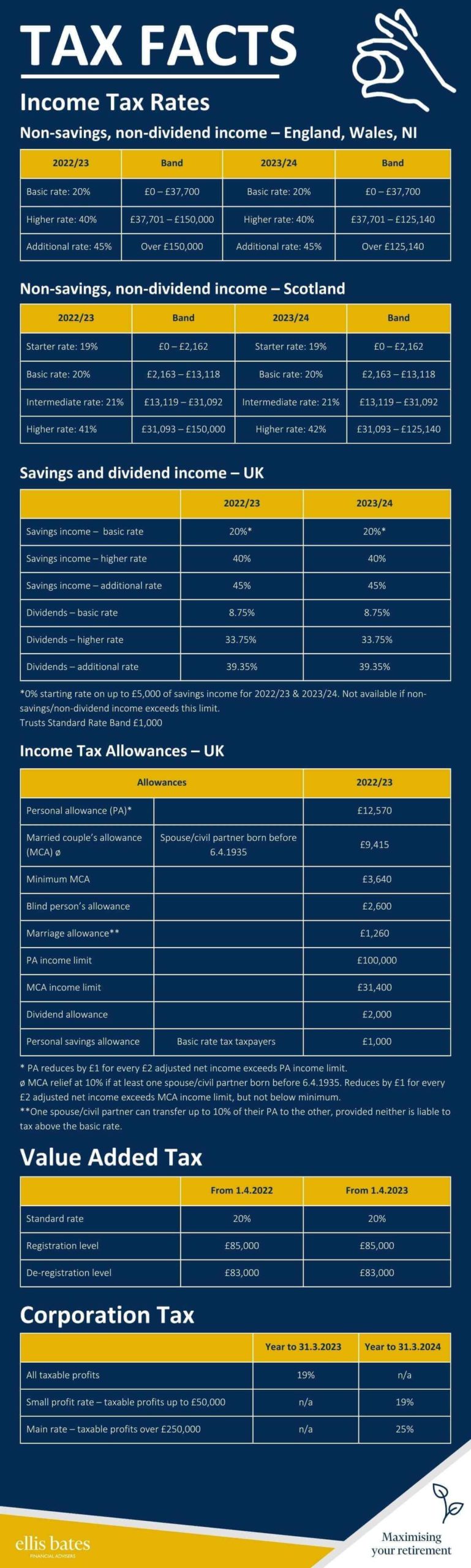

We work with you to ensure you maximise all tax relief available and to look at all your current and future finances to mitigate a whole range of liabilities such as income tax, VAT and corporation tax.

We work with you to ensure you maximise all tax relief available and to look at all your current and future finances to mitigate a whole range of liabilities such as income tax, VAT and corporation tax.