Meet our Head of Pensions: Nigel Swan

https://www.ellisbates.com/wp-content/uploads/2024/05/Screenshot-2024-05-21-140724-1024x574.png 1024 574 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g“My aim is to make matters both understandable and relevant to my clients, ensuring their financial knowledge improves significantly throughout the planning journey. I hold regular reviews with my clients, to keep abreast of any changes in circumstances or new financial goals they may wish to work towards.”

– Nigel Swan, Regional Director & Head of Pensions

If you’d like to know more about Nigel and how his team can support you with your pensions, take a look at his Profile Here

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

Unlike pension drawdown arrangements, annuities do not typically pass down any remaining funds to beneficiaries after the holder’s death. However, it is possible to balance security and flexibility by partially combining annuities with pension drawdown.

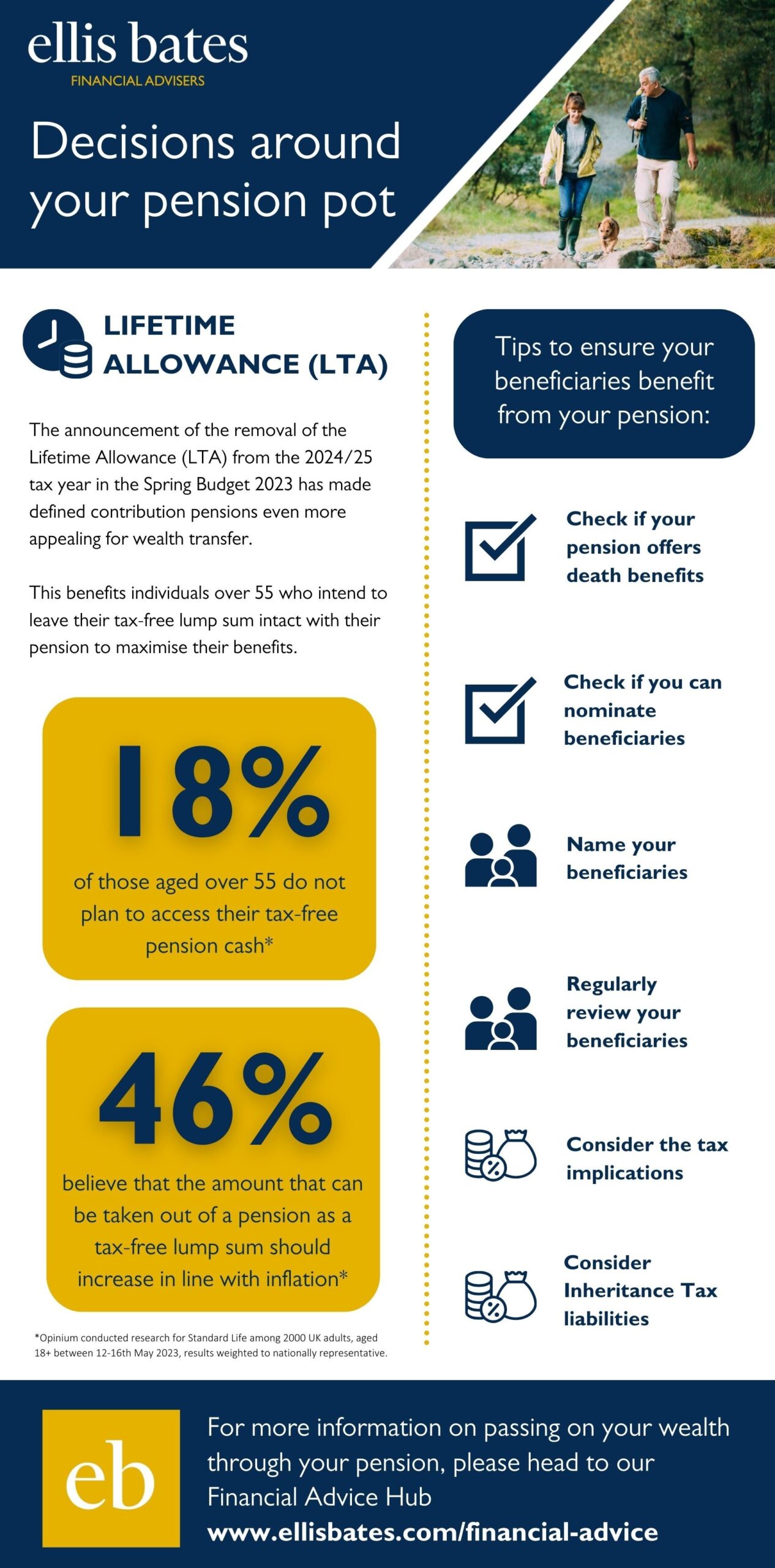

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.