Tax Year End

https://www.ellisbates.com/wp-content/uploads/2023/02/Tax-year-end-checklist-infographic-holder.jpg 560 315 Jess Easby Jess Easby https://secure.gravatar.com/avatar/70f816837c455030814d46a740cfc12d89893aaf8cbf8c8f8f59387d7b30ac08?s=96&d=mm&r=g

Tax Year End Checklist – Have you made use of your 2022/23 Allowances?

- ISA allowance: £20,000pa

- Junior ISA allowance: £9,000pa

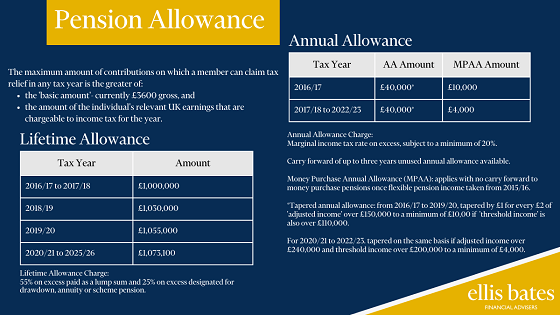

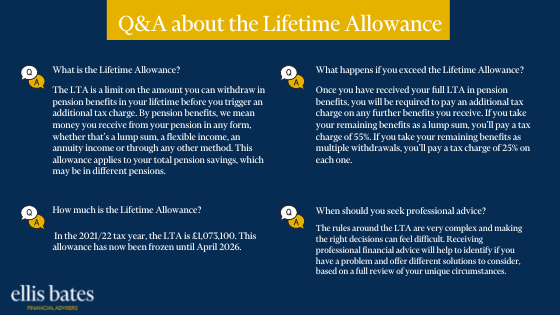

- Pension annual allowance: £40,000*pa (*or 100% of your earning and this allowance varies for higher rate tax payers and business owners.)

- Check your carry-forward pension allowance

- Check your pension lifetime allowance status (£1,073,100)

For more information on our tax planning services, please get in touch.