Planning For a Secure Future

https://www.ellisbates.com/wp-content/uploads/2023/03/Property-Protection-Trusts.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gThe journey to financial freedom begins with a roadmap.

To start you can outline your current financial situation and this will pave the way towards your desired destination – your financial goals. It’s time to ask yourself, what are these goals? Saving for retirement, building an investment portfolio or establishing an emergency fund? The more precise your goals, the more tailored your roadmap can be.

Charting your course: the power of goal-based planning

Once you’ve defined your objectives, the magic begins. Goal-based financial planning allows you to invest systematically and in a disciplined way. It keeps you focused on your destination, unswayed by the market’s short-term turbulence.

While everyone’s goals vary depending on their life stage, they can generally be bucketed into three categories: essential needs, lifestyle wants and legacy aspirations.

ACHIEVING FINANCIAL SUCCESS: A COMPREHENSIVE APPROACH

Navigating the terrain of financial success in these areas can be challenging. It demands a holistic understanding of everything from complex retirement plans and investment products to risk management strategies and tax laws.

Your financial roadmap should be your beacon of clarity. It should encapsulate every facet of your vision – your hopes, fears and goals, vividly depicting your financial future.

What are some of the questions to ask yourself?

- Can I sleep soundly knowing my future is financially secure?

- Do I have a clear direction for my journey

- Will my current lifestyle be sustainable in retirement?

- Am I financially equipped to live the life I want now and in the future

- Have I planned adequately to ensure I don’t run out of money?

- Do I fully understand my financial position?

- What is my financial ‘magic number’ to secure my current and future lifestyle?

The cost of your future lifestyle: Understanding your number

Start by identifying your financial goals and the time frame to achieve them. Determine their current cost, factor in a reasonable inflation rate, and voila – you’ll know what they’ll likely cost when you aim to achieve them. This exercise helps you uncover ‘your number’ – the money you need to secure your future lifestyle without fear of running out of funds.

Your financial roadmap is your guide to making informed financial decisions, striking a balance between current responsibilities and future aspirations. It’s designed to help you sustainably achieve your lifestyle goals and objectives over time.

We have produced a comprehensive guide to help you build a more secure financial future. To download your free guide, fill in the form below:

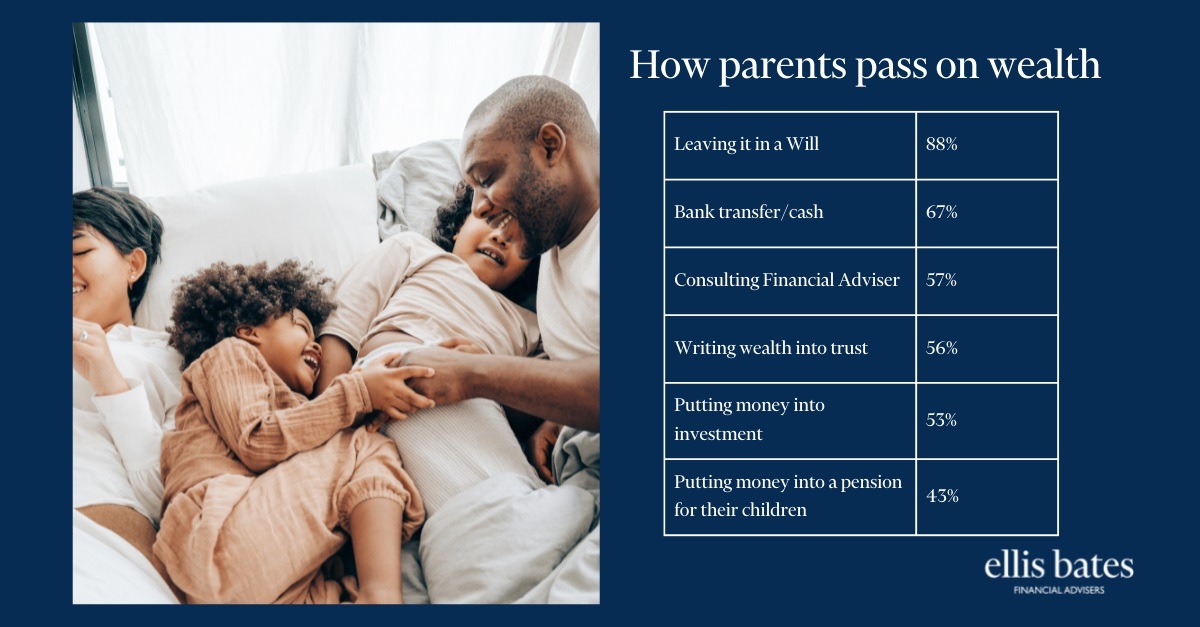

Why parents should look to Christmas investment gifts instead of toys.

Why parents should look to Christmas investment gifts instead of toys.