Environmental Sustainability

https://www.ellisbates.com/wp-content/uploads/2022/08/Environmental-ESGs-holders.png 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

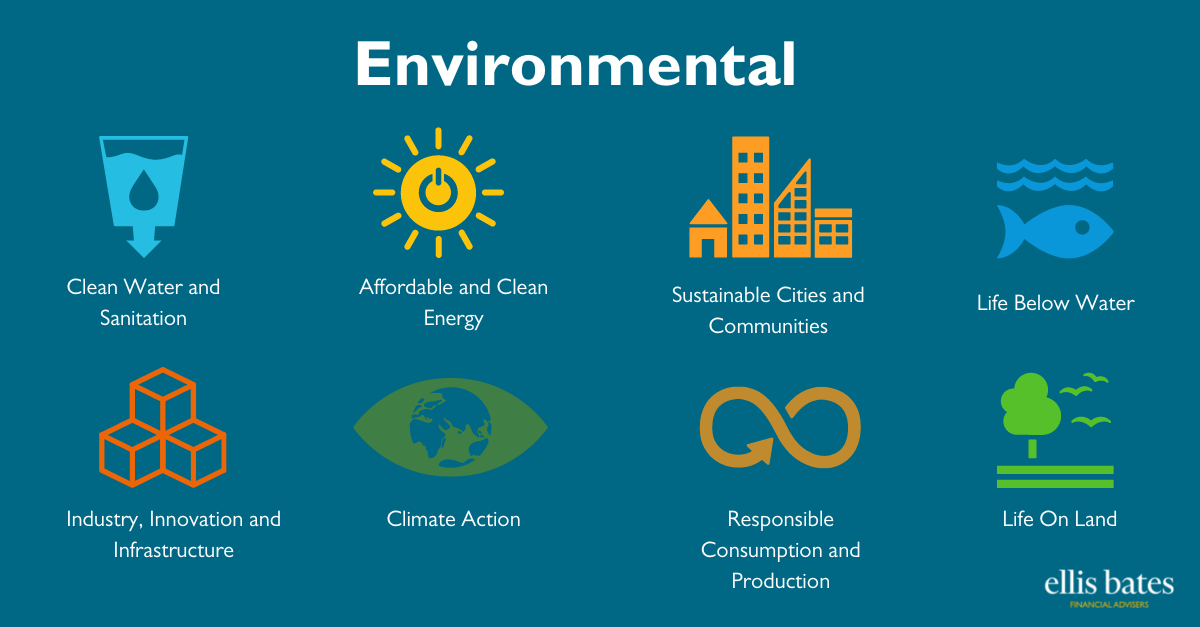

Environmental impact of SRI portfolios

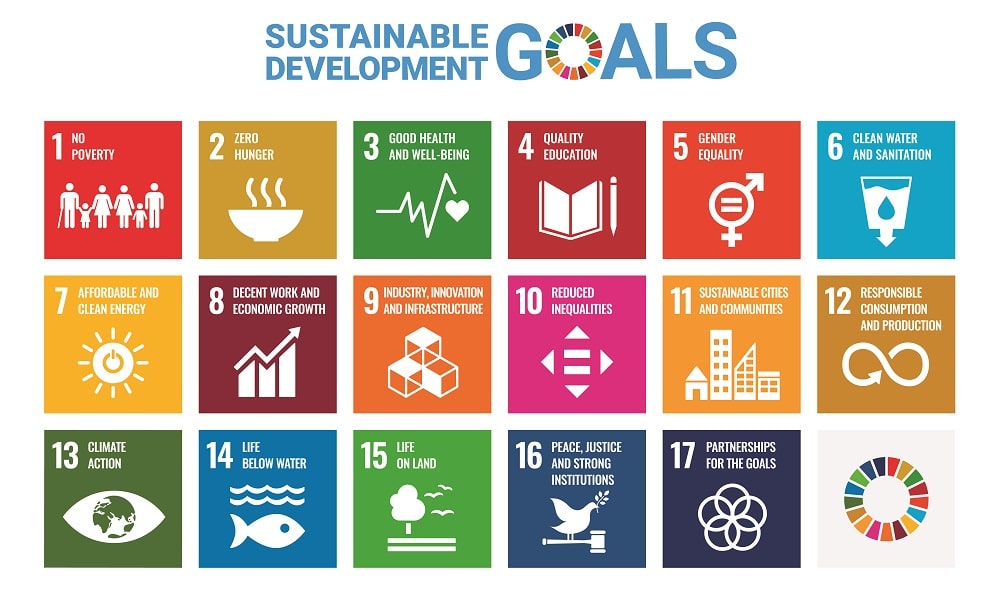

- Clean water and sanitation

- Affordable and clean energy

- Sustainable cities and communities

- Life below water

- Industry, innovation and infrastructure

- Climate action

- Responsible consumption and production

- Life on land

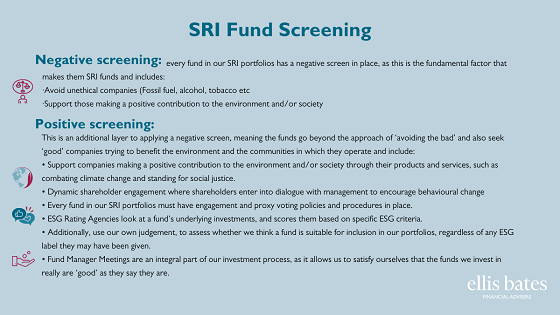

The 2030 Agenda for Sustainable Development, adopted by all United Nations Member States in 2015, provides a shared blueprint for peace and prosperity for people and the planet, now and into the future. As part of our commitment to our clients, as socially responsible investors we are committed to supporting the SDGs, so much so that every single fund we hold can easily be associated with one or more of these goals.

The 2030 Agenda for Sustainable Development, adopted by all United Nations Member States in 2015, provides a shared blueprint for peace and prosperity for people and the planet, now and into the future. As part of our commitment to our clients, as socially responsible investors we are committed to supporting the SDGs, so much so that every single fund we hold can easily be associated with one or more of these goals.

Social and environmental good as well as financial returns

Social and environmental good as well as financial returns