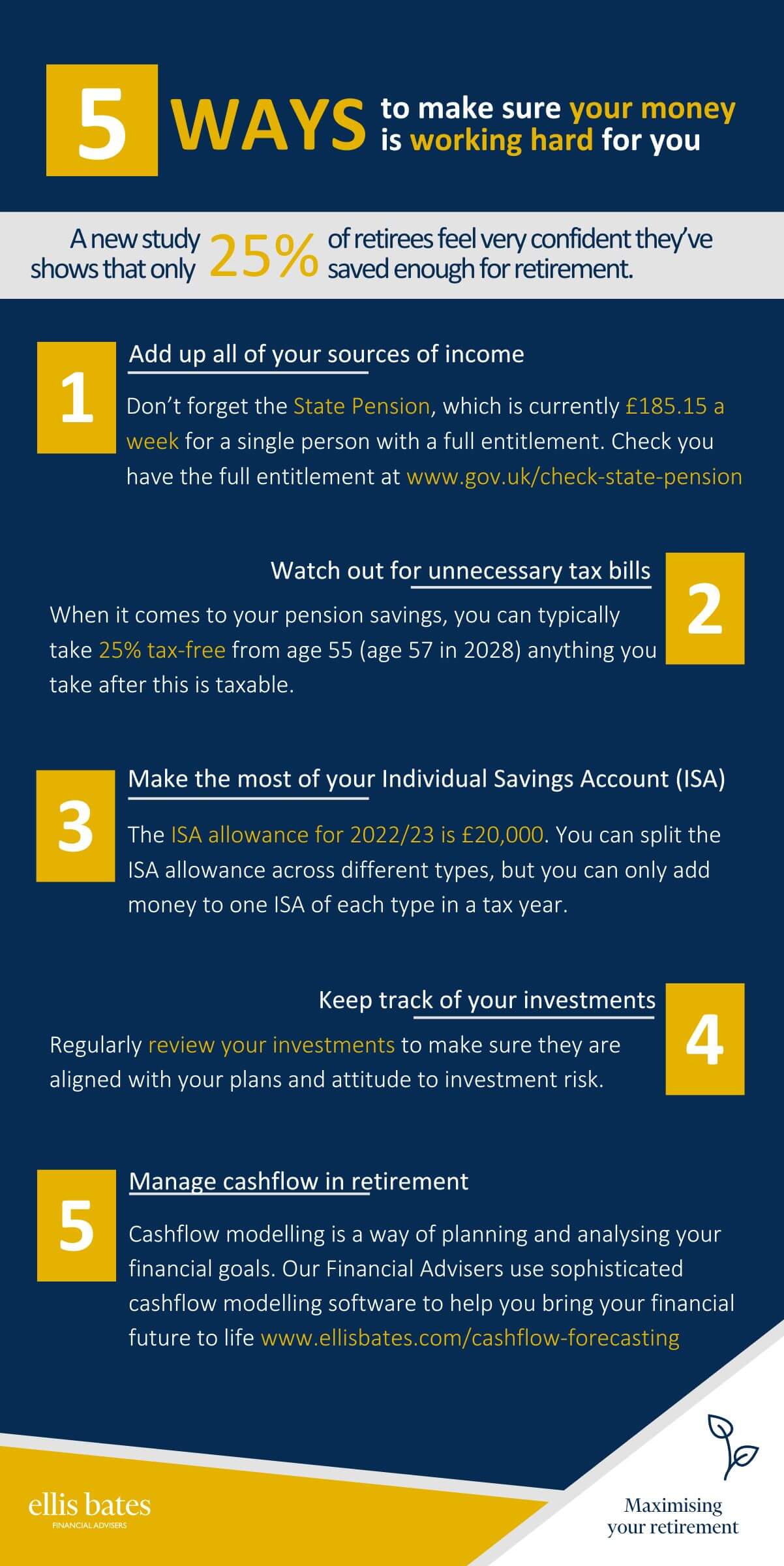

Is your money working hard for you?

https://www.ellisbates.com/wp-content/uploads/2023/02/Make-your-money-work-hard-for-you-holder.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/0e2a278e0eef1defdd7ee9d0ae7bb398?s=96&d=mm&r=g

Are you feeling uncertain on the way forward to your retirement?

We offer a range of retirement planning services, including a handy retirement calculator to see how much you need to save for retirement. Alternatively, find out more about how our cashflow modelling service can help you visualise your expenditure, income and preferred lifestyle in retirement.

Why now is the time to make sure you protect your wealth.

Why now is the time to make sure you protect your wealth.

Time to review your financial plans with a financial check-up?

Time to review your financial plans with a financial check-up?