7 Benefits of Financial Planning

https://www.ellisbates.com/wp-content/uploads/2023/07/7-Benefits-of-Financial-Advice-holder.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g 7 Benefits of Financial Advice

7 Benefits of Financial Advice

Whether you want your money to work harder or if you are approaching retirement and want to make informed decisions about your pension options we will offer expert, qualified advice at every stage of your journey.

- To help you build your assets

- To help you achieve your financial goals

- To plan the right investment strategy for you

- To help you tax plan efficiently

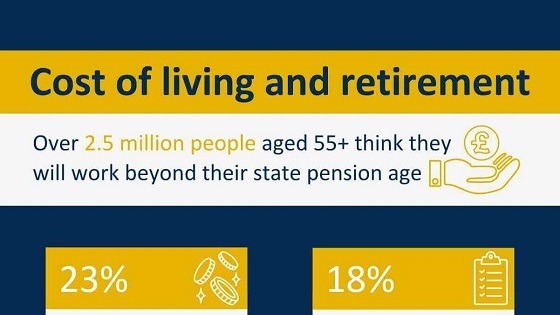

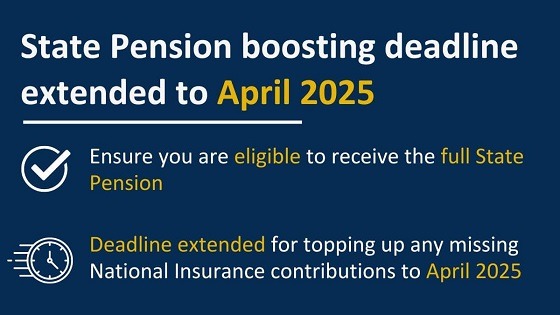

- To help you plan for retirement

- To protect you and your family

- To give you financial peace of mind

We will work together with you to create a holistic, comprehensive financial plan to achieve your goals. Please get in touch with us for more information.