Meet the Financial Adviser: Andy King

https://www.ellisbates.com/wp-content/uploads/2024/01/Screenshot-2024-01-15-094755-1024x541.png 1024 541 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gAndy is here to help you with a holistic financial planning service, including tax planning, tax and inheritance tax mitigation, savings and investments, insurance and protection, pensions and retirement and estate planning. He uses sophisticated cashflow modelling software to help you develop lifetime financial plans and to bring your financial future to life.

If you’d like to know more about Andy and how he can help you achieve your financial goals, take a look at his profile: https://www.ellisbates.com/meet-your-advisers/andy-king

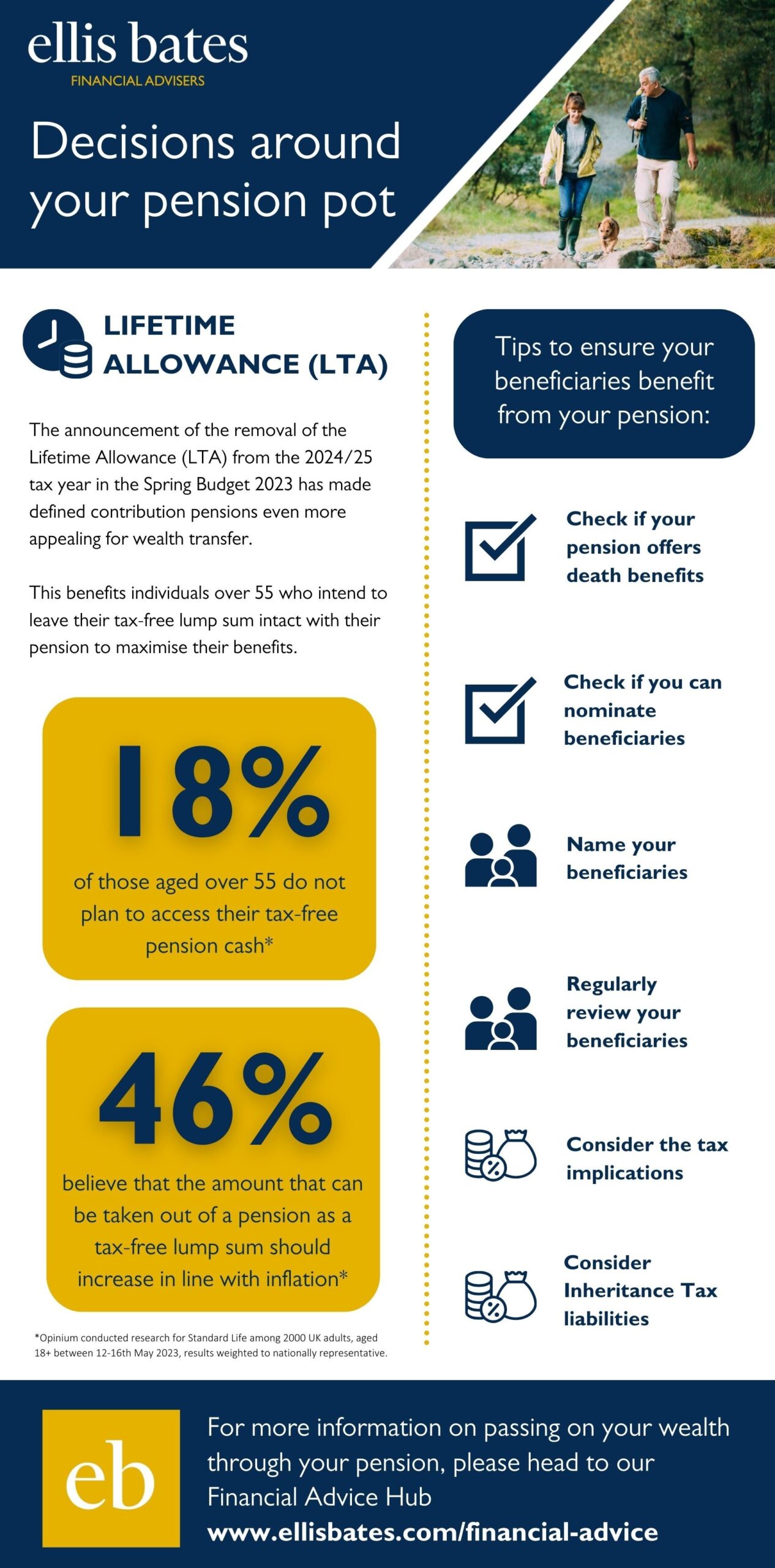

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.

The announcement of the removal of the Lifetime Allowance (LTA) from the 2024/25 tax year in the Spring Budget 2023 has made defined contribution pensions even more appealing for wealth transfer. This benefits individuals over 55 who intend to leave their tax-free lump sum intact with their pension to maximise their benefits.