UK Cost of Living Crisis

https://www.ellisbates.com/wp-content/uploads/2022/12/Cost-of-living-crisis.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g Funding the retirement lifestyle you want vs the cost of living: time to get your retirement plans in motion!

Funding the retirement lifestyle you want vs the cost of living: time to get your retirement plans in motion!

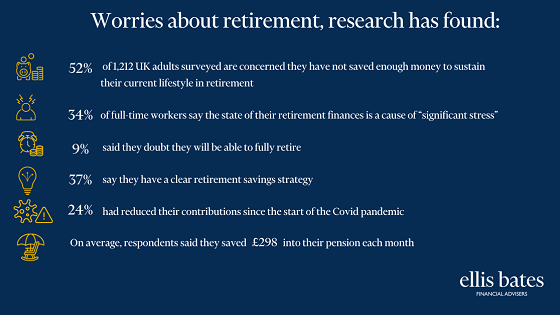

One of the most common concerns among those approaching retirement is whether they will have enough money to last them with only 25% of retirees feel very confident they’ve saved enough for retirement.

The cost of living crisis

As food prices continue to soar and petrol costs reach an all-time high in the UK, the rising cost of living is without doubt having an impact on many people’s financial plans, both short and long term.

If you’re approaching retirement or have already started taking money from your pension or other retirement savings, you wouldn’t be alone in feeling a little anxious about the effect the cost-of-living crisis might have on your lifestyle in retirement. While it’s impossible to predict the future with complete certainty, there are a few things you can do to feel more confident about spending your money in retirement.

Add up all sources of income

Your main source of retirement income may well be your pension plan. But when it comes to planning your finances in retirement, it’s important to think beyond this. Consider other potential sources such as Individual Savings Accounts (ISAs) and other investments, as well as any rental income you receive from rental properties you let.

Don’t forget the State Pension, which is currently £185.15 a week (£9,628 a year) for a single person with a full entitlement. Although the State Pension’s annual increase is currently below inflation, every little helps and the total of all your savings and income might add up to more than you think.

Watch out for unnecessary tax bills

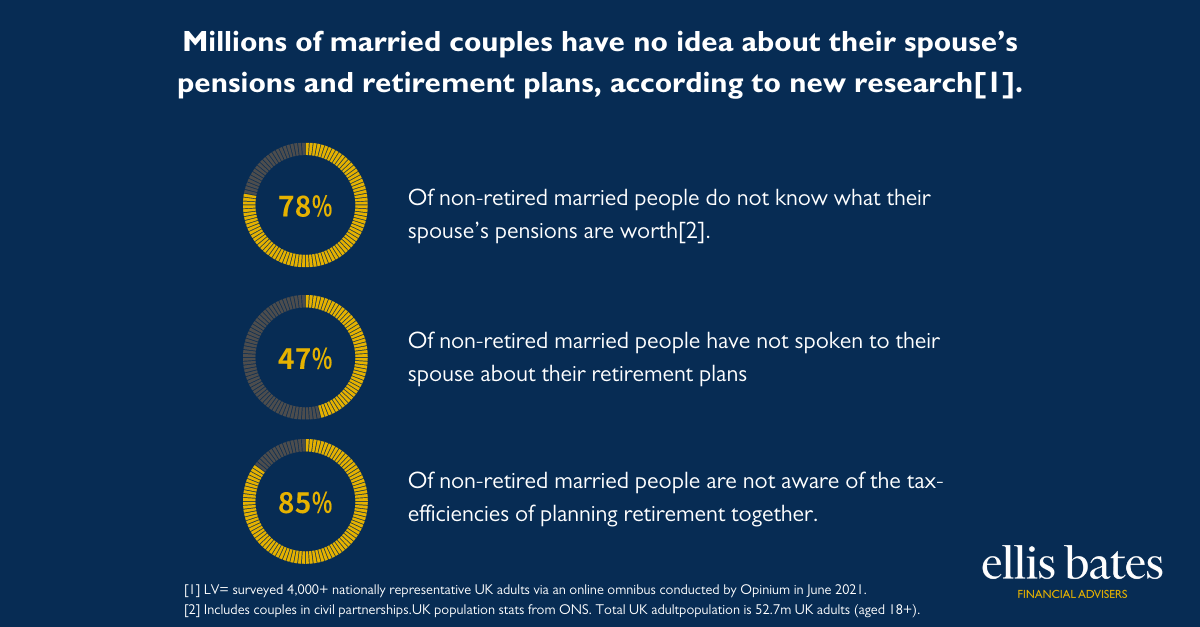

Paying too much tax in retirement is a common pitfall for some retirees, and one that could be potentially avoided with having the right plans in place. If you’re already taking or plan to take income from multiple sources, you need to consider how that will be taxed. When and how you take your money can make a big difference to how much tax you pay and how long it will last. Taking money little and often could make all the difference when it comes to reducing your tax bill.

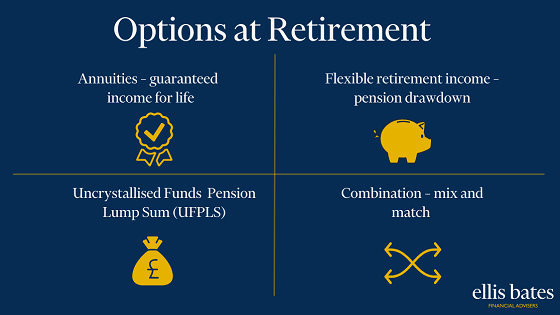

When it comes to your pension savings, you can typically take 25% tax-free from age 55 (age 57 in 2028), either in one go or spread out over a longer period. After this, any money you take from your pension savings, as well as your State Pension, is taxable just like any other income.

That means you’ll need to pay income tax on anything over your tax-free cash limit and any annual personal Income Tax allowance you get. It’s likely that the more money you take, the more tax you’ll have to pay, although how much will depend on which tax band your income falls into. So if you take all of your pension savings at once, or in big lump sums, you could be paying more tax than you need to. But by taking your pension savings over a number of years and taking just enough to stay in the lowest tax band you can, you could keep more of your money overall.

Make the most of your individual savings accounts (ISA)

Another way to avoid an unnecessary tax bill is to make the most of your ISA savings. You don’t pay tax on any investment growth or interest you earn, or on the proceeds you take from an ISA. So it’s a very tax-efficient way to save.

You could consider using any ISA savings you have first and delay accessing your pension savings, giving them more time to stay invested and potentially grow in value. Remember though, the value of all investments can go down as well as up, and you may get back less than you paid in.

Or, if you’ve already started taking an income from your pension, you could use your ISA savings to supplement that income. This could allow you to take smaller payments from your pension and avoid overpaying Income Tax on them. Getting to grips with tax implications can be a bit overwhelming as there’s a lot to consider.

Tax rules and legislation can change, and personal circumstances and where you live in the UK also have an impact on your tax treatment. On top of that, tax varies for other sources of income like property, state benefits, or even your salary if you’re planning on working in some capacity for a little longer.

Keep track of your investments

Where your money is invested could have the biggest impact on how long it will last in retirement. It’s important to regularly review your investments to make sure they remain on track and remain aligned with your plans and attitude to investment risk. For example, your pension savings may be invested in fairly high-risk funds that have the potential to grow significantly in value, but also are more likely to be impacted, particularly during periods of market volatility.

Moving to lower-risk investments means that you’re less likely to see big ups and downs in the value of your pension savings. However, if you’re relying on your pension savings to provide you with a comfortable income for the rest of your life, you also need to make sure that your investments will provide enough growth potential. This is particularly important in the current climate where your money faces the double challenge of rising inflation and potentially having to last for many years.

Want to review your retirement plans?

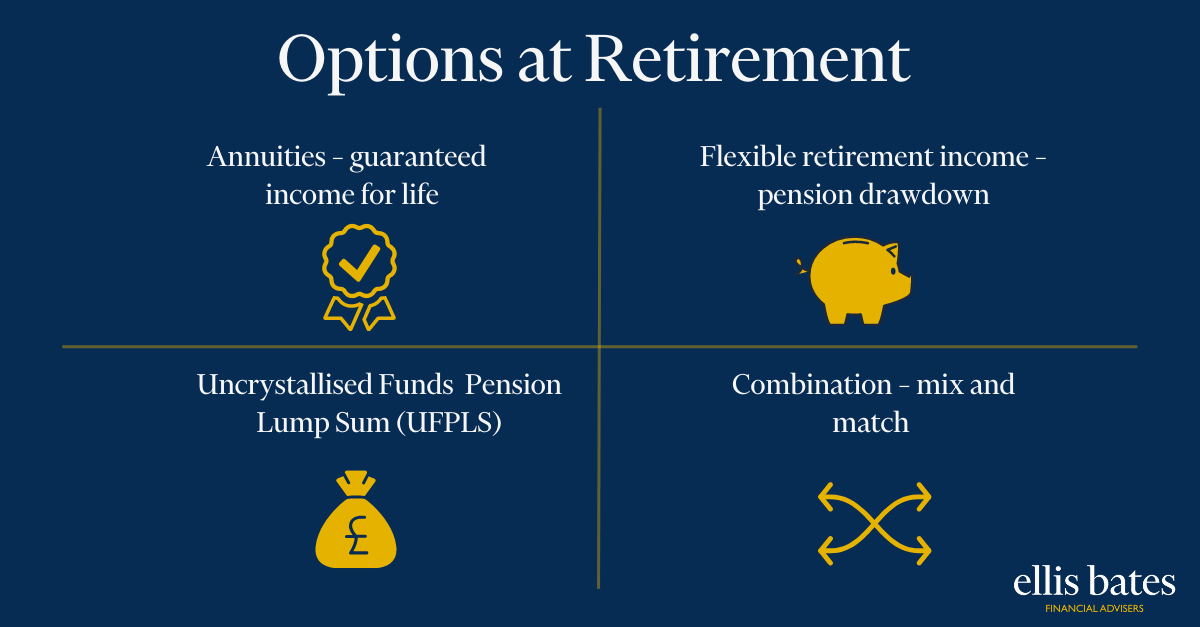

If you have specific questions about funding your retirement lifestyle, or if you’re feeling anxious about spending money in retirement, speak to us to discuss your options