Your 50’s – the crucial decade for financial planning and advice

https://www.ellisbates.com/wp-content/uploads/2024/08/Screenshot-2024-08-20-153231-1024x574.png 1024 574 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=gIf you have not considered financial advice before, your 50s is the time to do so.

Now is the time to check in on your

- Retirement resources

- Pensions and contributions

- Savings & Investments in the best place at the right risk level

- Tax position

We use sophisticated cashflow software to model your desired retirement plan and identify the gaps and adjustments needed.

In your 50s and looking for a retirement review?

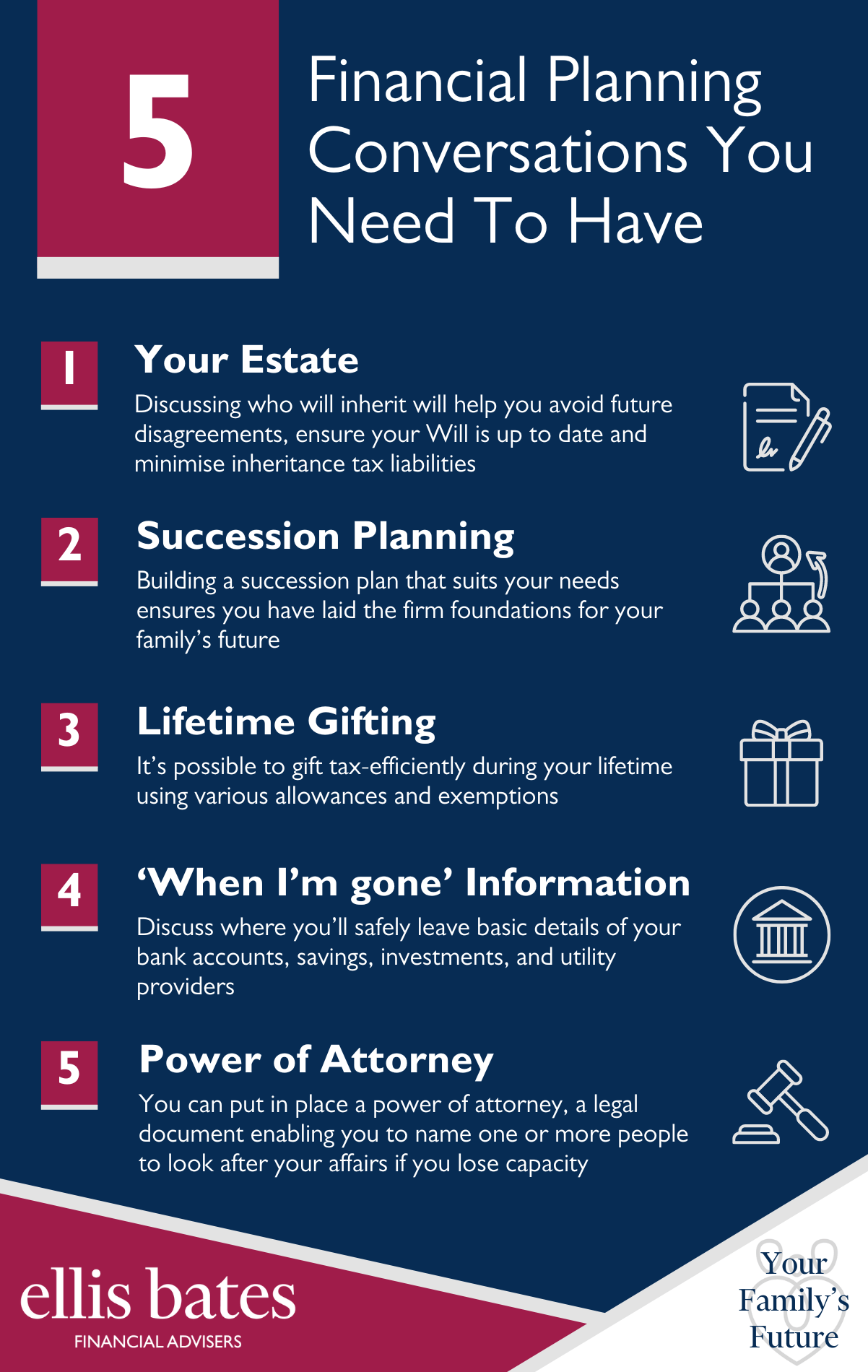

Many people still lack a properly organised estate plan despite the numerous benefits of writing a Will—such as getting our finances in order, planning our legacy, and ensuring that our loved ones are well looked after.

Many people still lack a properly organised estate plan despite the numerous benefits of writing a Will—such as getting our finances in order, planning our legacy, and ensuring that our loved ones are well looked after.