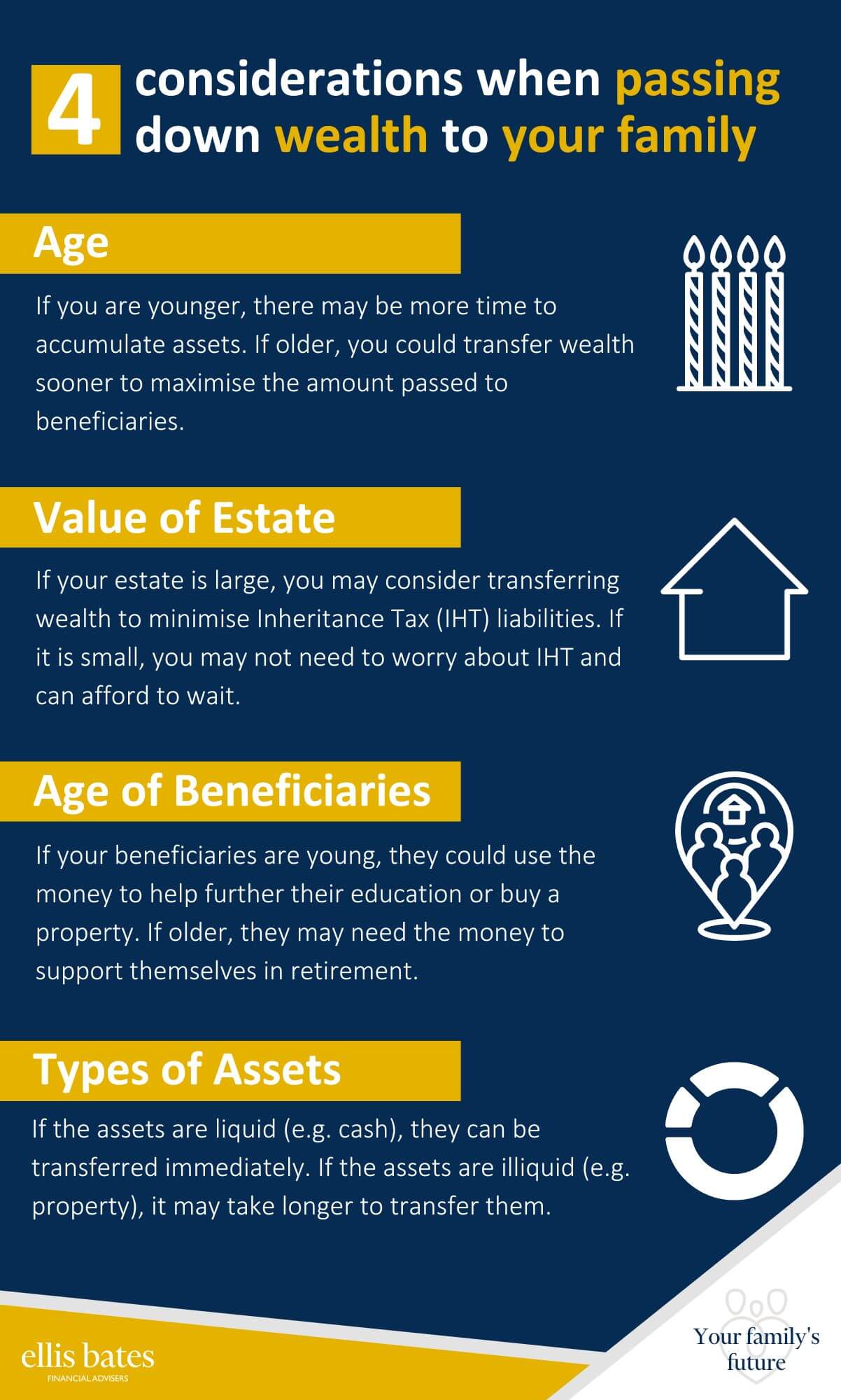

4 considerations when passing down wealth to your family

Age

If you are younger, there may be more time to accumulate assets. If older, you could transfer wealth sooner to maximise the amount passed to beneficiaries.

Value of estate

If your estate is large, you may consider transferring wealth to minimise Inheritance Tax (IHT) liabilities. If it is small, you may not need to worry about IHT and can afford to wait.

Age of beneficiaries

If your beneficiaries are young, they could use the money to help further their education or buy a property. If older, they may need the money to support themselves in retirement.

Types of assets

If the assets are liquid (e.g. cash), they can be transferred immediately. If the assets are illiquid (e.g. property), it may take longer to transfer them.

Start your estate planning journey

Estate planning, inheritance tax planning and wealth transfer within families requires expert advice. Please get in touch today so we can help you and your family every step of the way.