Pension Allowance

https://www.ellisbates.com/wp-content/uploads/2022/06/pension-allowance-graphic-2-1.png 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

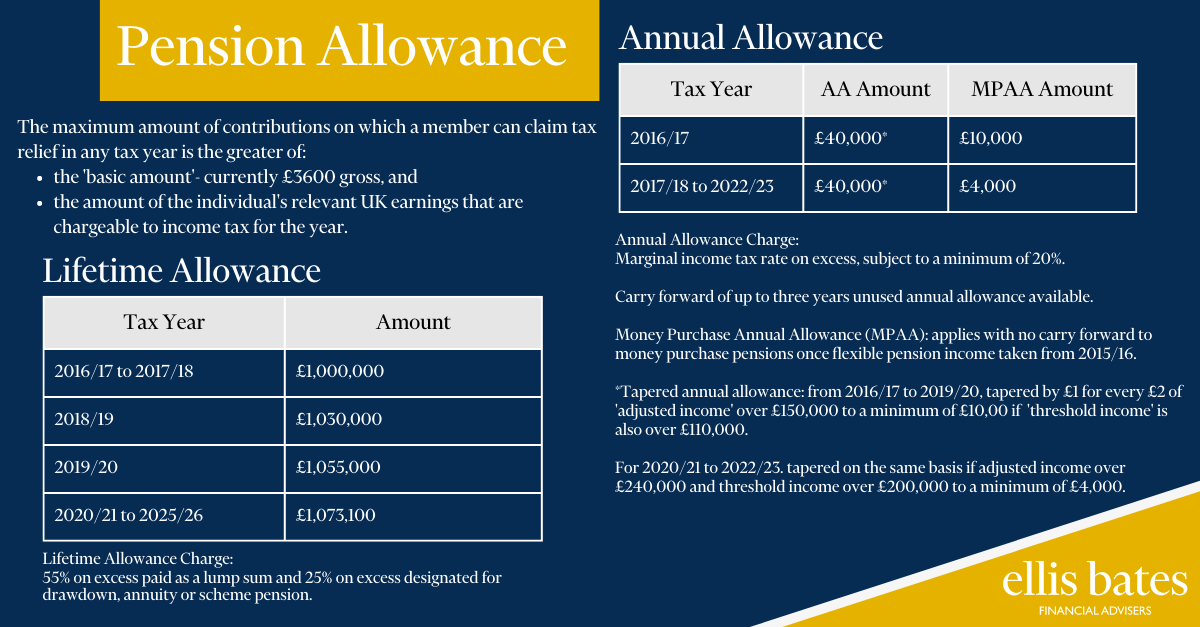

Pension Allowance

The maximum amount of contributions on which a member can claim tax relief in any tax year is greater of:

- the ‘basic amount’ – currently £3600 gross, and

- the amount of the individual’s relevant UK earnings that are chargeable to income tax for the year.

Lifetime Allowance

| Tax Year | Amount |

| 2016/17 to 2017/18 | £1,000,000 |

| 2018/19 | £1,030,000 |

| 2019/20 | £1,055,000 |

| 2020/21 to 2025/26 | £1,073,100 |

Lifetime Allowance Charge: 55% on excess paid as a lump sum and 25% on excess designated for drawdown, annuity or scheme pension.

Annual Allowance

| Tax Year | AA Amount | MPAA Amount |

| 2016/17 | £40,000* | £10,000 |

| 2017/18 to 2022/23 | £40,000* | £4,000 |

Annual Allowance Charge: Marginal income tax rate on excess, subject to a minimum of 20%.

Carry forward of up to three years unused annual allowance available.

Money Purchase Annual Allowance (MPAA): applies with no carry forward to money purchase pensions once flexible pension income taken from 2015/16.

*Tapered annual allowance: from 2016/17 to 2019/20, tapered by £1 for every £2 of ‘adjusted income’ over £150,000 to a minimum of £10,000 if ‘threshold income’ is also over £110,000.

For 2020/21 to 2022/23, tapered on the same basis if adjusted income over £240,000 and threshold income over £200,000 to a minimum of £4,000.

Women are being urged to think about their long term savings

Women are being urged to think about their long term savings

A more popular and increasingly common option many are considering.

A more popular and increasingly common option many are considering.

Time to review your financial plans with a financial check-up?

Time to review your financial plans with a financial check-up?

Planning your future has arguably never been more important.

Planning your future has arguably never been more important.

Are you scared of running out of money in retirement?

Are you scared of running out of money in retirement?

Time for pensions to contribute towards building a better world

Time for pensions to contribute towards building a better world

Pension Awareness Day

Pension Awareness Day